Baran Group Ltd (TLV:BRAN) Looks Just Right With A 27% Price Jump

Baran Group Ltd (TLV:BRAN) shares have continued their recent momentum with a 27% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 81% in the last year.

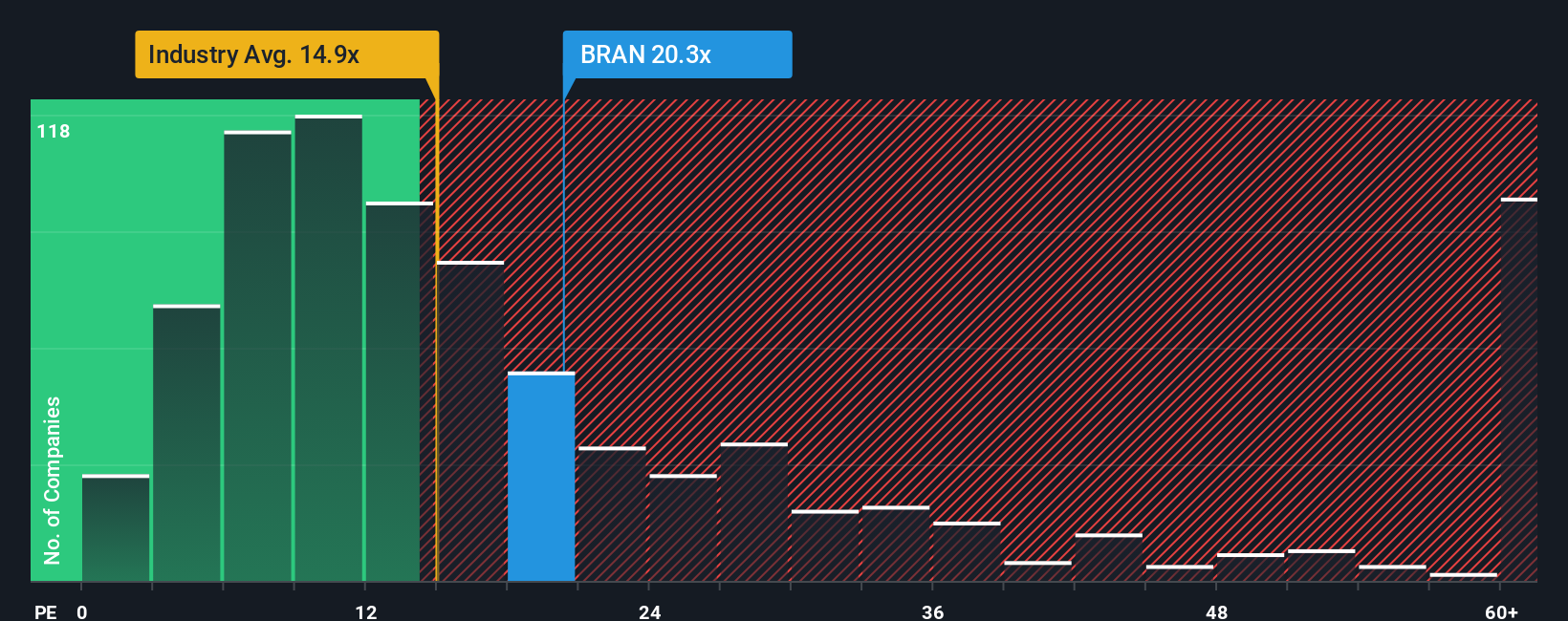

After such a large jump in price, Baran Group's price-to-earnings (or "P/E") ratio of 20.3x might make it look like a sell right now compared to the market in Israel, where around half of the companies have P/E ratios below 16x and even P/E's below 11x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

For example, consider that Baran Group's financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Baran Group

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Baran Group's is when the company's growth is on track to outshine the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 44%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 225% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 23% shows it's noticeably more attractive on an annualised basis.

In light of this, it's understandable that Baran Group's P/E sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Final Word

The large bounce in Baran Group's shares has lifted the company's P/E to a fairly high level. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Baran Group maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 4 warning signs for Baran Group you should be aware of, and 2 of them are a bit concerning.

You might be able to find a better investment than Baran Group. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal