Assessing Uranium Energy (UEC) Valuation After Sector-Wide Optimism In Uranium Miners

Uranium Energy (UEC) caught investor attention after a sector-wide jump in uranium miners, sparked by Denison Mines signaling construction readiness for its Phoenix in situ recovery project, pending final approvals and highlighting uranium project momentum.

See our latest analysis for Uranium Energy.

That sector tailwind has arrived on top of a 1-day share price return of 3.93% and a 7-day share price return of 23.53%, while the 1-year total shareholder return of 98.91% and very large 5-year total shareholder return suggest momentum has been building rather than fading.

If uranium’s move has your attention, it could be a useful moment to broaden your search and check out fast growing stocks with high insider ownership.

With UEC up 99% over the past year and trading at a roughly 15% discount to the average analyst price target of US$16.75, the real question is whether there is still a buying opportunity here or if the market is already pricing in future growth.

Price to Book of 5.4x: Is it justified?

Uranium Energy last closed at US$14.54 and is trading on a P/B of 5.4x, which screens as expensive both against peers and the wider US Oil and Gas industry.

P/B compares the company’s market value to the accounting value of its net assets, which can be useful for asset heavy businesses such as resource companies.

For Uranium Energy, the P/B discussion is happening while the company is still loss making, has a negative return on equity of 5.93% and is forecast to move into profitability. Revenue growth forecasts stand at 38.4% per year and earnings growth forecasts at 111.02% per year. That combination means the market is paying a premium relative to the balance sheet, with the focus clearly on future growth rather than current profits.

Compared with its immediate peer set, Uranium Energy’s 5.4x P/B is above the peer average of 4.9x. It also stands further above the broader US Oil and Gas industry average of 1.3x, which is a strong valuation gap for investors to weigh.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-book of 5.4x (OVERVALUED)

However, the current loss of US$77.839 million and a P/B above both peers and the wider industry mean that any setback in uranium sentiment could quickly pressure that premium.

Find out about the key risks to this Uranium Energy narrative.

Another View: Our DCF Model Says UEC Is Overvalued

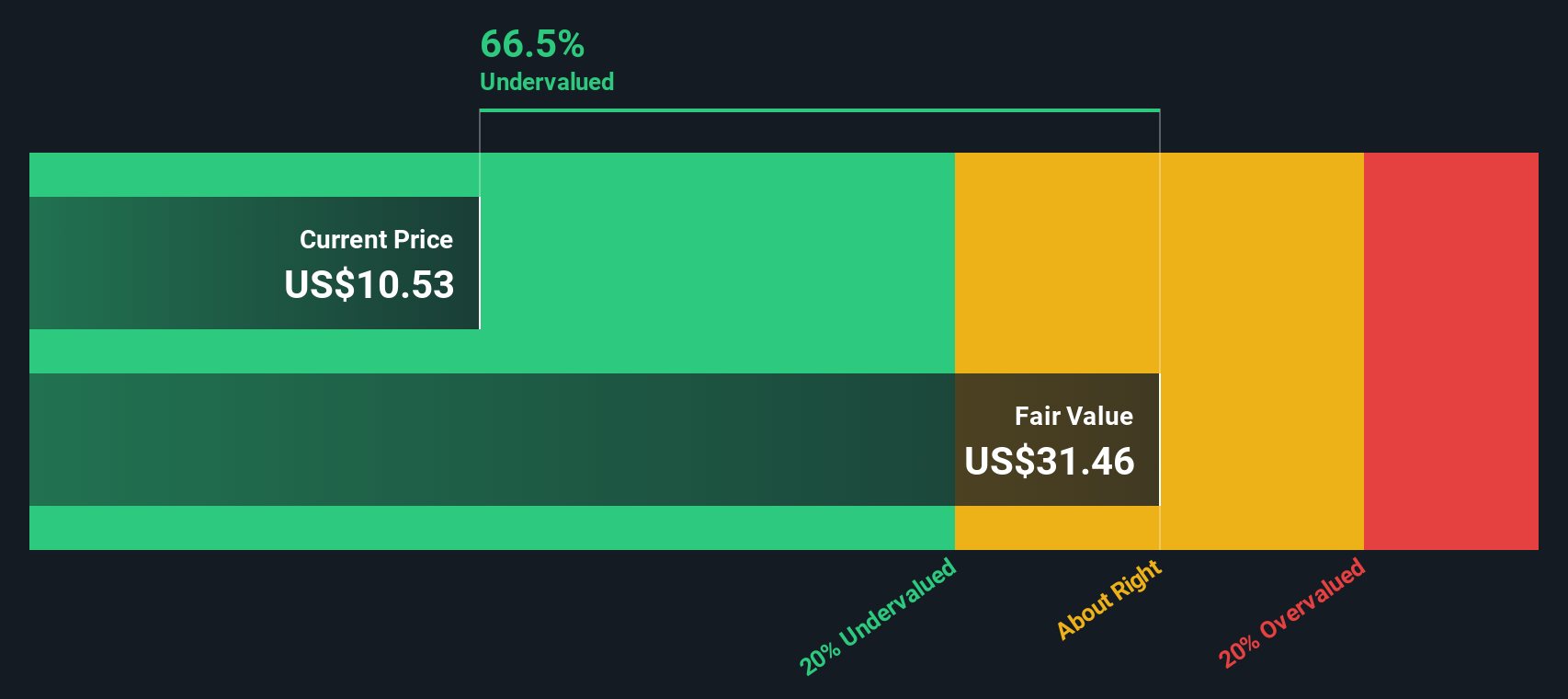

While the 5.4x P/B ratio already looks rich, our DCF model suggests Uranium Energy at US$14.54 is trading above an estimated fair value of US$12.49, which points to an overvalued reading. That raises a simple question for you: is the market paying too much for the story right now?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Uranium Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 877 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Uranium Energy Narrative

If you look at this and reach a different conclusion, or simply want to test the numbers yourself, you can build a fresh view in just a few minutes with Do it your way.

A great starting point for your Uranium Energy research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If UEC has sharpened your focus, do not stop there. Widen your watchlist with ideas that line up better with your goals and risk comfort.

- Target income streams by checking out these 11 dividend stocks with yields > 3% that may suit investors who want regular cash returns alongside potential capital appreciation.

- Explore technology trends by scanning these 25 AI penny stocks where artificial intelligence is at the center of each company’s business model.

- Look for potential mispricings by reviewing these 877 undervalued stocks based on cash flows that trade below estimates based on their cash flow profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal