Northern Star Resources (ASX:NST) Valuation After Production Guidance Cut And Operational Disruptions

Northern Star Resources (ASX:NST) is under pressure after equipment failures and outages at Kalgoorlie, Jundee and Pogo reduced December quarter gold sales and prompted a cut of roughly 100,000 ounces to FY26 production guidance.

See our latest analysis for Northern Star Resources.

The production guidance cut has come after a sharp one day share price reaction and short term weakness, with a 7 day share price return of 4.3% decline and 30 day share price return of 4.48% decline. However, the 1 year total shareholder return of 64.03% and 3 year total shareholder return of 132.34% show that longer term momentum has been strong despite recent concerns about operational reliability and potential cost pressure.

If the recent guidance cut has you reassessing your options, this can be a useful moment to look beyond a single gold producer and check out fast growing stocks with high insider ownership.

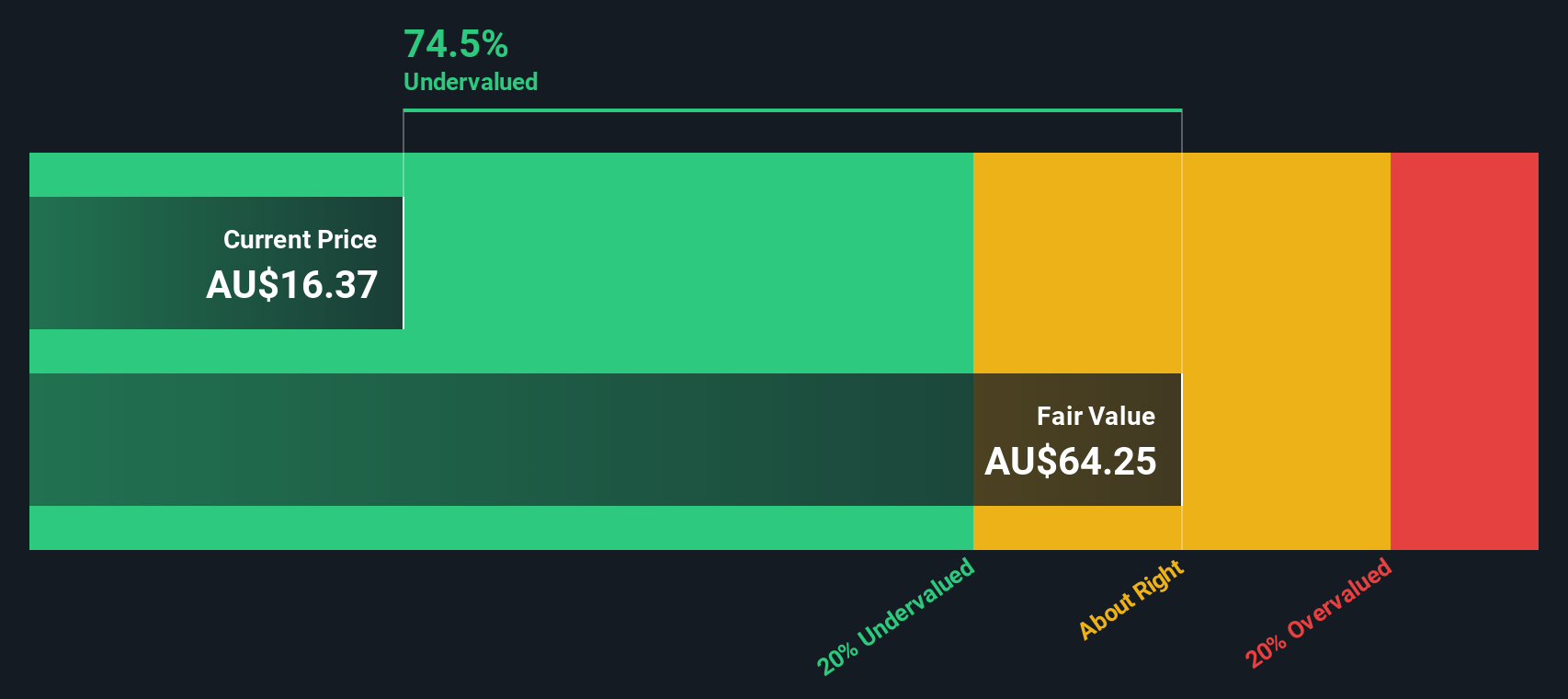

With Northern Star now trading at A$25.15, sitting on a 51% intrinsic discount estimate and around a 12% gap to analyst targets, the key question is simple: are you looking at a mispriced pullback or a stock where the market already sees the growth story clearly?

Most Popular Narrative: 14.3% Overvalued

According to Robbo's narrative, Northern Star's fair value of A$22.00 sits below the last close at A$25.15, which sets up a more cautious stance on upside.

Northern Star Resources (NST) is one of Australia’s largest gold producers. As of March 2025, the company reported proven ore reserves of nearly 4.5 million ounces and probable reserves of around 18 million ounces. Total resources across its Australian and Alaskan assets stand at approximately 70.6 million ounces. The company has been expanding aggressively. In May, it completed the acquisition of De Grey Mining, adding the Hemi Gold Project with a further 11.2 million ounces of resources. This was followed in August by the acquisition of Mt Roe Mining. With estimated annual production of around 2 million ounces by 2027, Northern Star is well-positioned to capitalise on the elevated gold price in the coming years.

Curious how robust margins, a premium earnings multiple and a moderate discount rate can still result in an overvaluation call on a growth oriented gold producer? The narrative runs the numbers on revenue expansion, profitability and future cash generation in a way that may surprise you. If you want to see which assumptions tip the fair value below today’s price, the full story is worth a closer look.

Result: Fair Value of A$22.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this view could be challenged if operational setbacks at key sites persist or if gold prices soften, which would pressure the earnings assumptions baked into the narrative.

Find out about the key risks to this Northern Star Resources narrative.

Another View: DCF Points the Other Way

Robbo sees Northern Star as 14.3% overvalued at A$25.15, but our DCF model paints a very different picture, with a fair value estimate of A$51.29. That implies the shares trade at roughly a 51% discount. This raises a simple question: is the market too cautious, or is the model too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Northern Star Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 877 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Northern Star Resources Narrative

If you are not convinced by these conclusions or prefer to lean on your own judgment, you can test the assumptions yourself in just a few minutes by starting with Do it your way.

A great starting point for your Northern Star Resources research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

If Northern Star has you thinking more broadly about your portfolio, now is the time to act, compare different themes and avoid missing potential opportunities elsewhere.

- Target potential mispricing by scanning these 877 undervalued stocks based on cash flows that might offer stronger fundamentals than what the current share price suggests.

- Explore influential technology themes by checking out these 25 AI penny stocks that are focused on building businesses around artificial intelligence.

- Consider emerging developments in digital finance by reviewing these 79 cryptocurrency and blockchain stocks that link listed companies to cryptocurrency and blockchain activity.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal