A Look At Dutch Bros (BROS) Valuation As New Breakfast Drinks Roll Out Nationwide

Dutch Bros (BROS) is back in focus after rolling out three breakfast inspired drinks across more than 1,000 shops, a move aimed at capturing more morning traffic and testing how food adjacent offerings influence spending patterns.

See our latest analysis for Dutch Bros.

The new breakfast drinks land at a time when momentum in Dutch Bros shares has been strong, with a 90 day share price return of 31.98% and a 3 year total shareholder return of 93.34% from a last close of $63.26.

If you like the growth angle behind Dutch Bros recent menu expansion, it could be a good prompt to broaden your watchlist and check out fast growing stocks with high insider ownership.

With Dutch Bros shares up strongly over the past 3 months and the stock trading at $63.26, the key question now is whether the recent growth story is already reflected in the price, or if the current level still leaves room for future growth expectations to surprise the market.

Most Popular Narrative: 18% Undervalued

At a last close of US$63.26 versus a narrative fair value of about US$76.74, the current pricing sits below what the most followed model implies.

The evolving menu, featuring specialty beverages, energy drinks, and an expanded food pilot, taps into the consumer trend toward premiumization and customization in beverages; these higher-margin offerings and incremental morning daypart food sales support higher average ticket sizes and future margin/earnings growth. Tight operational control through a focus on company-owned stores (as opposed to franchising), more efficient new shop build-outs, and favorable labor and input cost management are creating operational leverage as scale increases, supporting higher net margins and earnings growth as new units mature.

Curious why a coffee chain gets a growth and margin profile usually reserved for high multiple names? The narrative leans on aggressive earnings compounding, richer profit margins and a premium future P/E that still steps down from today. Want to see exactly how those ingredients stack up into that fair value line? Read on to see the full set of assumptions behind this story.

Result: Fair Value of $76.74 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this story can be knocked off course if rising labor costs squeeze margins, or if rapid shop expansion leads to market saturation and weaker unit returns.

Find out about the key risks to this Dutch Bros narrative.

Another View: High P/E Puts Pressure On The Story

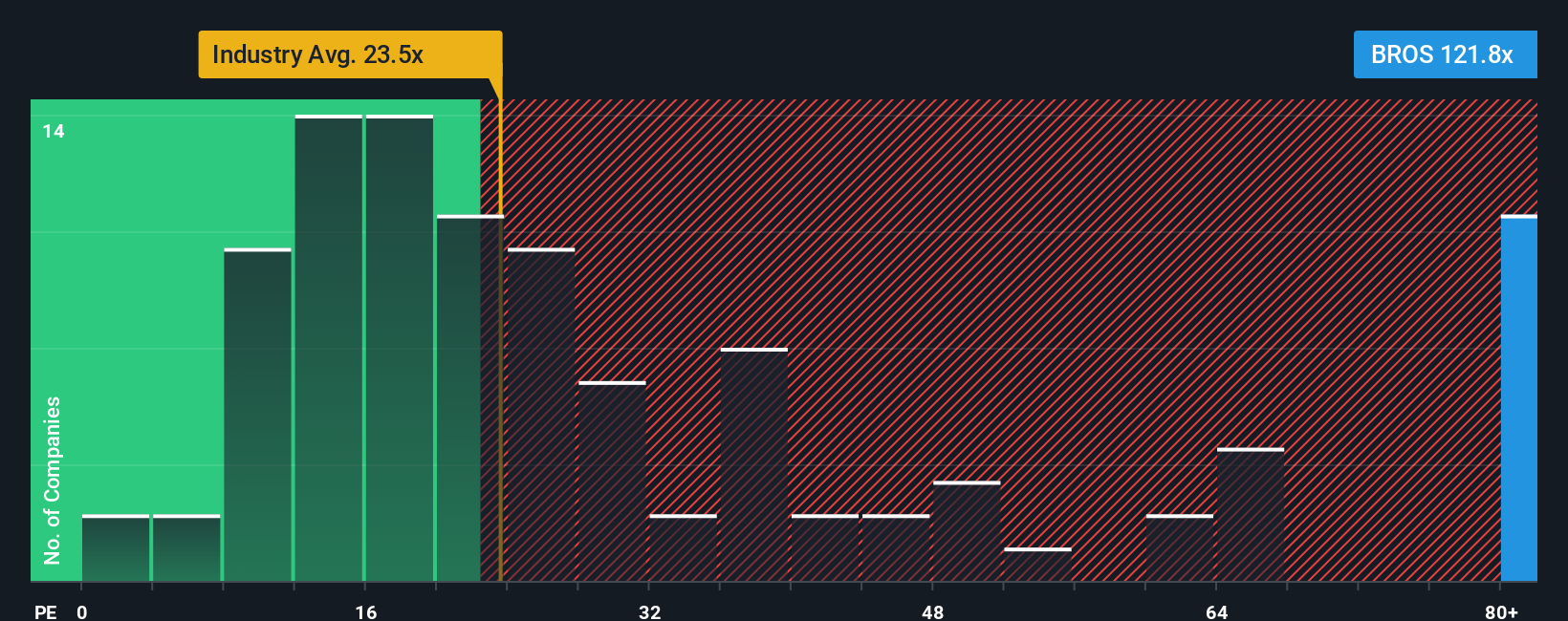

While the narrative fair value of about US$76.74 points to upside from the current US$63.26 share price, the P/E ratio tells a tougher story. Dutch Bros trades on roughly 129.4x earnings, compared with a fair ratio of 56.4x, a US Hospitality average of 21.8x, and peer average of 36.4x.

That gap suggests the market is already paying a heavy premium for future growth and execution, which can leave less room for error if results or sentiment cool. The question for you is whether that kind of valuation premium still feels comfortable given the risks you are weighing.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dutch Bros Narrative

If you interpret the numbers differently or prefer to apply your own assumptions, you can build a custom thesis in minutes with Do it your way.

A great starting point for your Dutch Bros research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready For More Investment Ideas?

If Dutch Bros has sparked your interest, do not stop here. Use the same structured approach to scan other opportunities that might fit your goals even better.

- Spot potential mispricing early by checking out these 877 undervalued stocks based on cash flows that may offer more compelling entry points.

- Tap into cutting edge themes by reviewing these 25 AI penny stocks that sit at the intersection of technology and earnings potential.

- Strengthen your income stream by focusing on these 11 dividend stocks with yields > 3% that put regular cash returns front and center.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal