ArcelorMittal (ENXTAM:MT) Valuation In Focus As Shares Trend Higher On Buybacks And Decarbonization Spending

Why ArcelorMittal Is Back On Investors’ Radar

ArcelorMittal (ENXTAM:MT) is drawing fresh attention as its share price trends higher despite softer steel prices and ongoing macro questions, supported by continued buybacks and capital allocation focused on decarbonization.

See our latest analysis for ArcelorMittal.

Recent trading has been constructive, with an 8.31% 1 month share price return and 12.29% 3 month share price return, while the 1 year total shareholder return of 88.43% points to momentum that is still intact over a longer stretch.

If ArcelorMittal’s move has your attention, this could be a good moment to broaden your watchlist and check out aerospace and defense stocks.

With the shares at €39.64, slightly above the €38.60 analyst target and screening with a mid range value score of 3, the key question is whether ArcelorMittal is already fully valued or if the market is still underestimating its prospects.

Most Popular Narrative Narrative: 5.8% Overvalued

With ArcelorMittal last closing at €39.64 against a narrative fair value of about €37.47, the valuation story hinges on future earnings power and margins.

Major expansion in India and Brazil, where steel demand is structurally growing due to continued infrastructure development and urbanization, will increase shipped volumes and profitable market share, benefitting top-line revenue and normalized profitability.

Curious what earnings, revenue and margin path has to line up for this valuation to work? The full narrative spells out the assumptions in plain numbers.

Result: Fair Value of €37.47 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still clear pressure points, including high decarbonization spending that could weigh on cash flow, as well as global overcapacity that can keep steel pricing under strain.

Find out about the key risks to this ArcelorMittal narrative.

Another Way To Look At Valuation

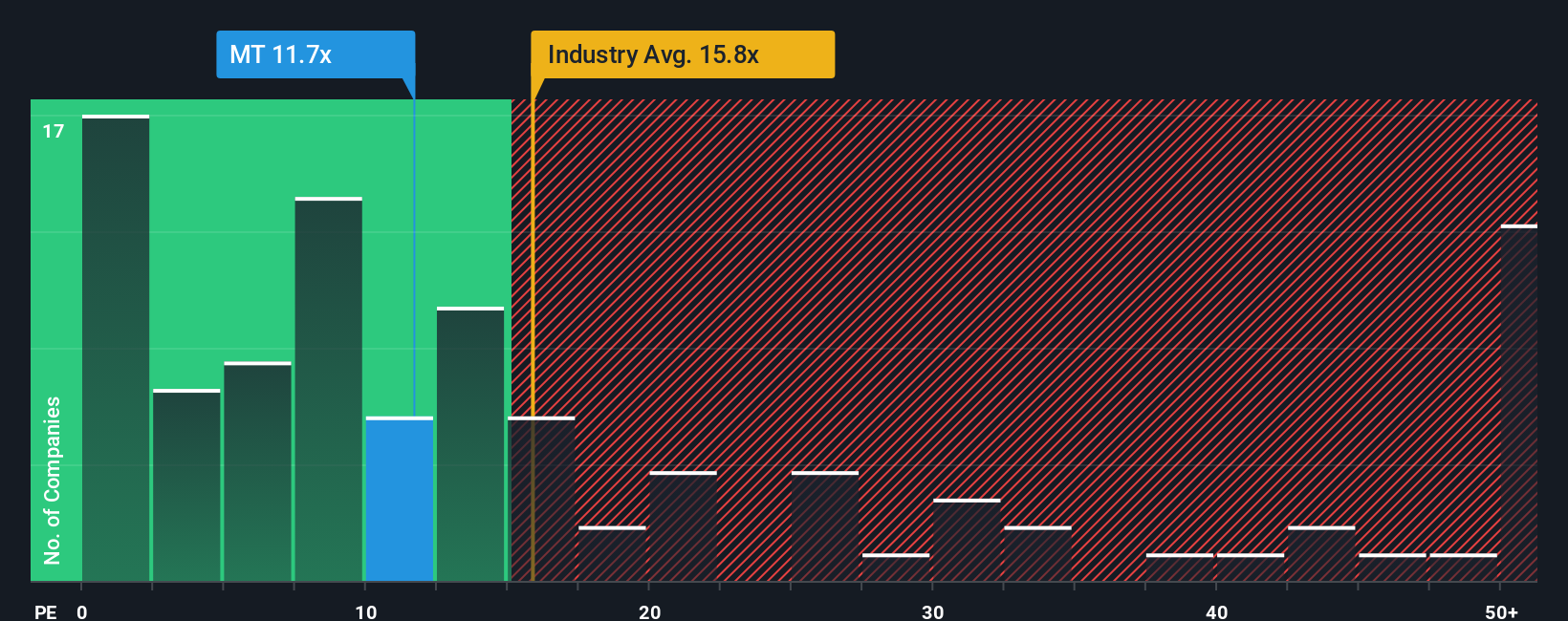

The narrative model puts fair value at €37.47 per share, so ArcelorMittal screens as about 5.8% overvalued. Yet the current P/E of 13.6x sits well below the Dutch market on 17.1x, the European metals and mining group on 17.4x, and our fair ratio of 21x. That gap hints at a valuation that still prices in quite a bit of risk, so the real question is whether you think those risks justify such a wide discount.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ArcelorMittal Narrative

If you see the numbers differently or prefer to test your own assumptions, you can spin up a custom view in just a few minutes: Do it your way.

A great starting point for your ArcelorMittal research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If ArcelorMittal is on your radar, this is the moment to widen your opportunity set and stress test your thinking against other focused stock ideas.

- Spot potential mispricings by scanning these 877 undervalued stocks based on cash flows that could suit investors hunting for companies priced below their estimated cash flow value.

- Tap into growth themes by checking out these 25 AI penny stocks that tie into artificial intelligence and related technologies.

- Strengthen your income watchlist by reviewing these 11 dividend stocks with yields > 3% that match higher yield preferences.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal