Is Goldman Sachs (GS) Using Its New Debt Issuance Wave to Quietly Recast Its Risk Profile?

- In late December 2025 and early January 2026, The Goldman Sachs Group, Inc. issued a series of senior fixed and variable-rate notes across maturities from 2027 to 2046, largely at par and with features such as callability, unsecured status, and medium-term note structures.

- This concentrated burst of debt issuance highlights how Goldman Sachs is actively tapping fixed-income markets to optimize its funding mix and support business growth.

- We’ll now examine how Goldman’s recent burst of fixed-income issuance, alongside upcoming earnings, could reshape its existing investment narrative.

This technology could replace computers: discover 29 stocks that are working to make quantum computing a reality.

Goldman Sachs Group Investment Narrative Recap

To own Goldman Sachs today, you have to believe in its ability to turn a diversified investment banking, trading, and wealth platform into consistent earnings while managing heavy regulation and capital needs. The recent burst of medium term note issuance looks incremental to that story, with the more immediate share price catalyst remaining the upcoming earnings report and the key risk still centered on evolving capital rules and how they could affect margins and capital returns.

Among recent announcements, the US$40,000 million share repurchase authorization from April 2025 stands out alongside this new debt issuance, because together they shape how Goldman balances funding, leverage, and returning excess capital. For investors watching catalysts such as a recovery in M&A and continued growth in asset and wealth management, the way Goldman finances itself and pursues buybacks will be an important context for interpreting the next earnings print.

Yet investors should not overlook how future shifts in regulatory capital requirements could affect Goldman's flexibility...

Read the full narrative on Goldman Sachs Group (it's free!)

Goldman Sachs Group's narrative projects $61.4 billion revenue and $17.0 billion earnings by 2028. This requires 3.9% yearly revenue growth and about a $2.3 billion earnings increase from $14.7 billion today.

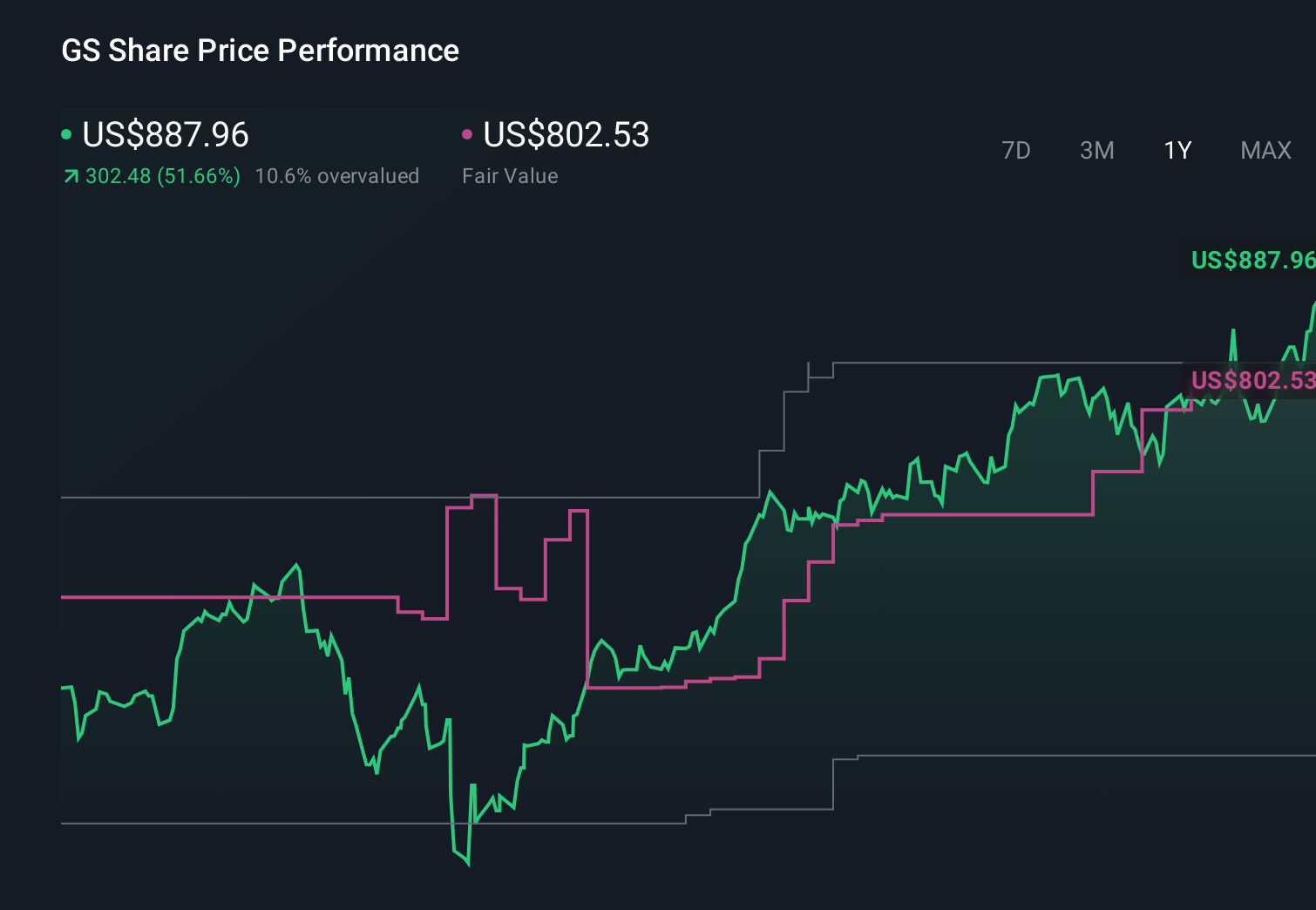

Uncover how Goldman Sachs Group's forecasts yield a $813.47 fair value, a 15% downside to its current price.

Exploring Other Perspectives

Nine fair value estimates from the Simply Wall St Community span roughly US$552 to US$900, underlining how far apart individual views on GS can be. You are weighing those views against a company whose outlook is still tied to regulatory uncertainty around capital buffers and the potential impact on profitability and capital returns.

Explore 9 other fair value estimates on Goldman Sachs Group - why the stock might be worth 42% less than the current price!

Build Your Own Goldman Sachs Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Goldman Sachs Group research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Goldman Sachs Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Goldman Sachs Group's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal