Assessing Upstart Holdings (UPST) Valuation After Strong Q3 AI Lending Growth And Profit Rebound

Upstart Holdings (UPST) is back in focus after management highlighted strong Q3 results, with 80% year-on-year growth in originations, 71% revenue growth, and a sixfold sequential increase in GAAP net income.

See our latest analysis for Upstart Holdings.

The latest Q3 update comes after a mixed share price run, with a 12.74% 7 day share price return and 8.42% 30 day share price return, but a 15.87% decline in 1 year total shareholder return, while the 3 year total shareholder return is over 2.5x.

If strong Q3 momentum has you looking beyond Upstart Holdings, this could be a good time to widen your search with high growth tech and AI stocks.

With Upstart trading close to both its analyst price target and an intrinsic value estimate, the market already appears to be assigning a premium to its AI lending story. This raises the question of whether there is still a buying opportunity here, or whether expectations for future growth are already fully reflected in the share price.

Most Popular Narrative Narrative: 8.5% Undervalued

Upstart Holdings' most followed narrative points to a fair value of about US$55.38 per share, compared with the last close of US$50.69. This frames a modest valuation gap.

The analysts have a consensus price target of $80.846 for Upstart Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $105.0, and the most bearish reporting a price target of just $20.0.

Want to see what kind of revenue ramp and margin shift sits behind that fair value? The narrative leans on ambitious profit expansion and a premium future earnings multiple. Curious how those moving parts fit together over the next few years? The full breakdown joins the dots.

Result: Fair Value of $55.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could be knocked off course if delinquency trends worsen further or if funding from banks and credit unions tightens materially.

Find out about the key risks to this Upstart Holdings narrative.

Another View: Multiples Send A Different Signal

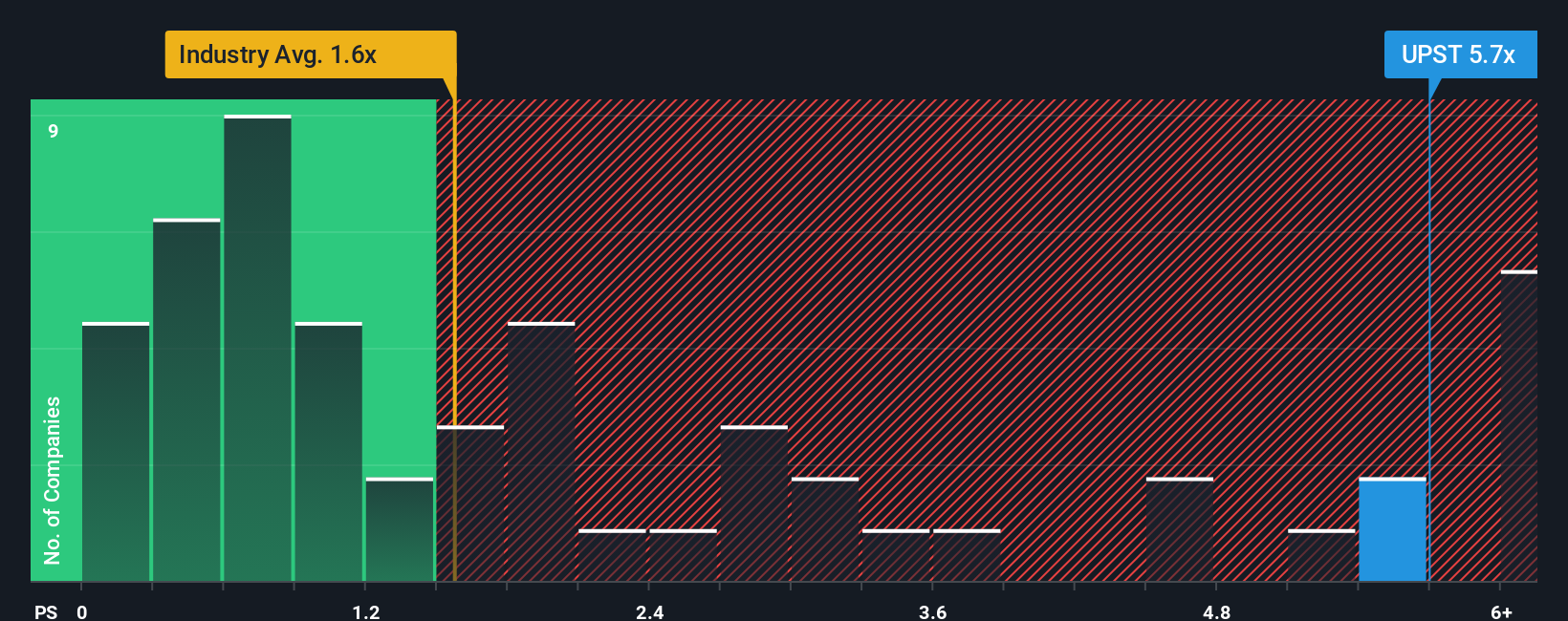

While the most followed narrative points to an 8.5% gap to fair value, the market is assigning a rich P/S of 4.9x to Upstart Holdings. That compares with 3.4x for peers, 1.5x for the wider US Consumer Finance group, and a fair ratio estimate of 3.8x, which suggests less room for error.

Put simply, the story model says modest undervaluation, but current trading multiples lean towards a premium. The key question for you is whether earnings and cash flows can catch up fast enough to justify that richer P/S, or if expectations are already running ahead of themselves.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Upstart Holdings Narrative

If you see the data differently or simply want to test your own assumptions, you can spin up a custom Upstart story in minutes using Do it your way.

A great starting point for your Upstart Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Upstart has sharpened your thinking, do not stop here. Broaden your watchlist now so you are not late when the next opportunity shows up.

- Spot potential early movers by scanning these 3554 penny stocks with strong financials with solid balance sheets and room to grow.

- Target the AI trend more broadly by zeroing in on these 25 AI penny stocks that tie artificial intelligence to real business models.

- Hunt for mispriced opportunities by filtering for these 877 undervalued stocks based on cash flows where current prices differ from underlying cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal