A Look At TransUnion (TRU) Valuation After New Global Consumer Solutions Leadership Appointment

TransUnion (TRU) is back in focus after appointing Francesca Noli as Executive Vice President of Global Consumer Solutions, putting her in charge of TruEmpower’s product roadmap and go to market plans.

See our latest analysis for TransUnion.

The appointment comes as TransUnion’s share price sits at US$82.72 after a recent 1-day share price return of 4.86% decline and a 90-day share price return of 4.38%, while the 1-year total shareholder return of 7.80% decline contrasts with a 3-year total shareholder return of 31.21%. This suggests that short term momentum has cooled compared with a stronger multi year picture.

If this kind of leadership change has caught your attention, it could be a good moment to widen your research and check out fast growing stocks with high insider ownership.

With TRU trading at US$82.72 and indicators such as an intrinsic discount of 39.72%, the key question is whether the current price already reflects its growth ambitions or whether the recent weakness is opening up a fresh opportunity.

Most Popular Narrative Narrative: 22.9% Undervalued

With TransUnion last trading at US$82.72 against a narrative fair value of US$107.25, the story centers on how future earnings power might close that gap.

With technology modernization and operational transformation investments ending in 2025, management projects free cash flow conversion to rise significantly (from 70% in 2025 to 90%+ in 2026), providing a catalyst for future shareholder returns through buybacks, acquisitions, or reinvestment, and supporting a step change in long-term earnings growth.

Curious what kind of revenue climb, margin rebuild and future P/E this story is banking on to justify that higher value? The projections behind this fair value lean on a multiyear revenue build, a sizeable uplift in profitability and an earnings multiple that sits above the broader industry. The full narrative lays out how those moving parts fit together and what has to happen for the price target to stack up.

Result: Fair Value of $107.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are clear pressure points, including tighter data privacy rules and the risk of cyberattacks, that could quickly challenge this upbeat earnings story.

Find out about the key risks to this TransUnion narrative.

Another View: Rich on Earnings

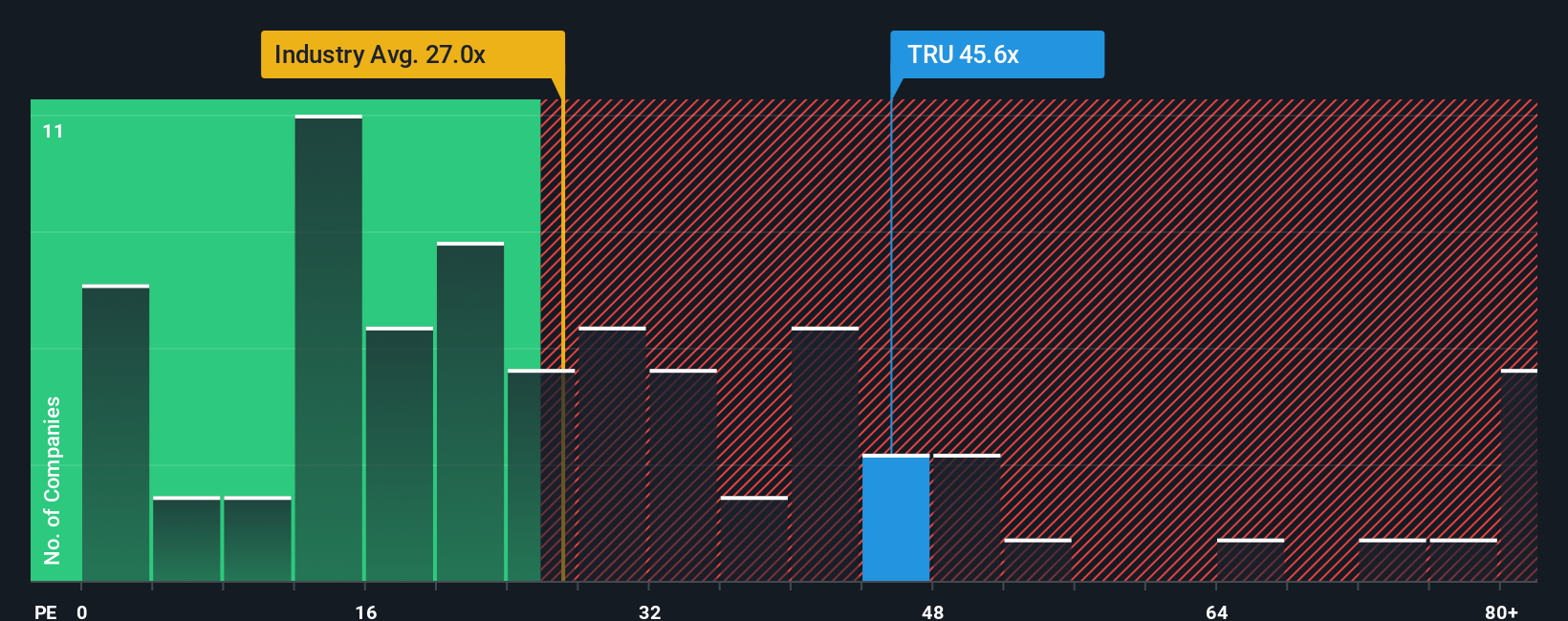

While the narrative fair value suggests TransUnion is 22.9% undervalued, its current P/E of 38.2x tells a different story. That is higher than the US Professional Services industry at 24.8x, the peer average at 36.9x, and a fair ratio of 32.3x, which points to valuation risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TransUnion Narrative

If you look at the same data and reach a different conclusion, or simply want to test your own assumptions, you can quickly build a custom thesis in just a few minutes, Do it your way.

A great starting point for your TransUnion research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If TransUnion is on your radar, do not stop there. Use the screener to spot other opportunities that fit your style before the market moves on.

- Target reliable income streams by scanning these 11 dividend stocks with yields > 3% that might suit an income focused approach.

- Chase growth stories at compelling prices by reviewing these 877 undervalued stocks based on cash flows that match your return expectations.

- Position yourself early in emerging themes by checking out these 79 cryptocurrency and blockchain stocks shaping the future of digital finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal