FactSet Research Systems Q1 2026 Net Margin Strength Reinforces Bullish Profitability Narratives

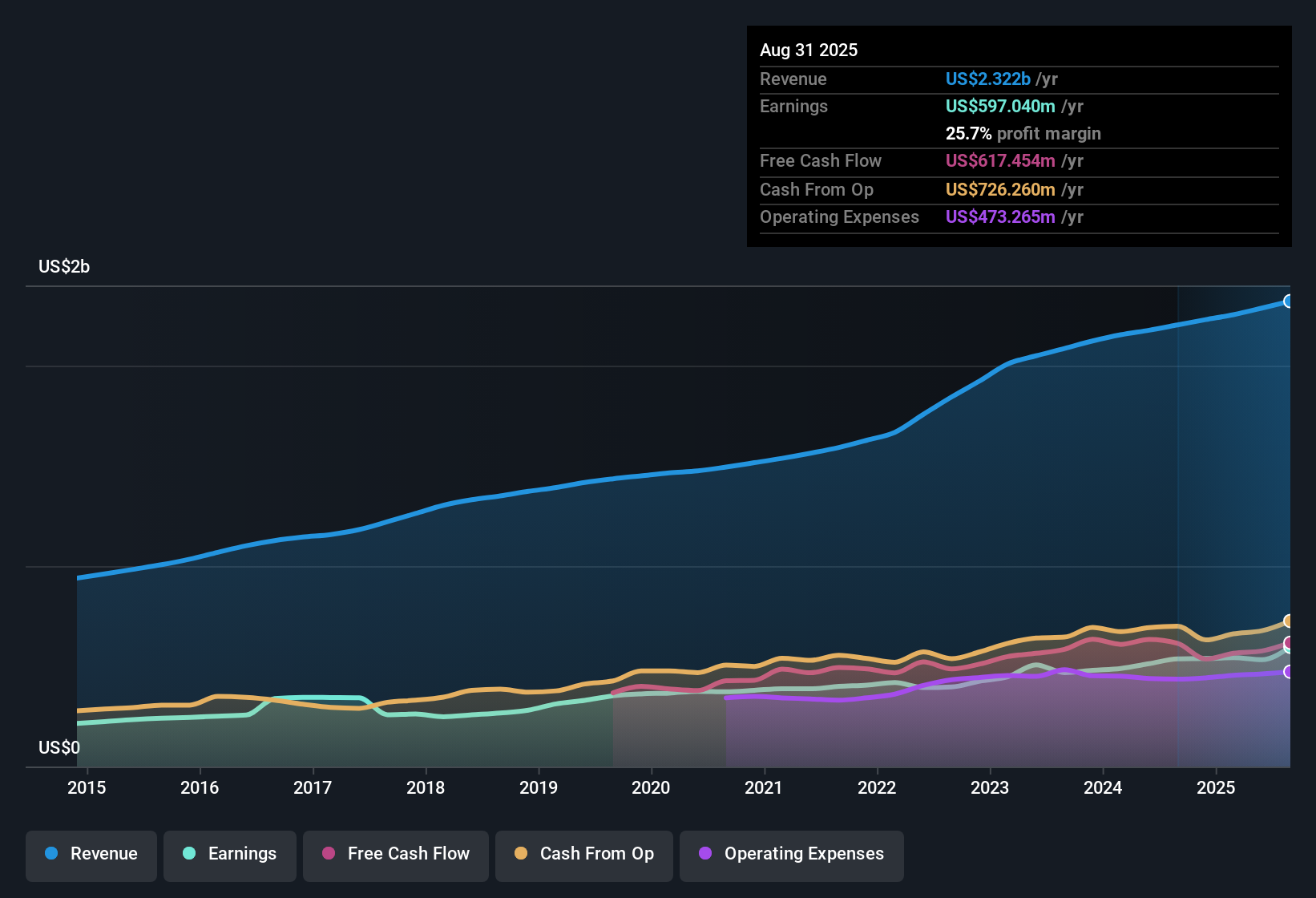

FactSet Research Systems (FDS) opened fiscal Q1 2026 with revenue of US$607.6 million and basic EPS of US$4.08, setting the tone for another period where profit trends are front and center for investors. Over the past six quarters, the company has seen revenue move from US$562.2 million in Q4 2024 to US$607.6 million in Q1 2026, while basic EPS increased from US$2.35 to just over US$4.00, with trailing twelve month EPS at US$15.87. With net profit margins running in the mid 20% range over the last year, this latest print gives investors more detail on how efficiently FactSet is converting its data platform into bottom line results.

See our full analysis for FactSet Research Systems.With the headline numbers on the table, the next step is to see how this earnings run rate lines up against the widely followed narratives around FactSet's growth, profitability, and long term outlook.

See what the community is saying about FactSet Research Systems

Margins stay firm around 25%

- Over the last 12 months, FactSet earned US$599.6 million of net income on US$2.4b of revenue, which works out to a 25.4% net profit margin compared with 24.2% a year earlier.

- Analysts' consensus view expects operational productivity and cost savings to support margins, and the current 25.4% margin gives some backing to that, although rising technology expenses are a clear watchpoint.

- The consensus narrative points to actions such as reducing third party content costs and using automation to lift efficiency. This is consistent with margins holding in the mid 20% range.

- At the same time, technology expenses were flagged as 31% higher, mainly from cloud and software. This lines up with the risk that higher tech spend could put pressure on margins if cost savings do not keep pace.

TTM earnings growth at 11.3%

- Trailing twelve month earnings grew 11.3% compared with a five year earnings growth rate of 9.4% per year, with trailing EPS at US$15.87 and trailing net income at US$599.6 million.

- Bulls argue that new products and acquisitions can support revenue and ASV growth, and the recent 11.3% earnings growth rate aligns with that view while also highlighting some friction points.

- The bullish narrative points to integration of Irwin and LiquidityBook and the launch of GenAI tools such as Pitch Creator as growth drivers. The step up from 9.4% to 11.3% earnings growth fits with a business adding new commercial engines.

- However, management commentary in the narrative also mentions slower price increases tied to lower CPI, creating a nearly US$7 million headwind to ASV. This shows that even with product launches, pricing power can face limits.

Valuation sits below peers

- The stock trades on a trailing P/E of 18.3x against peer and industry averages of 29.6x and 25.7x, while the current share price of US$292.79 sits below both a DCF fair value of US$329.36 and an analyst price target of US$320.69.

- Bears focus on slower forecast growth and debt levels, and the valuation gap raises the question of whether the discount reflects these concerns or an opportunity that the numbers do not fully support.

- Forecasts in the inputs point to earnings growth of about 6.1% per year and revenue growth of about 4.9% per year, both below the broad US market growth rates cited. This supports the cautious view that FactSet may grow more slowly than some alternatives.

- The company is also tagged as having a high level of debt, which fits the bearish argument that leverage adds risk, even though the 25.4% net margin and multi year earnings growth show that profitability has held up so far.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for FactSet Research Systems on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? If this earnings story sparks a different view, shape it into your own narrative in just a few minutes with Do it your way.

A great starting point for your FactSet Research Systems research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

FactSet's lower forecast earnings and revenue growth alongside its identified high debt level highlight that not every investor will be comfortable with the current risk profile.

If that balance of slower growth and higher leverage makes you hesitate, compare it with companies screened for stronger financial footing using solid balance sheet and fundamentals stocks screener (1938 results) so you can focus on businesses built with sturdier balance sheets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal