CICC: The spring A-share market is expected to continue to focus on insurance and brokerage firms

The Zhitong Finance App learned that CICC released a research report saying that the A-share market is expected to continue in spring. In January, it is recommended to focus on the following configuration ideas: 1) Along with the spread of AI technology and applications, focus on optical modules and cloud computing infrastructure, and focus on robots, consumer electronics, intelligent driving, etc. on the application side. 2) Some segments of the non-ferrous metals industry benefit from the restructuring of the global monetary order and unequal supply and demand. 3) The procyclical market, represented by the real estate chain and pan-consumption, is still on the left. It comprehensively considers the production capacity cycle and the demands of enterprises to expand the market, focusing on chemicals, power grid equipment, construction machinery, white goods, commercial vehicles, etc. 4) The entry of medium- to long-term capital into the market is a long-term trend. Starting from high-quality cash flow, volatility and dividend certainty, leading companies with high dividends are arranged. 5) Improving risk appetite in the capital market boosts non-bank financial performance, and focuses on insurance and brokerage firms.

Industry configuration view: Spring market is expected to continue

Market risk appetite improved in December, and the spring market is expected to continue. The risk appetite of the A-share market improved in December, and the Shanghai Composite Index rose for 11 consecutive trading days, starting the New Year's Eve market. The style is still biased towards growth. Liquidity easing cycles resonate between China and foreign countries. Commodities have generally risen as interest-rate sensitive assets, and the weak US dollar and domestic settlements have combined to cause the RMB to appreciate. Looking ahead to the future market, changes in the industry's production capacity cycle and the boom in the growth industry drive the performance expectations of A-share listed companies. 2026 is the first year of the “15th Five-Year Plan” period. The Central Economic Work Conference has made positive statements on expanding domestic demand and focusing on stabilizing the real estate market. In 2026, the strength and scope of “two new” subsidies have been adjusted, and “double” construction projects have been approved in advance. In terms of allocation, the current focus is still on the general market growth style. With the implementation of the steady growth policy, a longer-term change in style may occur from February to March.

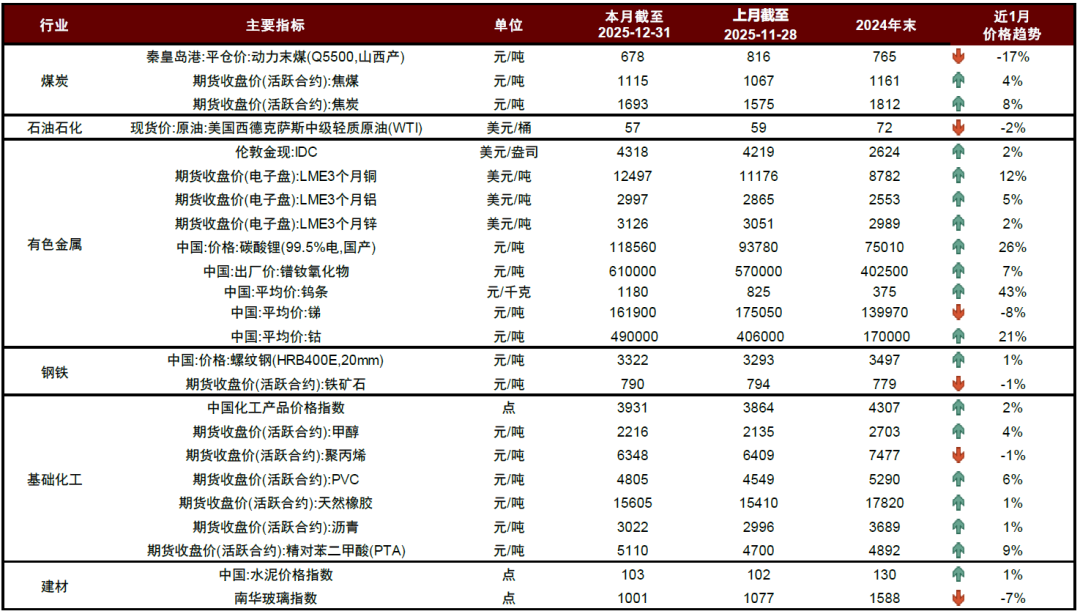

Let's look at the economic performance of various industries separately: 1) Energy and basic materials: Weakening demand expectations affect thermal coal prices, real estate chain commodities remain weak, supply and demand cycles are compounded by monetary easing, and prices of precious metals, industrial metals, and small metals have generally risen sharply. There were differences in the price performance of cyclical products we observed in December. Coking coal, coke, London gold, copper, aluminum, zinc, lithium carbonate, praseodymium oxide, tungsten, cobalt, rebar, chemical index, and cement index rose 4%, 8%, 2%, 26%, 7%, 43%, 21%, 1%, 1%, 1%, 1%, and 1%, respectively. Terminal demand was divided, and commodity prices in the domestic real estate chain continued to weaken. The Federal Reserve cut interest rates as scheduled in December. The US labor market and inflation data weakened. Market expectations for the number of times the Fed would cut interest rates in 2026 rose to 2 to 3 times. The artificial intelligence technology revolution was compounded by the energy revolution, and demand for electricity and high-end manufacturing expanded. However, commodity properties made the supply of related non-ferrous metal varieties tight in stages, supporting the strengthening of non-ferrous metal prices.

2) Industrial products: Domestic demand is structurally divided, and the manufacturing industry is performing well overseas in emerging markets. Domestic excavator sales increased 19% year on year in November, up 9% year on year in a single month, export sales increased 15% year on year, and 19% year on month. Vehicle sales were 3.43 million units, up 3% year on year, and sales of new energy vehicles were 1.82 million units, up 21% year on year. The cumulative year-on-year increase in completed investment in power grid projects across the country was 6%. The cumulative year-on-year increase in new wind power and photovoltaic installations increased 59% and 33%, respectively. The growth rate slowed significantly compared to the previous period. The export growth rates of lithium batteries, solar cells, and new energy vehicles were 23%, 106%, and 145%, respectively. China's dominant industries are concentrated in the field of industrial products. Most industrial product segments have higher overseas gross margins than domestic ones. From a regional perspective, the share of emerging markets has increased rapidly due to their cost ratio advantages.

3) Consumer goods: The traditional consumption boom needs to be boosted, and consumer support policies have been introduced. Domestic sales of household appliances continued to decline. Sales of washing machines, refrigerators, and air conditioners in November were -13%, -25%, and -25%, respectively, and total retail sales of social consumer goods grew by 3% and 1% year-on-year, respectively. In terms of agricultural products, pork prices fell. Prices of fresh vegetables rose 14.5% year on year in November, driving the CPI increase by 0.49 percentage points in the same month. Affected by the cold tide in the previous period, the supply of some fresh agricultural products was gradually tightened. The Central Economic Work Conference set key tasks. Expanding domestic demand is still at the top of proposing “adhering to domestic demand leadership and building a strong domestic market”, which specifically includes “formulating and implementing plans to increase income for urban and rural residents,” “expanding the supply of high-quality goods and services,” “unleashing the potential for service consumption,” and “optimizing the 'two news' and 'double'”. The strength and scope of state subsidies will be adjusted in 2026, and the effects of policy implementation remain to be seen.

4) Technology: AI application innovations are still emerging, and manufacturing is benefiting from the expansion of computing power capital expenditure. Due to their different positions in the industrial chain, we believe that manufacturers in the communication equipment and other industries in China have a high share of the global market and are expected to continue to benefit from the increase in computing power capital expenditure in North America. In terms of terminal demand, mobile phone sales increased 5% year on year in November, while laptop and computer hardware/monitor/computer peripherals fell 21% and 14% year over year, respectively. The semiconductor industry is still booming. Global semiconductor sales increased 25% year on year in October, and semiconductor sales in China increased 15% year on year. Segments in the fields of semiconductors, consumer electronics, intelligent driving, and embodied intelligence still deserve attention. In November, 178 domestic game versions were released, a new monthly high in recent years. Imported versions have been approved for 14 consecutive months. In terms of movies, the box office revenue of Chinese films in November was about 3.6 billion yuan, an increase of 88.82% over the previous year. Among them, “Zootopia 2” reached 1.9 billion yuan in the five days it was released, contributing most of the revenue.

5) Finance: Banks' high dividend attributes attract medium- to long-term capital allocation, and stock market sentiment has steadily improved. In the macroeconomic bottom-finding phase, bank stock profits remained stable. With dividend certainty and undervaluation, medium- to long-term capital allocations such as insurance continued to increase. In November, the insurance industry's premium income increased 7.6% year on year, and the total assets of insurance companies grew 15.5% year on year. During the current “good start” period, premiums have maintained steady growth, and market demand is strong. In December, the average daily turnover of all A-shares was 1.88 trillion yuan, with a balance of 2.56 trillion yuan. The share of two-finance transactions in market turnover increased.

6) Real estate: Prosperity needs to be improved, and the Central Economic Work Conference focuses on mitigating industry risks. On December 30, the sales area of commercial housing in large and medium-sized cities was 11.34 million square meters, down 27% year on year and up 45% month on month. In terms of housing prices, the housing sales price index for 70 large and medium-sized cities fell 2.8% and 5.7% year-on-year, respectively, in the newly built commercial housing and second-hand housing segments. The Central Economic Work Conference focused on real estate supply issues, and proposed “focusing on stabilizing the real estate market, encouraging the acquisition of existing commercial housing and focusing on affordable housing due to urban policies to control growth, remove inventory, and improve supply” and “actively and orderly resolution of local government debt risks”, etc., and paid attention to the implementation of follow-up policies.

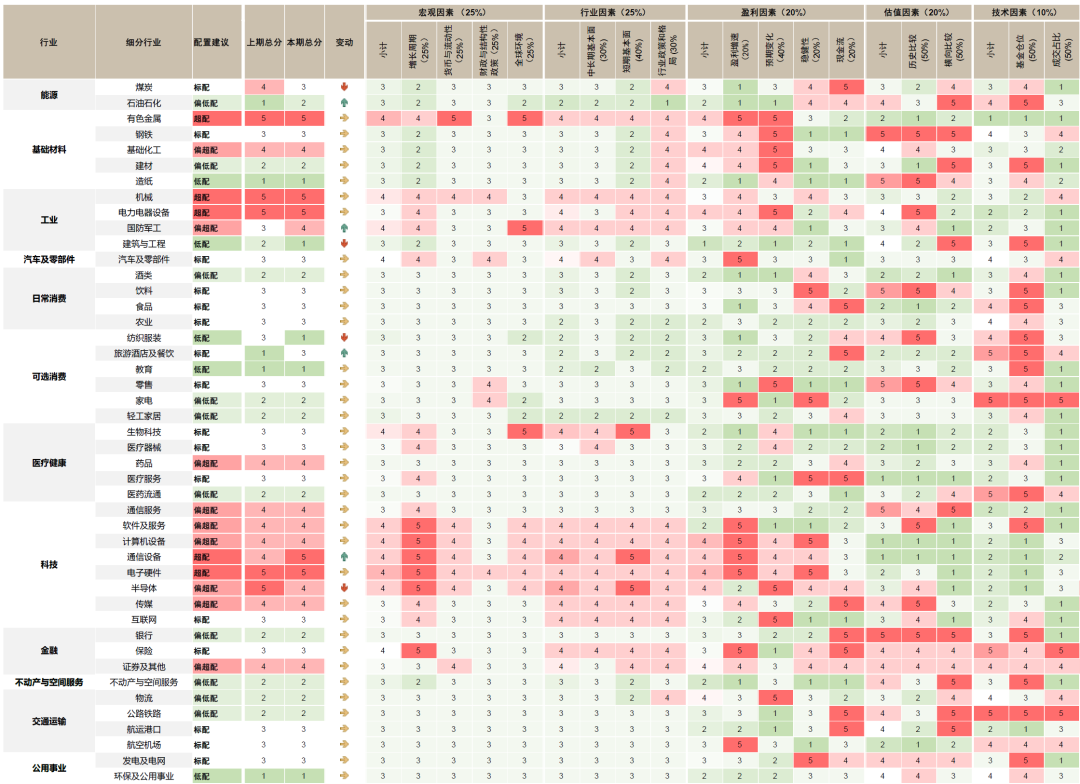

Chart 1: CICC A-share industry allocation views and sub-segments

Note: Data as of December 31, 2025

Source: FactSet, Wind, CICC Research Division

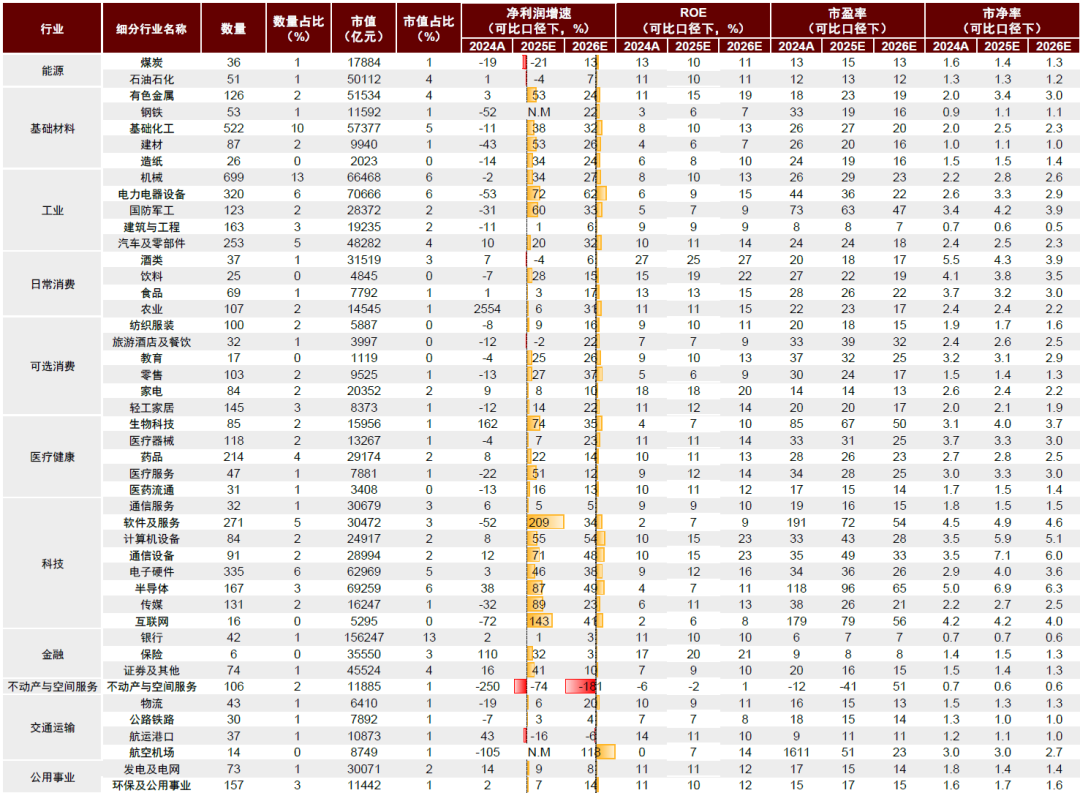

Chart 2: Fundamentals of A-share segments

Note: Data as of December 31, 2025, using Wind's consistent expectations

Source: FactSet, Wind, CICC Research Division

Observation on the climate of the meso industry

Energy and basic materials

coal

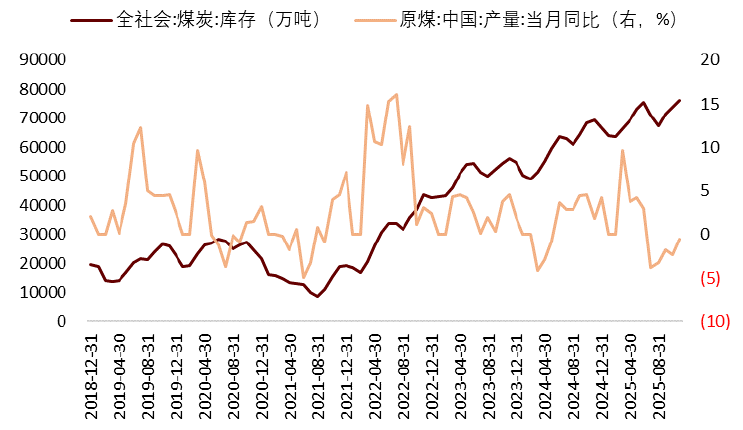

Demand expectations weakened in a warm winter environment, and thermal coal prices declined and adjusted. In December, the prices of thermal coal, coking coal, and coke fell 17%, 4%, and 8% month-on-month, respectively, and fell 11%, 4%, and 7% year-on-year respectively. In the early stages of the heating season, demand for coal storage replenishment was already concentrated. However, temperatures in most parts of the country were high, and residents' electricity consumption for heating was lower than expected. At the same time, near the end of the year, industrial production entered a low season, and demand for coal weakened marginally. On the supply side, the average daily production of raw coal in November was 146.79 million tons, up 5% from the previous month, and coal stocks were 763.49 million tons, up 3% from the previous month, reaching a new high in recent years. The rise and accumulation of production led to an imbalance between supply and demand. On December 17, the Development and Reform Commission and other departments issued the “Benchmarking Level and Benchmark Level for Key Areas of Clean and Efficient Use of Coal (2025 Edition)” [1], raising the requirements for core indicators such as standard coal consumption for coal-fired power generation. For the first time, heating coal consumption in the coal-fired power generation sector, as well as coal-to-natural gas, coal-to-oil, etc. were included in the scope of the target, eliminating backward production capacity with high pollution and high emissions. Clean coal utilization supervision extends from a single power generation link to the entire chain of cogeneration and modern coal chemicals to promote the optimization of the coal industry's supply structure.

Petroleum & Petrochemical

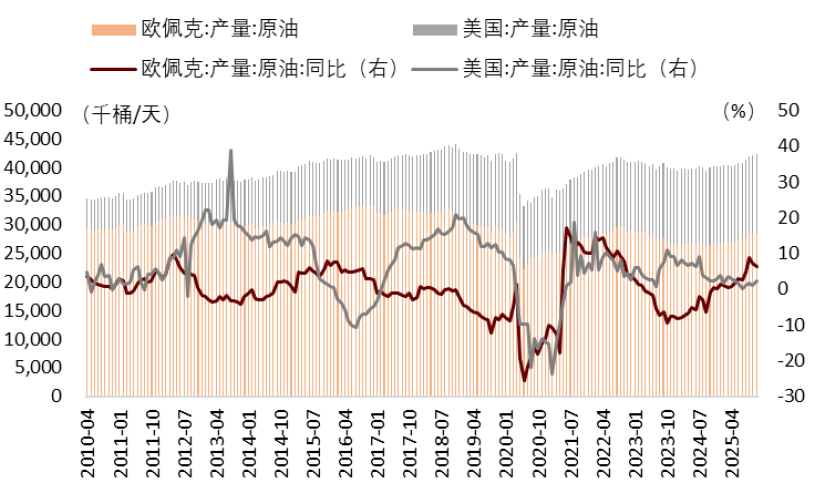

Geographic factors have changed, and oil prices have continued to fall. In December, WTI crude oil prices fell 2% month-on-month and 20% year-on-year. The OPEC+ production strategy is dynamically adjusted between the two goals of seeking market share and stabilizing oil prices. In order to gain market share, OPEC+ entered a production increase cycle in 2025 and rapidly increased monthly supply in the 2nd to 3rd quarter. Faced with weak demand and oversupply pressure, OPEC+ 8 countries suspended production growth plans in the first quarter of 2026 [2]. Short-term geopolitics and other factors are disrupting crude oil prices. US officials say the US-Ukraine negotiations have made a substantial breakthrough, and the two sides have reached preliminary consensus on a number of key issues [3]. The situation between Russia and Ukraine has further cooled down, driving oil prices down. On December 17, Trump sanctioned Venezuelan oil tankers [4], causing the country's crude oil supply to risk shrinking, and oil prices then rebounded.

non-ferrous metals

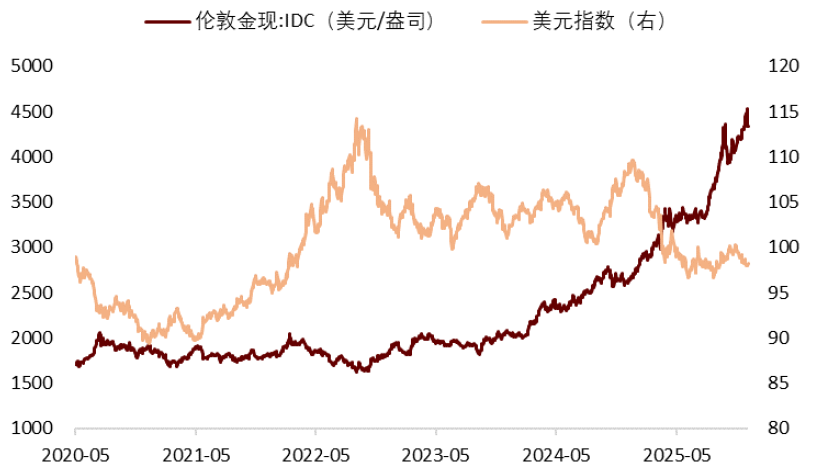

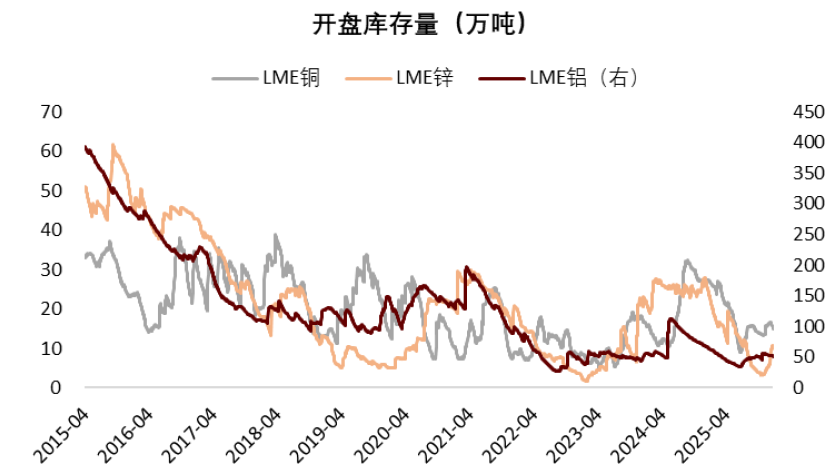

Prices of precious metals, industrial metals, and small metals have generally risen sharply due to a mismatch between supply and demand cycles combined with monetary easing. The price of gold in London rose 2% month-on-month in December. In terms of industrial metals, the closing price of LME's 3-month futures (electronic disk) copper, aluminum, and zinc rose 12%, 5%, and 2% month-on-month, respectively, and 42%, 17%, and 5%, respectively. The price of domestic lithium carbonate (99.5% electricity) continued to rise sharply by 26% month-on-month and 58% year-on-year. Prices of small metals generally rose. Prices of rare earths, tungsten bars, and cobalt rose 7%, 43%, and 21% month-on-month, and 52%, 215%, and 188% year-on-year respectively. The artificial intelligence technology revolution is compounded by the energy revolution, and demand for electricity, high-end manufacturing, etc. is expanding, but commodity properties have made the supply of related non-ferrous metal varieties tight. The Federal Reserve cut interest rates as scheduled in December. The US labor market and inflation data weakened, and the market's expectations for the number of times the Fed would cut interest rates in 2026 increased to 2 to 3 times, supporting the strengthening of non-ferrous metals prices.

steel

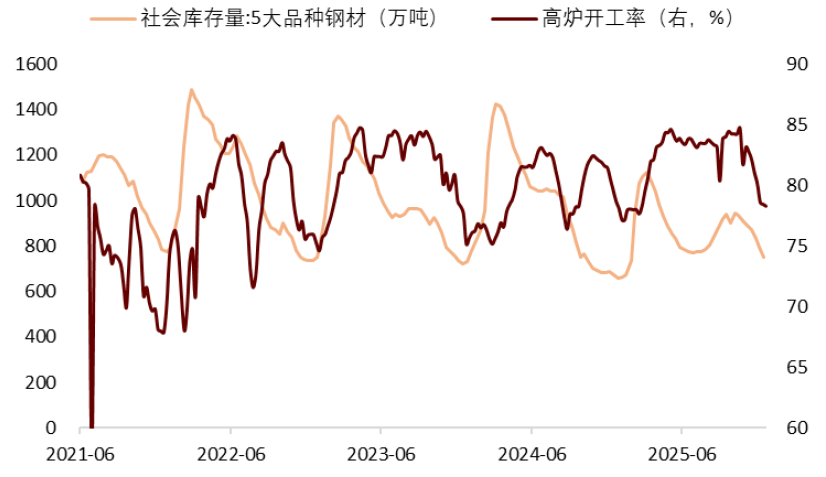

Both supply and demand in the steel industry are weak during the winter off-season. At the end of the year, the steel industry was in a low season. By the end of December, the price of rebar had risen 1% month-on-month, down 5% year-on-year, and iron ore fell 1% month-on-month, and rose 1% year-on-year. Social stocks of the five major types of steel were 7.48 million tons, down 10% from the previous month. The operating rate of blast furnaces was 78%, continuing to decline compared to the previous month.

Basic chemicals

Chemical prices have mostly risen, and we continue to focus on industry segments where supply is expected to be balanced. As of the end of December, China's chemical product price index had risen 2% month-on-month and fell 9% year-on-year. Looking at the closing price of futures (active contracts), methanol, PVC, natural rubber, asphalt, and PTA rose 4%, 6%, 1%, 1%, and 9%, respectively, and fell 18%, 9%, 18%, and 4% year-on-year respectively. Investment growth in the chemical industry has continued to decline since 2024. The CICC Chemical team expects [5] that this round of chemical production capacity expansion is expected to come to an end in 2H25. The profit inflection point of the midstream chemical industry is expected to gradually approach, and supply segments [6] include PX, polyester filament, spandex, MDI/TDI, silicone, caprolactam, etc. related to the polyester industry chain.

building materials

Downstream demand is sluggish, and the price of building materials is falling. By the end of December, the cement price index had risen 1% month-on-month and 21% year-on-year, while the Nanhua Glass Index had fallen 7% month-on-month and 37% year-on-year. Weakening real estate investment is dragging down demand for building materials. There is an overproduction capacity of clinker in the cement industry, and limiting overproduction is the main gripper for the industry to reduce production capacity. At the same time, the policy encourages leading enterprises to jointly establish green and low-carbon transformation funds to accelerate the exit of inefficient production capacity in a market-based manner. The industry increases the production costs of small enterprises by increasing the ratio of ultra-low carbon emissions and carbon trading, etc., and accelerates the increase in industry concentration. There are many private enterprises in the glass industry. The CICC Basic Materials Team believes that the “anti-internal roll” policy is less strong than cement, steel, coal, etc., and that the industry relies more on spontaneous cold repair and production cuts to obtain price flexibility [7].

Chart 3: Price performance of major energy and basic materials

Note: Data as of December 31, 2025

Source: Wind, CICC Finishing, CICC Research Division

Chart 4: The size of coal stocks and the growth rate of production

Source: Wind, Coal Resources Network, CICC Research Division

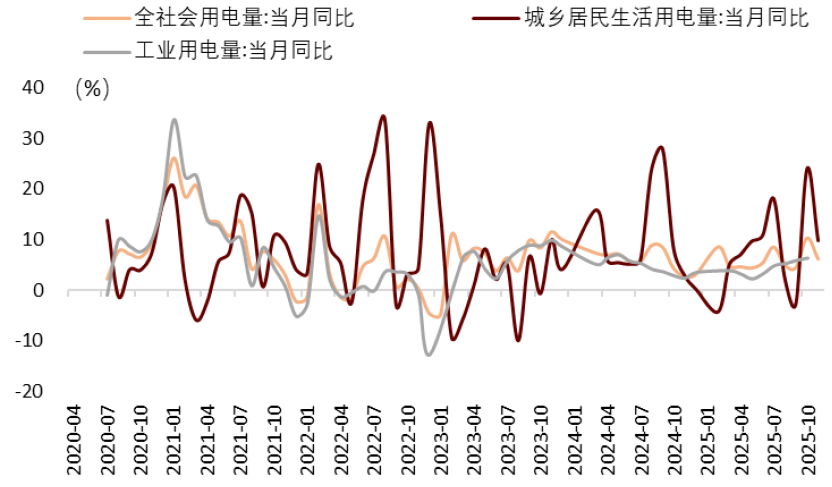

Chart 5: The growth rate of electricity consumption in society as a whole

Source: Wind, CICC Research Division

Chart 6: Steel society inventory size and blast furnace operating rate

Source: Wind, CICC Research Division

Chart 7: Gold prices and the US dollar fluctuated upward

Source: Wind, CICC Research Division

Chart 8: LME industrial metals opening inventory

Source: Wind, CICC Research Division

Chart 9: Crude oil production and growth rate

Source: Wind, CICC Research Division

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal