A Look At Centene (CNC) Valuation After Barclays Upgrade And Renewed Affordable Care Act Optimism

Barclays’ recent upgrade of Centene (CNC) to Overweight, supported by a detailed view of its Affordable Care Act business and margin potential, has pushed the stock into sharper focus for health insurance investors.

See our latest analysis for Centene.

The recent Barclays upgrade comes after a sharp rebound in sentiment, with a 30 day share price return of 19.30% and a 90 day share price return of 18.96%. This contrasts with a 1 year total shareholder return decline of 26.94%, so momentum has picked up even as longer term holders remain in negative territory.

If Centene’s move has you rethinking your healthcare exposure, this could be a useful moment to scan other US healthcare names using our healthcare stocks.

With Centene trading at US$45.74 and sitting on a 1 year total shareholder return decline of 26.94%, but with an intrinsic value estimate that is materially higher, you have to ask whether this is a reset opportunity or if the market is already baking in a recovery.

Most Popular Narrative: 11.2% Overvalued

With Centene last closing at US$45.74 against a narrative fair value of about US$41.12, the current market price sits ahead of that framework.

Plans to reach breakeven in the Medicare Advantage segment by 2027 are supported by operational efficiencies, such as reductions in SG&A and enhancements in STARS ratings, which may improve future net margins.

Curious how modest revenue growth, slim margins and a lower P/E than many peers still support this valuation? The earnings path reflected in this model might be unexpected.

Result: Fair Value of $41.12 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, policy reform setbacks or higher than expected medical and specialty drug costs could quickly pressure margins and challenge the earnings framework behind this narrative.

Find out about the key risks to this Centene narrative.

Another View: What The Ratios Are Saying

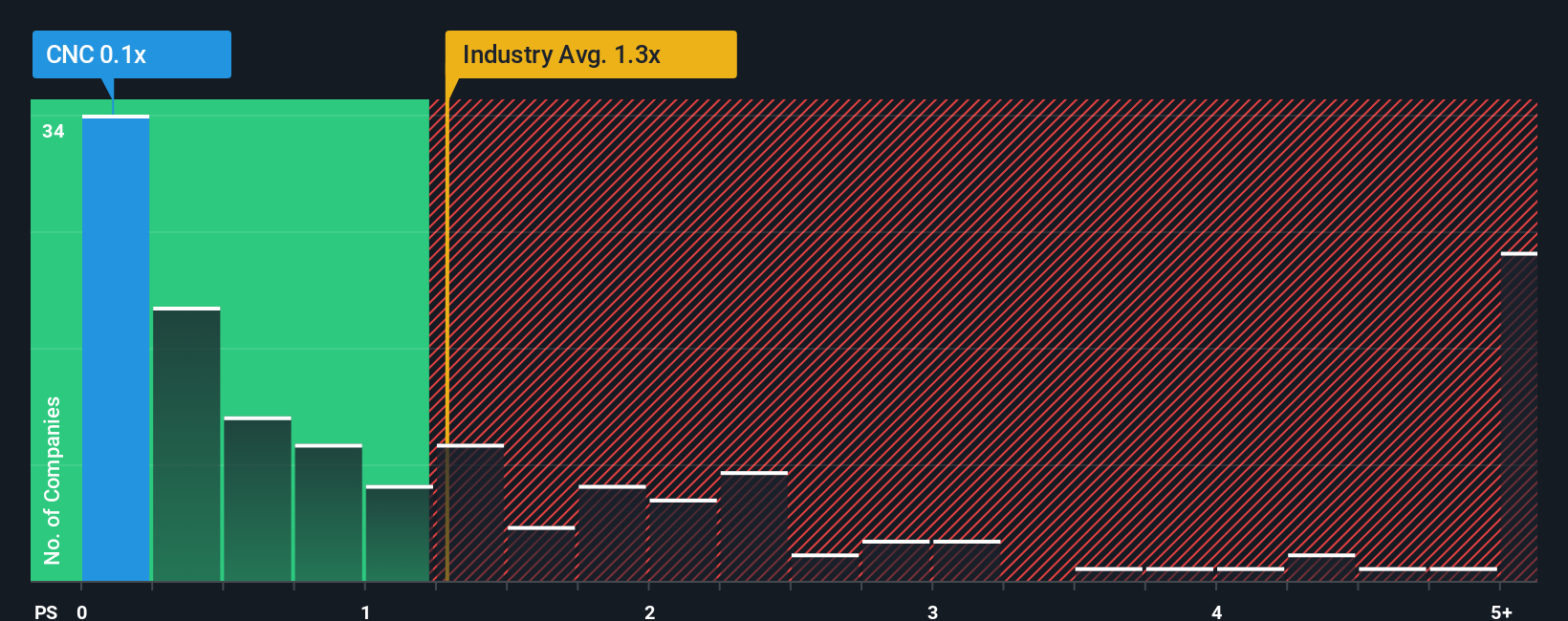

The AI narrative frames Centene as about 11.2% overvalued against a fair value of roughly US$41.12, but the current P/S ratio of 0.1x tells a very different story. That is far below the US Healthcare industry at 1.2x, the peer average at 1.8x, and the fair ratio of 0.9x. Together these figures point to a large valuation gap that could either signal mispricing or reflect the market’s concern about profitability, funding risk and recent returns. The real question is whether you think that gap eventually closes or that the narrative is still too optimistic.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Centene Narrative

If you see the numbers differently or simply want to test your own assumptions, you can build a custom view in just a few minutes, starting with Do it your way.

A great starting point for your Centene research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Centene has sharpened your focus on opportunities, do not stop here. Widen your search and let fresh ideas challenge your current watchlist.

- Spot potential value candidates early by checking out these 882 undervalued stocks based on cash flows that line up with your preferred risk and return profile.

- Target income-focused opportunities by reviewing these 13 dividend stocks with yields > 3% that may fit a cash flow oriented approach.

- Position yourself for potential tech shifts by scanning these 29 quantum computing stocks that could reshape how you think about future exposure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal