Invesco (IVZ) Valuation Check After Preference Share Buyback And LGT Private Markets Partnership

Invesco (IVZ) has been back in focus after announcing a US$500 million preference share buyback at an 18% premium, alongside an expanded private markets partnership with LGT Capital Partners that could reshape how investors view its capital priorities.

See our latest analysis for Invesco.

Those capital moves land at a time when the share price, now at US$28.25, has seen a 90 day share price return of 17.71%, while the 1 year total shareholder return of 72.01% points to momentum that has been building rather than fading.

If you are looking beyond Invesco for ideas in financials and beyond, this could be a good moment to broaden your watchlist with fast growing stocks with high insider ownership.

With the shares at US$28.25, sitting just above the average analyst price target and backed by mixed business trends, the key question is simple: are you looking at an undervalued asset manager or has the market already priced in future growth?

Most Popular Narrative: 4% Overvalued

With Invesco last closing at US$28.25 versus a narrative fair value of about US$27.08, the current share price is sitting slightly above that framework, which leans heavily on operating leverage and margin expansion.

The proposed modernization of QQQ's fund structure from a unit investment trust to an open-end ETF is expected to directly improve net revenue and earnings by ~4 basis points due to simplified fee treatment and marketing efficiencies, providing a near-term boost to operating income.

Want to see what is really backing that small premium to fair value? The narrative leans on shrinking revenues, rising margins and a future earnings multiple that contrasts sharply with today. Curious how those moving parts fit together to support that price?

Result: Fair Value of $27.08 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this story can change quickly if QQQ restructuring stalls again, or if fee pressure from lower cost products keeps chipping away at revenue and margins.

Find out about the key risks to this Invesco narrative.

Another View: Earnings Multiple Sends a Softer Signal

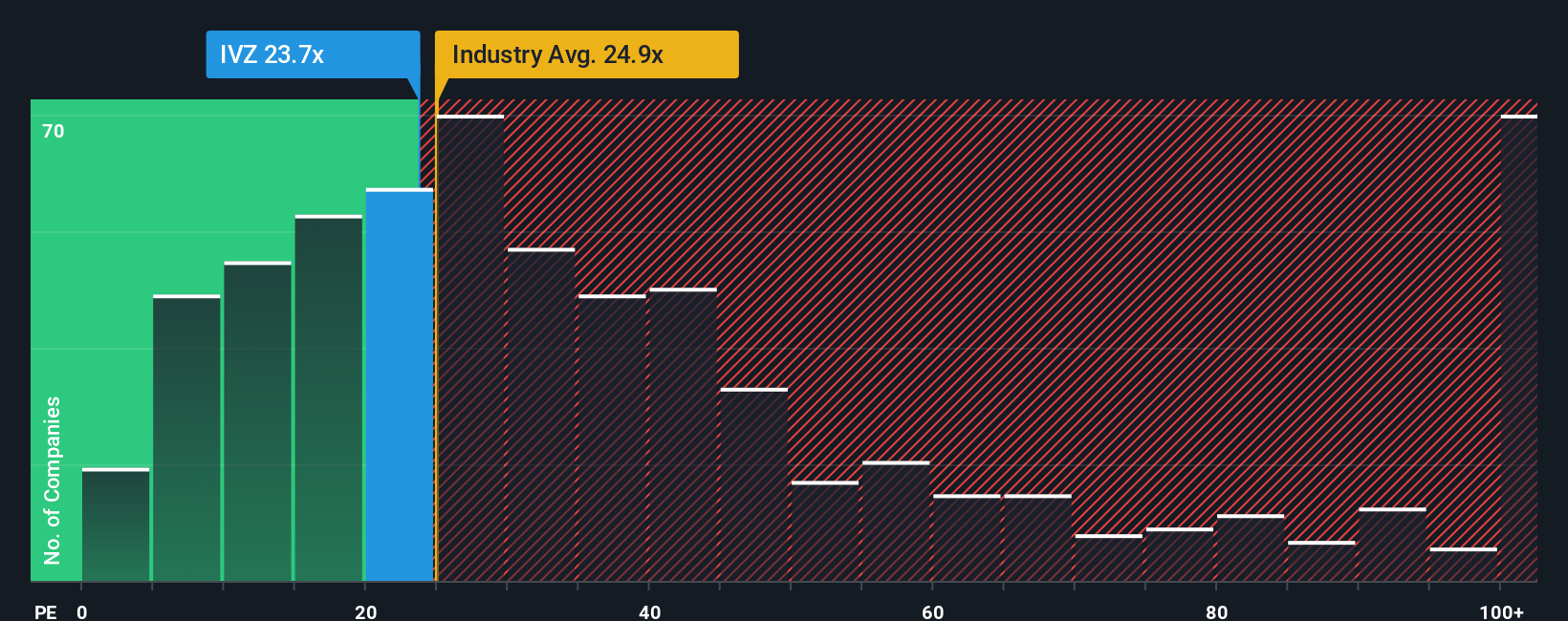

While the narrative fair value of about US$27.08 suggests Invesco looks slightly overvalued at US$28.25, the simple P/E snapshot tells a more forgiving story. The current P/E of 18.8x sits just below the US market at 19.1x, very close to peers at 18.4x, and slightly under the fair ratio of 19.3x.

In plain terms, the market is not treating Invesco as especially cheap or especially expensive, which softens the idea that you are taking on outsized valuation risk at today’s price. The key consideration is whether you trust the earnings path that this fairly middle-of-the-road multiple is built on.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Invesco Narrative

If you see the numbers differently, or prefer to test the assumptions yourself, you can build your own view in a few minutes: Do it your way.

A great starting point for your Invesco research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready To Hunt For Your Next Idea?

Before you move on, give yourself an edge by lining up a few more ideas that fit exactly what you want your portfolio to do next.

- Target potential value opportunities by scanning these 882 undervalued stocks based on cash flows that may be trading below what their cash flows suggest.

- Supercharge your growth watchlist with these 25 AI penny stocks that are tied to real business models rather than headlines alone.

- Lock in potential income ideas with these 13 dividend stocks with yields > 3% that focus on yields above 3% backed by listed businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal