Will Saba Capital’s Growing Stake and Insider Buying Shift ASA Gold and Precious Metals' (ASA) Narrative?

- Saba Capital Management, L.P. recently expanded its position in ASA Gold and Precious Metals Ltd through multiple open-market share purchases, including 8,782 shares on January 2, 2026, and additional blocks of 5,284 and 11,292 shares.

- With ASA now representing a meaningful portion of Saba Capital Management’s portfolio and insiders recording predominantly buy transactions over the past six months, major shareholders appear to be reinforcing their commitment to the company.

- We’ll now examine how Saba Capital Management’s increased ownership concentration and continued insider buying may influence ASA Gold and Precious Metals’ investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is ASA Gold and Precious Metals' Investment Narrative?

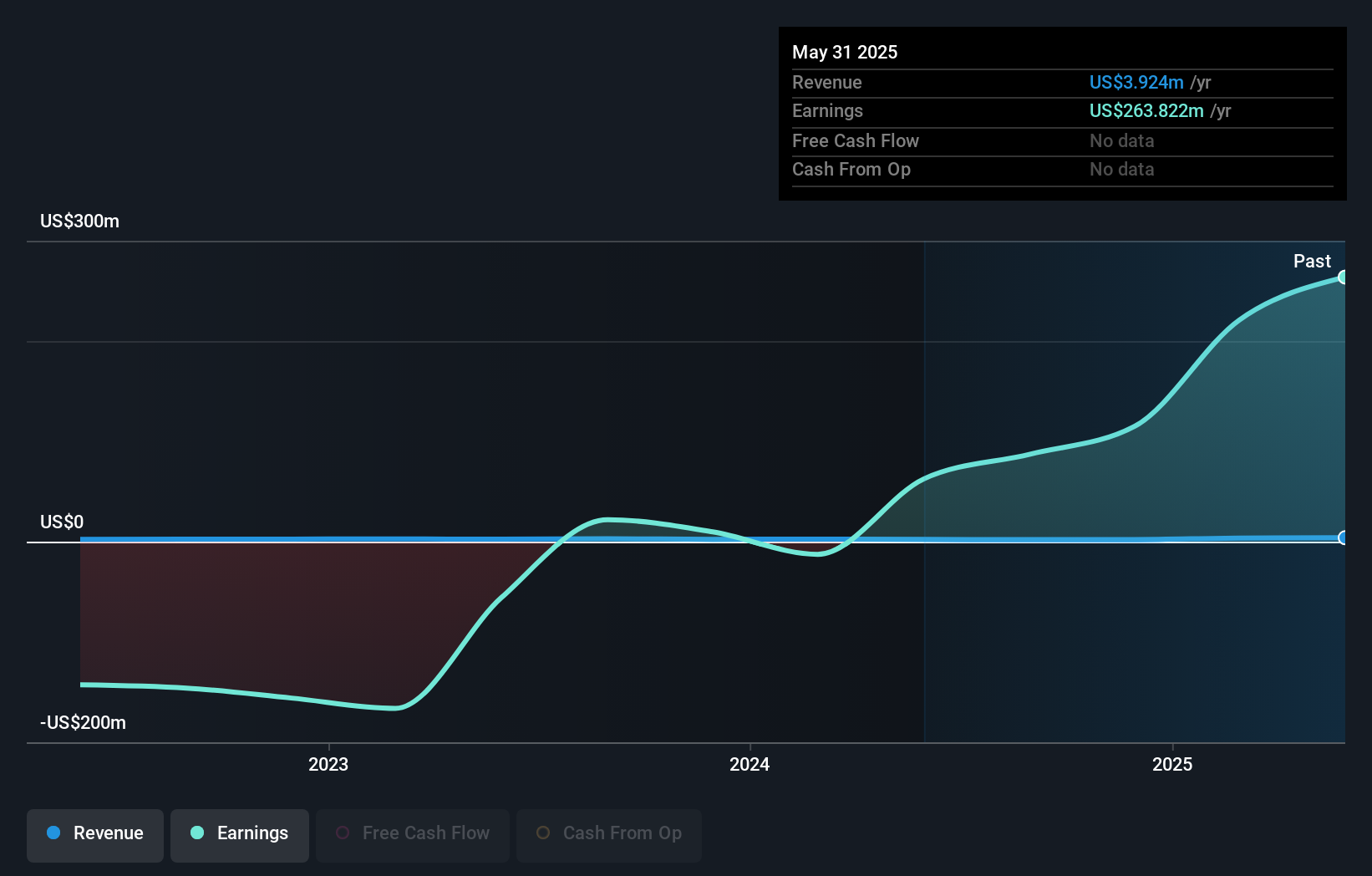

To own ASA Gold and Precious Metals, you need to be comfortable with a focused, niche vehicle that has limited revenue, a very large recent one-off gain and a relatively new board. The key short term catalysts still sit outside the company itself, in how its underlying holdings and the discount or premium to net asset value evolve, rather than in its own operating growth. Saba Capital Management’s fresh buying and already sizable portfolio exposure tighten the ownership base and could give shareholder activism more weight, which may influence governance, capital allocation and any future decisions on distributions or buybacks. That said, the latest purchases do not fundamentally change ASA’s core risks: reliance on volatile precious metals markets, concentrated ownership and a share price that has already moved sharply higher. However, there is one ownership-related risk here that investors should be aware of.

ASA Gold and Precious Metals' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

The Simply Wall St Community’s single fair value estimate clusters around US$8.53 per share, in sharp contrast to ASA’s recent trading strength and governance shifts, inviting you to weigh concentrated ownership risks against differing valuation views.

Explore another fair value estimate on ASA Gold and Precious Metals - why the stock might be worth as much as $8.53!

Build Your Own ASA Gold and Precious Metals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ASA Gold and Precious Metals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free ASA Gold and Precious Metals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ASA Gold and Precious Metals' overall financial health at a glance.

No Opportunity In ASA Gold and Precious Metals?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 39 stocks are leading the charge.

- Explore 29 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal