Alaska Air Group (ALK) Valuation Check As Hawaiʻi Investment Plan And Alliance Move Take Shape

Alaska Air Group (ALK) is back in focus after detailing the Kahuʻewai Hawaiʻi Investment Plan, a more than US$600 million, five year commitment at Hawaiian Airlines to upgrade airports, aircraft cabins, technology, and local programs.

See our latest analysis for Alaska Air Group.

That Hawaiʻi investment plan lands at a time when momentum in Alaska Air Group’s shares has been gently improving, with a 90 day share price return of 5.76% and a 1 year total shareholder return of a 20.68% decline, although total shareholder returns over three and five years are slightly positive.

If this kind of airline story has your attention, it could be a good moment to look wider across aerospace and defense stocks for other transport and travel related opportunities.

With shares still down 20.68% over the past year, but trading at roughly a 17% discount to one intrinsic value estimate and about 27% below analyst targets, you have to ask: is there real upside here, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 20.6% Undervalued

Against the last close of US$51.97, the most followed narrative points to a higher fair value, built on earnings power, margins, and network expansion.

The successful integration of Hawaiian Airlines and realization of synergy initiatives, particularly in network connectivity and premium offerings, are unlocking incremental profit, enhancing operational efficiency, and supporting margin expansion throughout the next several years.

Curious what has to happen for this valuation gap to close? Revenue climbing, margins rebuilding, and a future earnings multiple below many current airline peers all sit at the core. Want the full playbook behind those assumptions and how they link to that higher fair value line? Read on and weigh the narrative against your own expectations.

Result: Fair Value of $65.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on fuel costs remaining manageable and on the Hawaiian integration not weighing on margins longer than analysts expect.

Find out about the key risks to this Alaska Air Group narrative.

Another View: What Earnings Multiples Are Saying

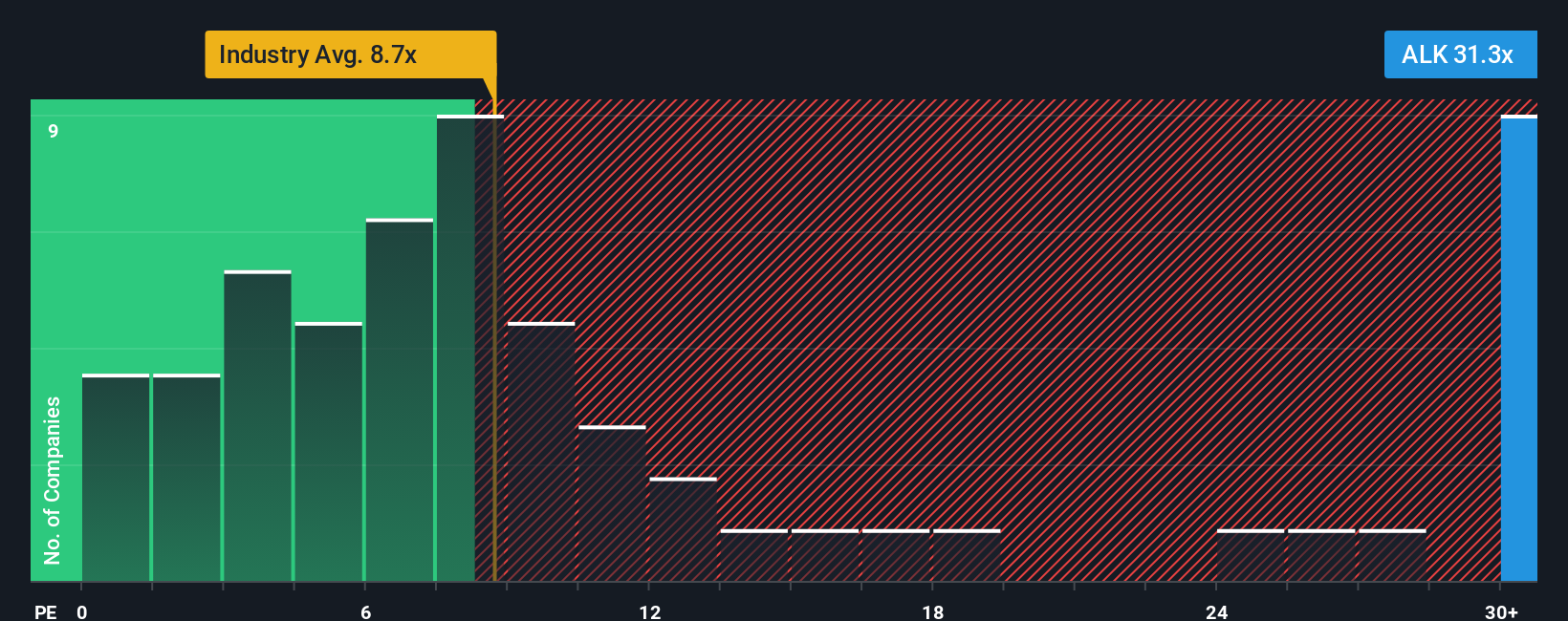

That 20.6% “undervalued” story sits uncomfortably next to how the market is pricing Alaska Air Group’s earnings today. The shares trade on a P/E of 40.2x, versus 9.5x for the global airlines industry and 11.8x for peers. Our fair ratio, meanwhile, is much higher at 210.2x.

On one hand, multiples suggest Alaska Air Group is expensive compared with airlines and peers. On the other hand, the fair ratio implies the market could still re rate the stock closer to that higher level. Which side of that gap do you think is more realistic?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alaska Air Group Narrative

If parts of this story do not line up with your view, or if you prefer to lean on your own research, you can build a tailored thesis in just a few minutes with Do it your way

A great starting point for your Alaska Air Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are weighing what to do next after reviewing Alaska Air Group, it makes sense to line up a few fresh ideas before the market moves on.

- Scan for income potential by checking out these 14 dividend stocks with yields > 3% that may suit a portfolio focused on regular cash returns.

- Tap into long term tech themes by reviewing these 25 AI penny stocks that link artificial intelligence to real business models.

- Hunt for possible mispriced opportunities by filtering for these 882 undervalued stocks based on cash flows that could fit your return and risk expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal