MercadoLibre (MELI) Is Up 6.3% After Venezuela Reopens As A New E-Commerce Frontier

- In early January 2026, MercadoLibre drew attention after geopolitical changes in Venezuela sparked speculation that the company could expand more fully into one of South America’s largest underdeveloped e-commerce and fintech markets.

- Investors are now weighing whether access to Venezuela’s sizeable population and potential demand for digital payments and logistics could materially enhance MercadoLibre’s long-term regional footprint and growth options.

- Next, we’ll examine how this potential Venezuela expansion reshapes MercadoLibre’s investment narrative, particularly around its regional growth runway.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

MercadoLibre Investment Narrative Recap

To own MercadoLibre, you need to believe its integrated commerce, payments and logistics model in underpenetrated Latin American markets can keep compounding, even as it manages credit risk and heavy reinvestment. The Venezuela headlines have lifted sentiment, but they do not change that the near term focus remains on the upcoming earnings report and how the business balances growth with profitability. The biggest risk still sits in credit quality and margin pressure, not in Venezuela execution.

In that context, I am watching the leadership transition from founder Marcos Galperin to incoming CEO Ariel Szarfsztejn more closely than the Venezuela speculation. With investors already focused on spending levels, credit losses and margin trends ahead of the next results, this handover adds another layer of attention to how consistently MercadoLibre executes its existing growth and profitability plans across the region.

Yet, while the upside story around new markets is compelling, investors should also be aware that rising credit losses or a misstep in the lending book could...

Read the full narrative on MercadoLibre (it's free!)

MercadoLibre's narrative projects $46.9 billion revenue and $5.1 billion earnings by 2028. This requires 24.8% yearly revenue growth and an earnings increase of about $3.0 billion from $2.1 billion today.

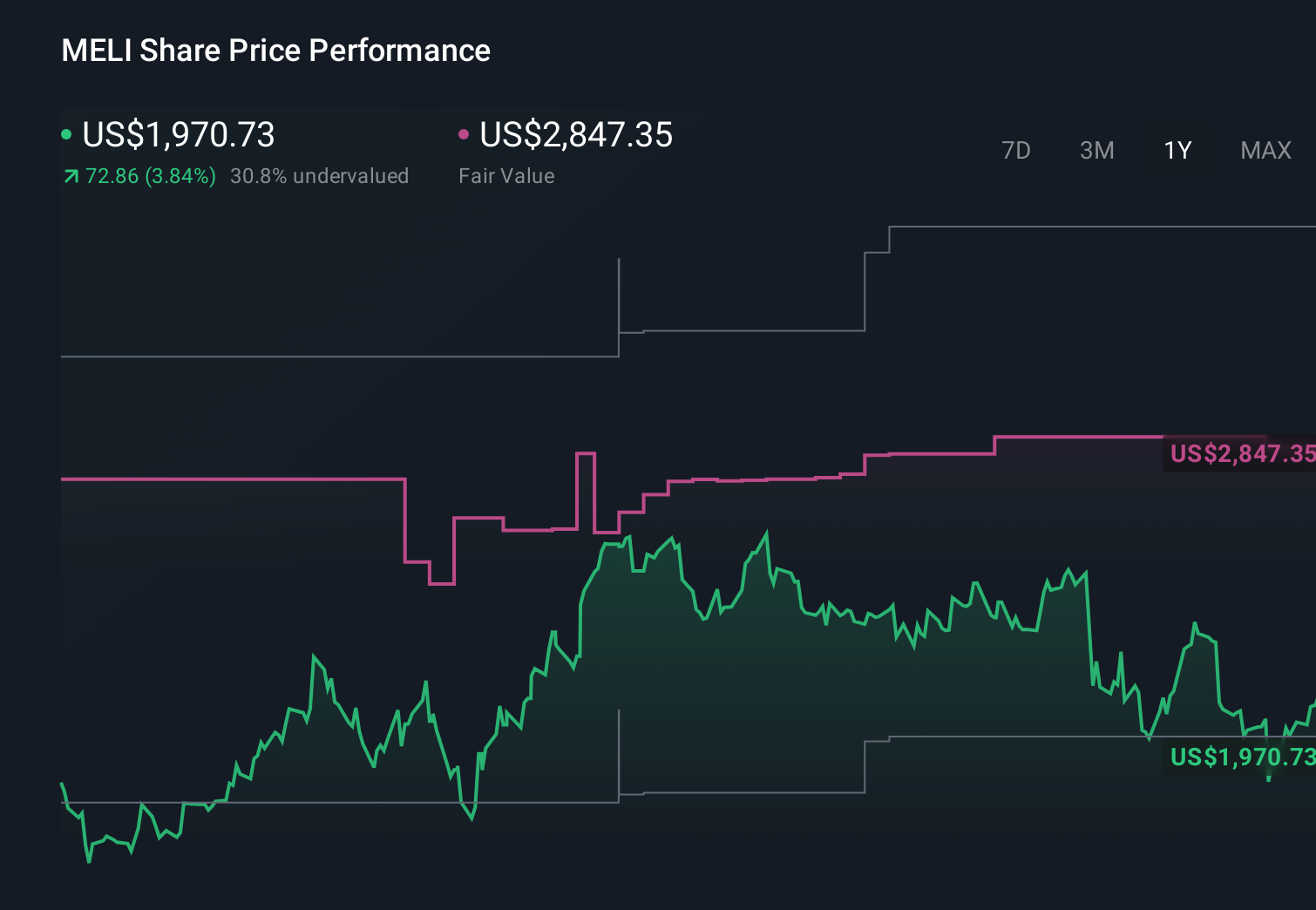

Uncover how MercadoLibre's forecasts yield a $2847 fair value, a 33% upside to its current price.

Exploring Other Perspectives

Twenty seven members of the Simply Wall St Community currently place MercadoLibre’s fair value between US$2,346.71 and US$3,406.20, reflecting a wide spread of individual expectations. Against that backdrop, the key risk around potential credit losses and margin pressure in its fast growing fintech and commerce operations is a reminder to weigh several viewpoints on how sustainable today’s profitability really is.

Explore 27 other fair value estimates on MercadoLibre - why the stock might be worth just $2347!

Build Your Own MercadoLibre Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MercadoLibre research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free MercadoLibre research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MercadoLibre's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 39 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal