Rambus (RMBS) Valuation Check As Semiconductor Rally And Data Center Expectations Lift Investor Interest

Rambus stock reaction and what is driving attention now

Rambus (RMBS) climbed 8.0% on January 3, 2026, as semiconductor stocks joined a broader Wall Street rebound, with traders positioning ahead of upcoming quarterly results and data center focused demand signals.

See our latest analysis for Rambus.

That move comes after a mixed stretch for the share price, with a 7 day share price return of 2.97% set against a 30 day share price return decline of 4.04%. At the same time, the 1 year total shareholder return of 72.47% points to momentum that has been strong over a longer horizon as investors weigh data center demand, DDR5 adoption and upcoming earnings.

If Rambus has you watching semiconductors more closely, it could be a good moment to scan other chip names using our high growth tech and AI stocks as potential ideas for further research.

With Rambus up strongly over the past year and trading at US$97.50 against an average analyst target of US$120, the key question is whether this represents an undervalued data center supplier or a stock where the market is already pricing in future growth.

Most Popular Narrative Narrative: 18.8% Undervalued

With Rambus closing at US$97.50 against a narrative fair value of US$120, the narrative is clearly leaning toward upside potential based on future fundamentals.

The company's sharpened focus on a core IP licensing and semiconductor business model is creating more diversified and recurring revenue streams, while supporting structurally higher net margins due to the scalable nature of licensing and improved product mix.

Curious what kind of revenue path and margin profile underpin that valuation uplift? The narrative rests on compounding top line growth and rising profitability assumptions. Want to see how those forecasts translate into earnings power and the profit multiple used to reach that fair value? Read through the full set of projections to judge whether those numbers stack up for you.

Result: Fair Value of $120 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on AI and data center demand staying on track, while any delay in MRDIMM adoption or tougher competition in high performance memory IP could quickly challenge that upside story.

Find out about the key risks to this Rambus narrative.

Another View: Market Pricing Looks Richer On Earnings

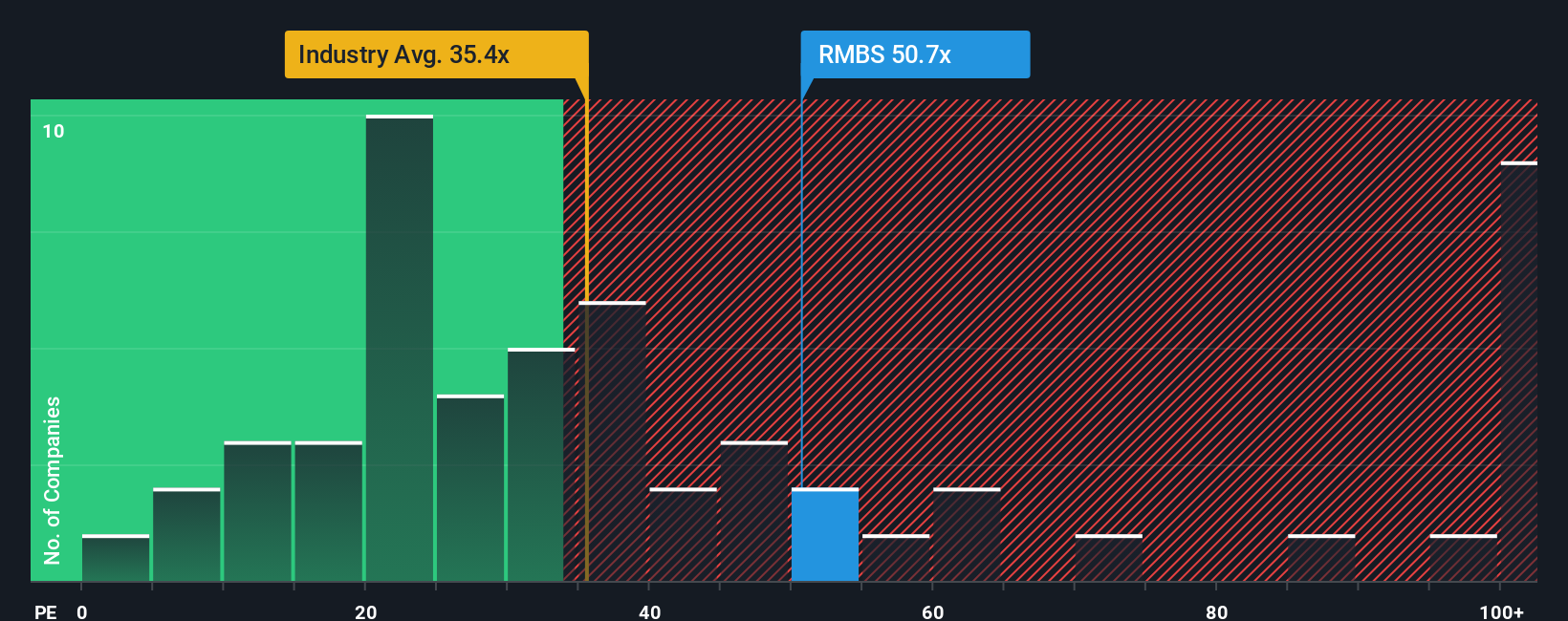

The fair value narrative points to Rambus as 18.8% undervalued, yet the current P/E of 45.9x sits well above both peers at 38x and the estimated fair ratio of 37.1x. That gap implies investors are paying a premium, which raises the question of how much good news is already in the price.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rambus Narrative

If you see the numbers differently or prefer to weigh the drivers yourself, you can build a personalized Rambus thesis in minutes with Do it your way.

A great starting point for your Rambus research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Rambus has sharpened your interest, do not stop here. Broader research across different themes can help you spot opportunities that better match your own investing checklist.

- Target potential value opportunities by scanning these 880 undervalued stocks based on cash flows that may trade below what their cash flows suggest.

- Spot emerging trends in artificial intelligence by reviewing these 25 AI penny stocks tied to data, model training and infrastructure demand.

- Lock in potential income ideas by checking out these 14 dividend stocks with yields > 3% that offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal