How Investors May Respond To General Electric (GE) Spinoff-Fueled Focus On Jet Engines And Services

- In recent months, GE Aerospace has completed its breakup from the old General Electric conglomerate and operated as a focused aviation business centered on jet engines, services, and high-tech aerospace systems, while easing supply bottlenecks has helped it ramp LEAP engine deliveries and support strong commercial order growth.

- At the same time, GE Aerospace’s growing free cash flow, share buybacks, and advanced propulsion test work with partners such as Starfighters Space highlight how a more concentrated aerospace model may support recurring service income and technology-led expansion.

- We’ll now examine how GE Aerospace’s sharpened focus on jet engines and services may influence the existing investment narrative for the company.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

General Electric Investment Narrative Recap

To own GE Aerospace today, you need to be comfortable with a focused aviation business whose fortunes are tightly linked to commercial and defense engine demand and long-term service contracts. Recent news of strong share gains alongside peers and easing supply bottlenecks supports the key near term catalyst of higher LEAP deliveries and services activity, while the biggest current risk remains the company’s heavy exposure to any slowdown in global air travel, rather than this latest news flow.

Among recent updates, GE Aerospace’s disclosed 14.5% annual revenue growth over the last two years and a 17.6% free cash flow margin stands out, as it underpins management’s capital returns through buybacks and dividends and supports the idea that a more concentrated aerospace model can fund investment in next generation propulsion programs that sit at the heart of the long term catalyst story.

Yet investors also need to weigh how a concentrated aviation focus could amplify the impact of any prolonged air travel downturn on GE Aerospace’s earnings...

Read the full narrative on General Electric (it's free!)

General Electric's narrative projects $50.8 billion in revenue and $9.5 billion in earnings by 2028.

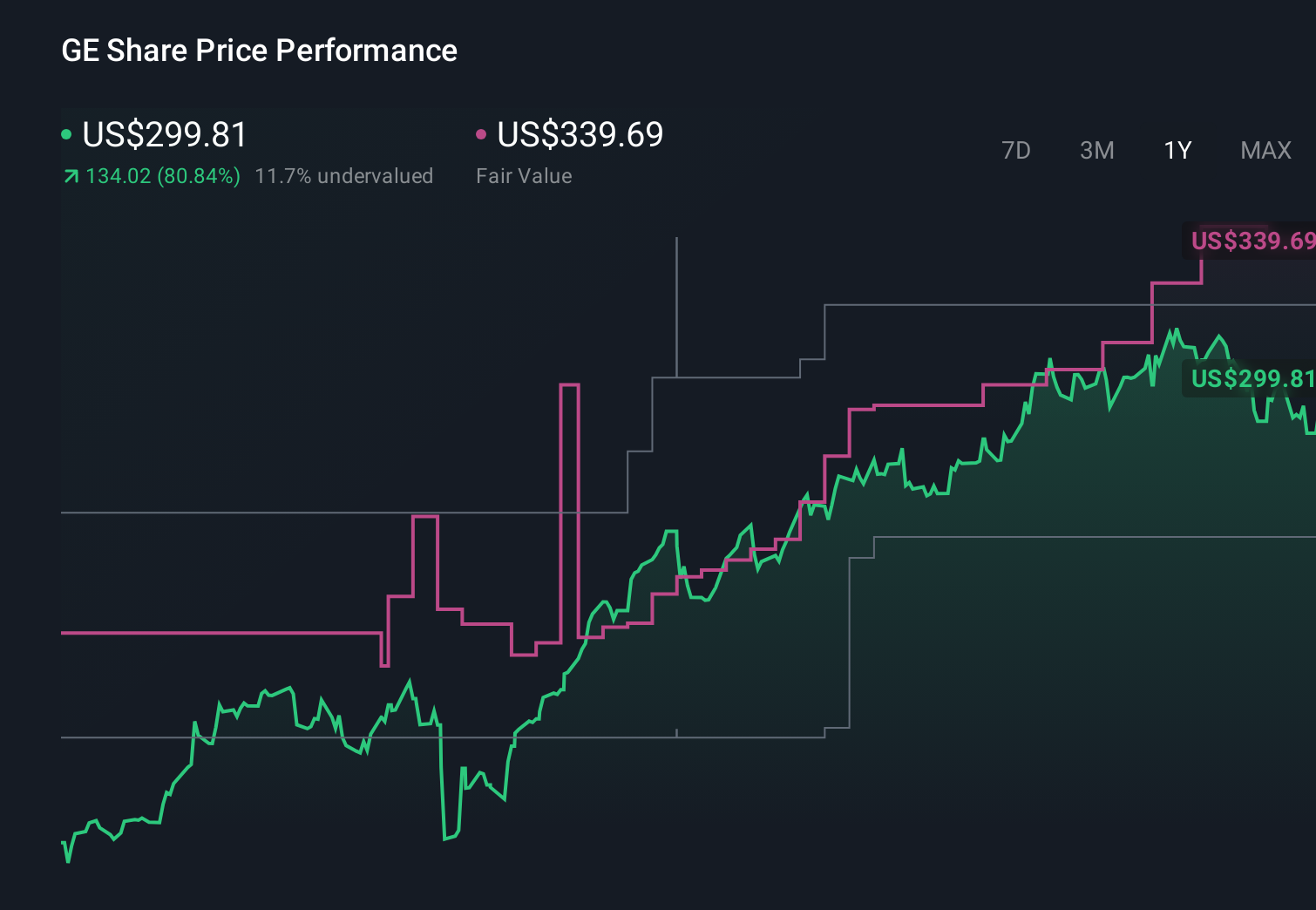

Uncover how General Electric's forecasts yield a $339.69 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Thirteen members of the Simply Wall St Community currently estimate GE Aerospace’s value between US$191 and US$394 per share, highlighting a wide spread of opinions. Against this backdrop, GE’s reliance on commercial aviation demand means you may want to weigh those differing views alongside the potential impact of any future air travel slowdown on its performance, and consider several alternative perspectives before deciding how to act.

Explore 13 other fair value estimates on General Electric - why the stock might be worth 41% less than the current price!

Build Your Own General Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your General Electric research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free General Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate General Electric's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal