Insiders Favor These 3 High Growth Stocks

As the Dow Jones Industrial Average hits an all-time high for the second consecutive day, buoyed by recent geopolitical events, investors are closely watching how these developments impact market dynamics. In such a robust environment, stocks with strong growth potential and high insider ownership often attract attention as they suggest confidence from those closest to the company's operations.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 14.1% | 59% |

| SES AI (SES) | 12% | 68.9% |

| Prairie Operating (PROP) | 32.2% | 100% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Duos Technologies Group (DUOT) | 16.4% | 155.1% |

| Credo Technology Group Holding (CRDO) | 10.1% | 30.7% |

| Corcept Therapeutics (CORT) | 11.5% | 43.6% |

| Bitdeer Technologies Group (BTDR) | 33.4% | 135.5% |

| Astera Labs (ALAB) | 10.5% | 29.0% |

We're going to check out a few of the best picks from our screener tool.

Webull (BULL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Webull Corporation operates as a digital investment platform with a market cap of $4.30 billion.

Operations: The company's revenue primarily comes from its brokerage segment, which generated $514.80 million.

Insider Ownership: 22.8%

Earnings Growth Forecast: 123.2% p.a.

Webull's recent inclusion in multiple Russell indices underscores its growing market presence, supported by a strong revenue increase to US$156.94 million in Q3 2025 from US$101.14 million the previous year. The launch of AI-powered Vega and corporate bond trading enhances its platform offerings, while forecasts indicate robust annual revenue growth of 25.1%, surpassing the U.S. market average. However, substantial shareholder dilution occurred over the past year despite no significant insider trading activity recently observed.

- Click to explore a detailed breakdown of our findings in Webull's earnings growth report.

- Our expertly prepared valuation report Webull implies its share price may be too high.

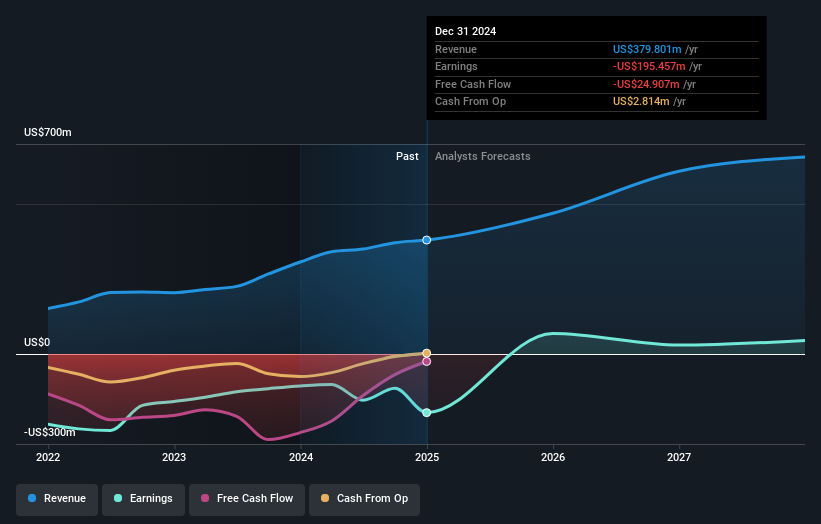

Microvast Holdings (MVST)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Microvast Holdings, Inc. specializes in battery technologies for electric vehicles and energy storage solutions with a market cap of approximately $1.03 billion.

Operations: The company's revenue primarily comes from its Batteries / Battery Systems segment, totaling $444.50 million.

Insider Ownership: 27.5%

Earnings Growth Forecast: 53.5% p.a.

Microvast Holdings, Inc. is experiencing significant revenue growth, with Q3 2025 sales rising to US$123.29 million from US$101.39 million a year ago, although it reported a net loss of US$1.49 million this quarter compared to last year's net income of US$13.25 million. The company maintains its 2025 revenue guidance between $450 and $475 million and anticipates becoming profitable within three years, outpacing average market growth despite recent impairment charges and share price volatility.

- Take a closer look at Microvast Holdings' potential here in our earnings growth report.

- The analysis detailed in our Microvast Holdings valuation report hints at an inflated share price compared to its estimated value.

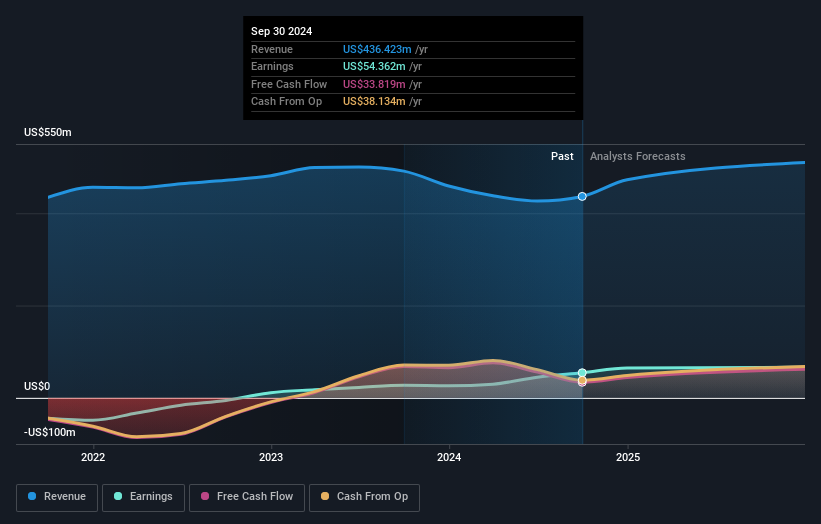

Power Solutions International (PSIX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Power Solutions International, Inc. designs, engineers, manufactures, markets, and sells engines and power systems globally with a market cap of $1.58 billion.

Operations: The company's revenue is primarily derived from its Engineered Integrated Electrical Power Generation Systems segment, which generated $675.48 million.

Insider Ownership: 17.4%

Earnings Growth Forecast: 16.7% p.a.

Power Solutions International is experiencing robust growth, with recent earnings guidance projecting a 45% sales increase for 2025, driven by power systems demand. Its revenue and earnings are expected to grow faster than the US market average. Despite high share price volatility, the stock trades significantly below estimated fair value and shows strong insider ownership through Weichai America Corp. Recent board changes reflect strategic alignment with this major shareholder's interests.

- Delve into the full analysis future growth report here for a deeper understanding of Power Solutions International.

- According our valuation report, there's an indication that Power Solutions International's share price might be on the cheaper side.

Next Steps

- Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 211 more companies for you to explore.Click here to unveil our expertly curated list of 214 Fast Growing US Companies With High Insider Ownership.

- Looking For Alternative Opportunities? AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal