Chevron Stock Just Broke Through Resistance Levels in an Epic Move Higher. Should You Buy CVX Now?

Chevron (CVX) shares extended gains on Jan. 5 as investors treated President Donald Trump’s administration’s strike on Venezuela as an opportunity for U.S. oil companies.

Monday’s price action confirmed CVX’s break above its major resistance (100-day moving average) at the $154 level, signaling bulls will likely remain in control in the weeks ahead.

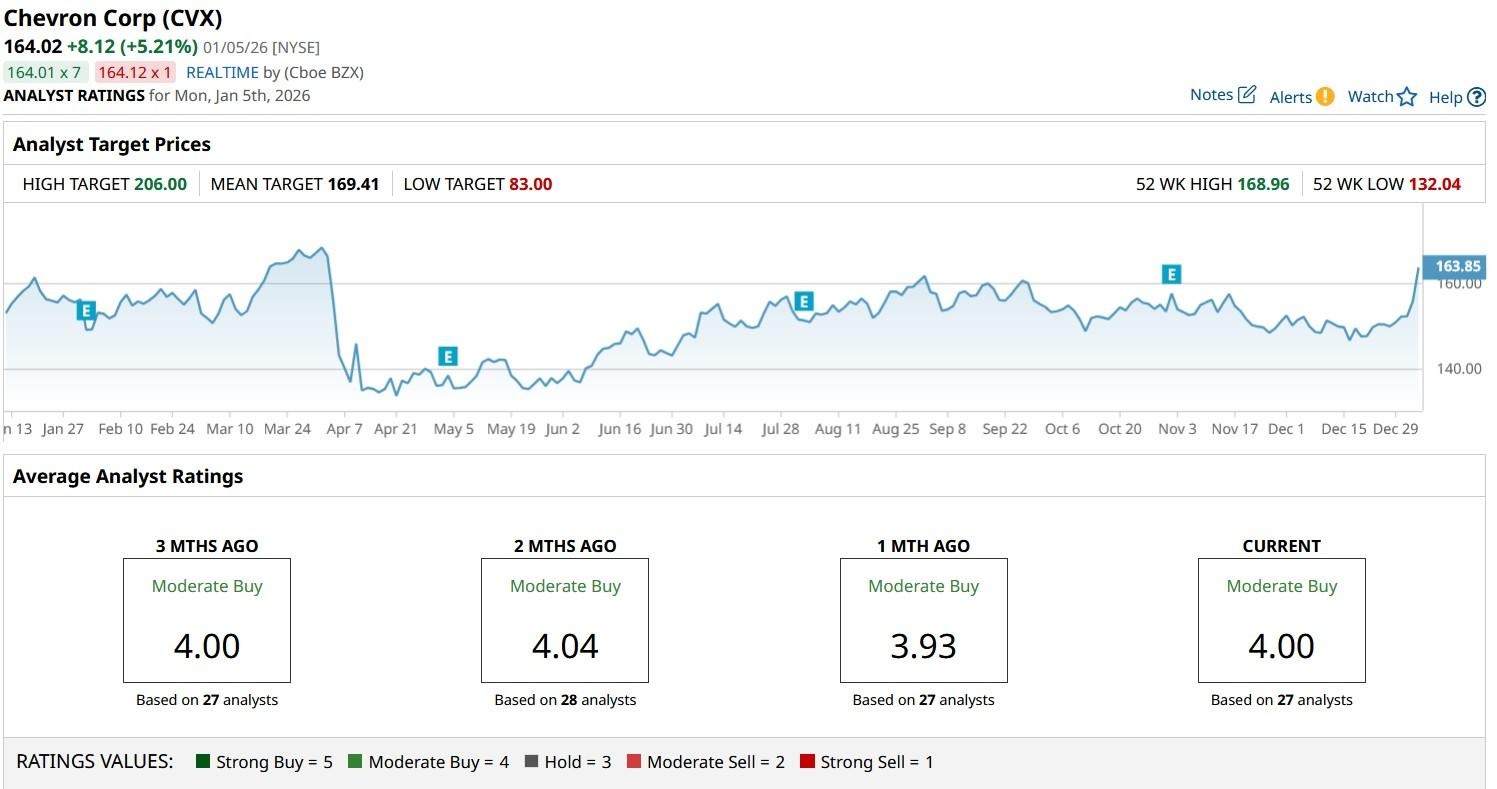

Despite the rally, Chevron stock remains down some 5% versus its 52-week high.

What the U.S.-Venezuela Conflict Means for Chevron Stock

As the only major U.S. oil producer with a continuous operational footprint in Venezuela, CVX stock is uniquely positioned to lead reconstruction efforts after the military strike on the South American country.

Investors believe the regime change will lift sanctions, allowing the NYSE-listed firm to recoup billions in past debts, significantly strengthening its balance sheet.

Moreover, access to Venezuela’s vast reserves could materially boost Chevron’s production from the current 250,000 barrels per day as well.

In short, the company’s established infrastructure and legal license provide it with a pole position to exploit the South American country’s unparalleled oil wealth under a U.S.-backed administration.

Where Options Data Suggests CVX Shares Are Headed

Citi analysts maintained a “Buy” rating on Chevron shares after the White House pledged to revive Venezuela’s energy sector on Monday.

According to them, the conflict could push the oil stock up to $179 in the near term, which signals potential upside of another 10% from current levels.

Options traders seem to agree with the investment firm as well. According to Barchart, bullish derivatives contracts expiring mid-May also suggest a rally to nearly $180 over the next four months.

What’s also worth mentioning is that CVX currently pays a rather lucrative dividend yield of over 4%, which makes it all the more attractive as a long-term holding in 2026.

How Wall Street Recommends Playing Chevron

Investors could also take heart in the fact that Citi isn’t the only Wall Street firm that favors owning CVX shares for the next 12 months.

The consensus rating on Chevron stock also currently sits at “Moderate Buy” with price targets going as high as $206 signaling potential upside of a whopping 26% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal