Assessing Danaher (DHR) Valuation As The Business Refocuses On Life Sciences And Diagnostics

Recent attention on Danaher (DHR) centers on its decision to spin off non core operations and place more emphasis on life sciences, biotechnology tools, and diagnostics, a shift that is reshaping how investors view the business.

See our latest analysis for Danaher.

Danaher’s focus on life sciences and diagnostics sits against a backdrop of a 14.83% 90 day share price return to US$235.36, while its 1 year total shareholder return of a 0.95% decline suggests recent momentum has been stronger than longer term results.

If this shift toward focused healthcare exposure interests you, it could be a good time to see what else is out there in healthcare stocks.

With Danaher posting a 14.83% 90 day return, modest long term total returns, and mixed signals from analyst targets and intrinsic estimates, investors may need to consider whether there is still value on the table or whether potential future growth is already reflected in the current price.

Most Popular Narrative: 9.2% Undervalued

The most followed narrative sees Danaher’s fair value at about US$259 per share versus the last close at US$235.36, framing today’s price as a discount that hinges on specific growth, margin, and valuation assumptions.

The company's disciplined execution of the Danaher Business System, which emphasizes cost productivity, structural cost reductions, and the integration of innovative new products, continues to drive operational efficiency and margin resilience, supporting improved net earnings and cash flow generation.

Curious what kind of revenue growth, margin expansion, and future P/E multiple need to line up to support that higher fair value? The narrative builds in a faster earnings trajectory than the wider US market, fatter profit margins than today, and a premium earnings multiple that still sits above the sector. The full story connects those moving parts into one valuation number.

Result: Fair Value of $259.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on China policy risk and early stage biotech funding. Weaker demand or tougher reimbursement could quickly challenge those premium multiple assumptions.

Find out about the key risks to this Danaher narrative.

Another View: Rich Multiple, Thin Margin For Error

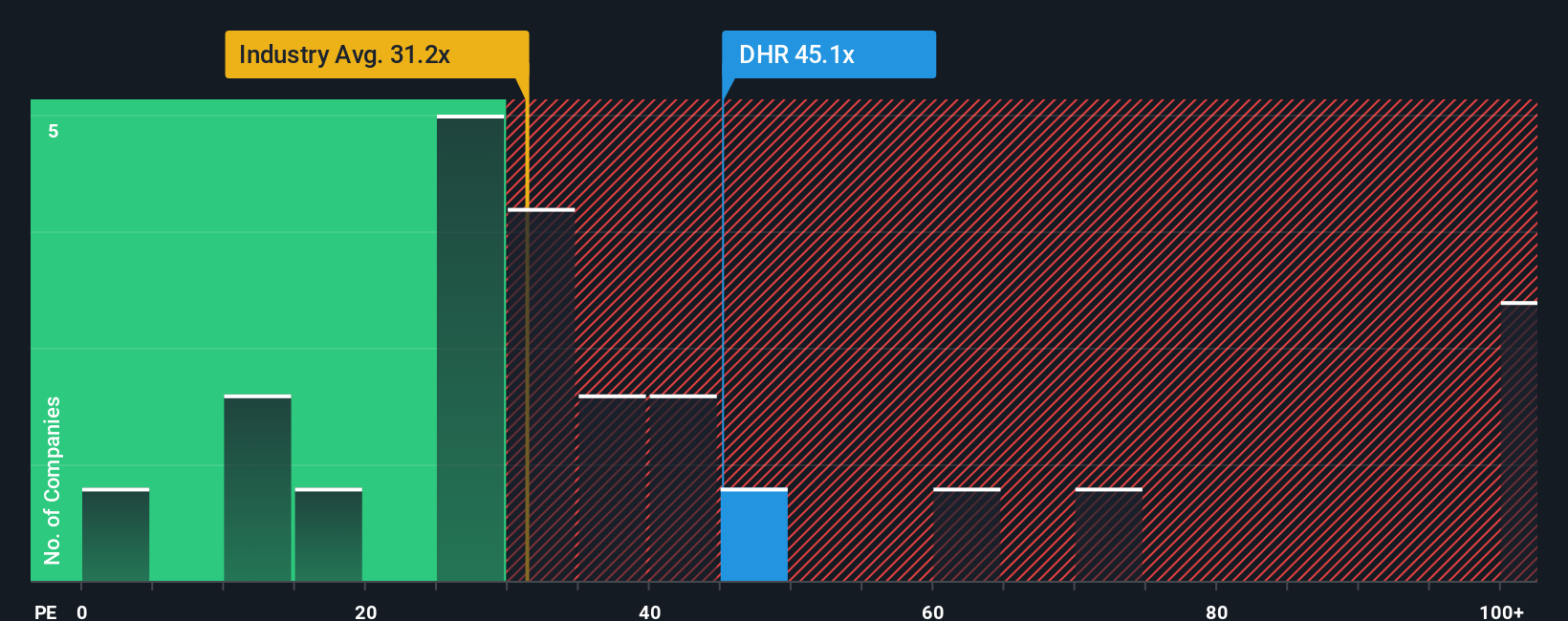

Analyst forecasts paint Danaher as 9.2% undervalued, but its 47.5x P/E tells a different story. That is higher than both the Global Life Sciences average of 37.2x and an estimated fair ratio of 31.6x. This suggests less room if those growth and margin assumptions slip.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Danaher Narrative

If you look at the numbers and reach a different conclusion, or simply want to test your own assumptions in detail, you can build a custom valuation narrative tailored to your view in just a few minutes, starting with Do it your way.

A great starting point for your Danaher research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas beyond Danaher?

Before you move on, take a few minutes to scan other opportunities with clear data and side by side comparisons that could sharpen your next investing decision.

- Spot potential bargains early by checking out these 880 undervalued stocks based on cash flows that the market may not be fully pricing yet.

- Zero in on income ideas by reviewing these 14 dividend stocks with yields > 3% that focus on cash returns to shareholders.

- Get ahead of emerging themes by scanning these 79 cryptocurrency and blockchain stocks tied to blockchain and digital asset trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal