A Look At Versant Media Group (VSNT) Valuation After Its Recent Share Price Slide

What Versant Media Group’s recent share slide means for investors

Versant Media Group (VSNT) has recently faced pressure, with the share price down about 13% over the past week and similar weakness year to date. This has prompted investors to reassess what they are paying for its media-focused business.

See our latest analysis for Versant Media Group.

That 13% 1 day share price return decline, which mirrors the year to date share price return, points to fading momentum as investors reassess Versant Media Group’s media portfolio and its perceived risk profile around US$40.57.

If recent volatility has you thinking about diversification, this could be a useful moment to scan fast growing stocks with high insider ownership for other ideas that might fit your style.

With an intrinsic discount estimate of 56% and a current price of US$40.57 sitting above a US$33.00 analyst target, you have conflicting signals. So is Versant Media Group mispriced, or is the market already factoring in its future prospects?

Price-to-Earnings of 4.3x: Is it justified?

On a simple earnings lens, Versant Media Group trades on a P/E of 4.3x at US$40.57, compared with a US Media industry average of 14.2x. This suggests the market is assigning a lower price to each dollar of earnings than it is for peers.

The P/E ratio compares a company’s share price to its earnings per share and is a common way investors look at media stocks that already generate profits. For a business with cable networks and digital platforms, it helps show what investors are currently willing to pay for those earnings, without getting into more complex cash flow modelling.

VSNT is described as good value on this measure. However, the picture is not one dimensional, with earnings contracting by 11.4% over the past year, net profit margins easing from 20.7% to 19.3%, and return on equity sitting at 12.5%, which is classed as low. That mix suggests the low P/E could reflect the market’s caution around recent profit and revenue trends rather than only a bargain, especially with revenue reported to have declined by 5.1% over the past year.

Compared with the 14.2x industry average, VSNT’s 4.3x P/E is far lower. This is a strong discount to sector pricing for earnings at the moment. If sentiment around its media portfolio or profit trajectory were to change, that gap is one lever that could potentially move, but right now it underlines how differently the market is valuing Versant Media Group against its US Media peers.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 4.3x (UNDERVALUED)

However, you still have to weigh revenue contracting by 1.9% and earnings pressures against a share price that is already sitting above the US$33.00 analyst target.

Find out about the key risks to this Versant Media Group narrative.

Another angle from the SWS DCF model

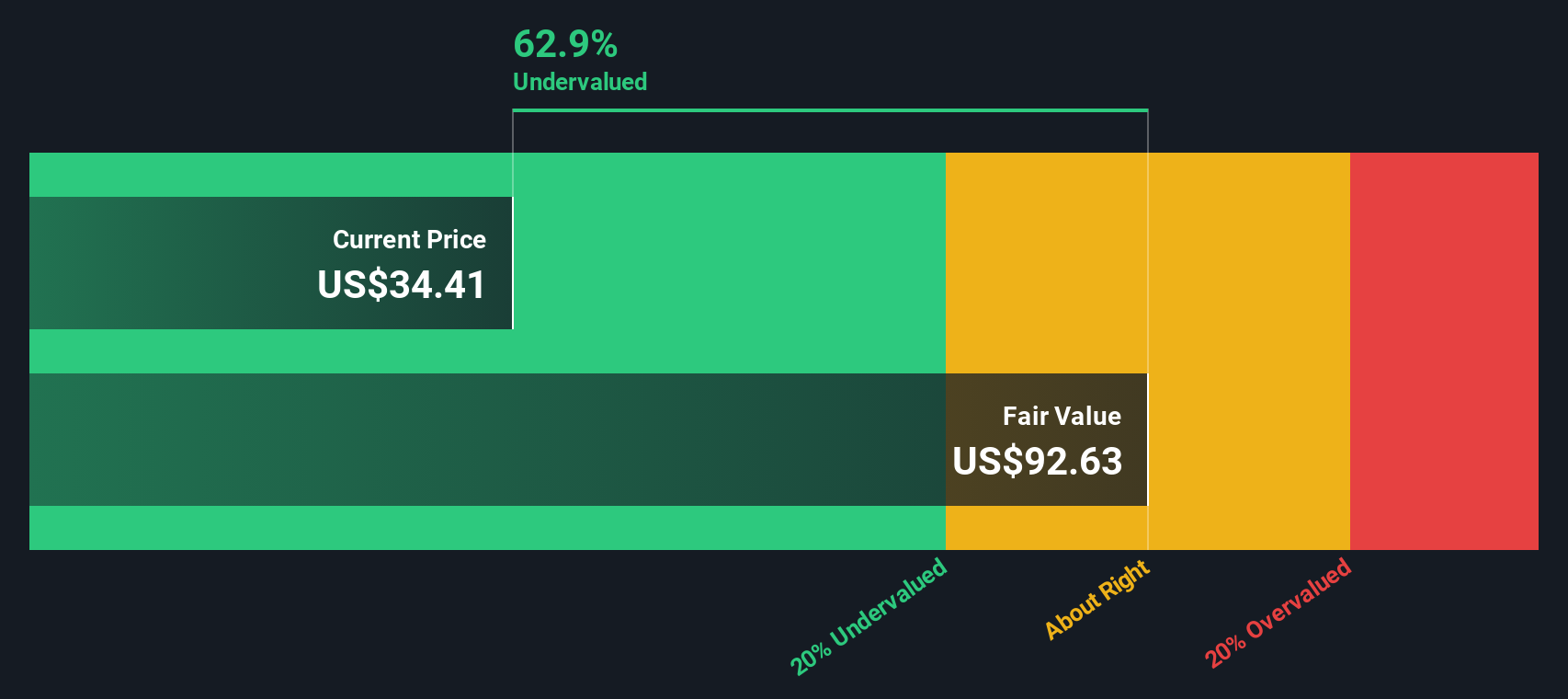

While the 4.3x P/E makes Versant Media Group look cheap next to the 14.2x US Media average, our DCF model points to something different. It suggests fair value around US$92.63, with the current US$40.57 price sitting at a 56.2% discount. This may indicate a potential mismatch between price and estimated value, or it may reflect assumptions in the model about future cash flows.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Versant Media Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 880 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Versant Media Group Narrative

If this view does not quite fit how you see the numbers, you can review the data yourself and build a custom story in just a few minutes, starting with Do it your way.

A great starting point for your Versant Media Group research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are reassessing Versant Media Group, do not stop there. Use this moment to line up a few fresh ideas that could better match your approach.

- Spot potential value by scanning these 880 undervalued stocks based on cash flows that might be trading below what their cash flows suggest you are paying for today.

- Tap into growth themes by checking out these 25 AI penny stocks that link artificial intelligence to real business models and current financials.

- Strengthen your income shortlist by reviewing these 14 dividend stocks with yields > 3% that already offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal