Discovering UK Penny Stocks: Intercede Group And Two More Promising Picks

The UK market has been experiencing some turbulence, with the FTSE 100 index closing lower due to weak trade data from China, which continues to affect global economic sentiment. In such fluctuating conditions, identifying stocks with solid fundamentals becomes crucial for investors seeking potential opportunities. While the term "penny stocks" may seem outdated, it still represents smaller or emerging companies that can offer both affordability and growth potential when backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| DSW Capital (AIM:DSW) | £0.66 | £16.59M | ✅ 3 ⚠️ 4 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.34 | £498.41M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £1.91 | £154.3M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £1.12 | £16.91M | ✅ 2 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.70 | $406.93M | ✅ 4 ⚠️ 2 View Analysis > |

| Michelmersh Brick Holdings (AIM:MBH) | £0.84 | £76.16M | ✅ 4 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.518 | £183.85M | ✅ 3 ⚠️ 2 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.465 | £40.08M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.16 | £186.68M | ✅ 6 ⚠️ 1 View Analysis > |

| Billington Holdings (AIM:BILN) | £3.50 | £45.69M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 294 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

Intercede Group (AIM:IGP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Intercede Group plc is a cybersecurity company that develops and supplies identity and credential management software for digital trust across the UK, Europe, the US, and internationally, with a market cap of £78.65 million.

Operations: Intercede Group generates revenue of £17.38 million from its Software & Programming segment, focusing on identity and credential management solutions.

Market Cap: £78.65M

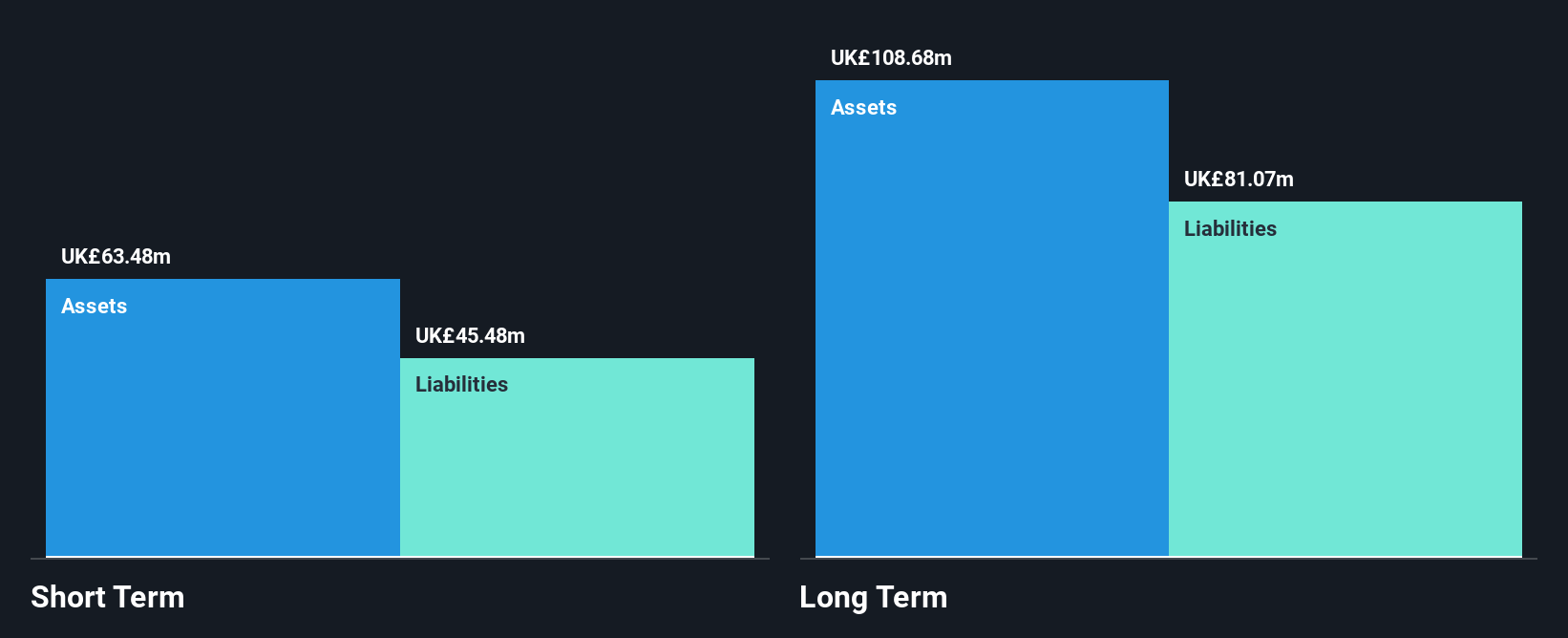

Intercede Group plc, a cybersecurity company with a market cap of £78.65 million, is actively pursuing strategic acquisitions to enhance its identity and credential management solutions. Recent contract wins include substantial orders from the US Federal Government and Asian government agencies, totaling approximately $4.2 million in Q3 FY2026. Despite facing a slight decline in sales to £8.21 million for H1 2026 compared to the previous year, Intercede maintains strong financial health with no debt and high-quality earnings. The company's seasoned management team supports its focus on shareholder value through careful acquisition strategies while maintaining robust short-term asset coverage over liabilities.

- Unlock comprehensive insights into our analysis of Intercede Group stock in this financial health report.

- Review our growth performance report to gain insights into Intercede Group's future.

Strix Group (AIM:KETL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Strix Group Plc designs, manufactures, and supplies kettle safety controls and other components globally, with a market cap of £108.07 million.

Operations: The company's revenue is segmented into Controls (£62.08 million), Billi (£44.13 million), and Consumer Goods (£32.16 million).

Market Cap: £108.07M

Strix Group Plc, with a market cap of £108.07 million, is navigating challenges and opportunities in the penny stock realm. Despite a decline in earnings by 26.5% annually over five years, recent growth of 7.7% indicates potential recovery, supported by forecasts of 17.46% annual earnings growth. The company trades at a favorable price-to-earnings ratio (13.2x) compared to the UK market (16.3x), yet high net debt to equity (147%) raises concerns about financial leverage despite operating cash flow covering debt well at 24%. Leadership changes are underway as CEO Mark Bartlett plans to step down in May 2026, impacting future strategic direction.

- Dive into the specifics of Strix Group here with our thorough balance sheet health report.

- Assess Strix Group's future earnings estimates with our detailed growth reports.

CAB Payments Holdings (LSE:CABP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: CAB Payments Holdings Limited offers foreign exchange and cross-border payment services to banks, fintech companies, supranationals, and governments globally with a market capitalization of approximately £165.01 million.

Operations: The company generates revenue from its unclassified services segment, totaling £88.73 million.

Market Cap: £165.01M

CAB Payments Holdings, with a market cap of £165.01 million, operates in the foreign exchange and cross-border payment services sector. The company is debt-free and has not diluted shareholders recently, which can be appealing to investors seeking stability in penny stocks. However, its management team and board are relatively inexperienced with average tenures of 1 year and 2.2 years respectively. Despite having short-term assets of £1.1 billion that exceed long-term liabilities (£64.4 million), they fall short against short-term liabilities (£1.4 billion). Recent financials show a decline in net profit margins to 7.1% from 21.9% last year due to significant one-off losses impacting earnings stability.

- Navigate through the intricacies of CAB Payments Holdings with our comprehensive balance sheet health report here.

- Understand CAB Payments Holdings' earnings outlook by examining our growth report.

Turning Ideas Into Actions

- Get an in-depth perspective on all 294 UK Penny Stocks by using our screener here.

- Searching for a Fresh Perspective? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal