A Look At U-Haul Holding (UHAL) Valuation As Migration To Texas And Florida Stays Strong

Fresh U-Haul Growth Index data shows Texas and Florida again leading U-Haul one way moves in 2025, with Texas ranked No. 1 for the seventh time in ten years, drawing investor attention to U-Haul Holding (UHAL).

See our latest analysis for U-Haul Holding.

The fresh migration data arrives as U-Haul Holding’s share price sits at US$53.02, with a 4.9% 1 day share price return and a 4.2% 7 day share price return. Its 1 year total shareholder return of a 23.5% decline contrasts with a 10.6% gain over five years, suggesting short term momentum has picked up even as longer term returns have been mixed.

If U-Haul’s recent move has you rethinking your watchlist, this can be a useful moment to look beyond one name and check out fast growing stocks with high insider ownership as potential future stories to follow.

So with shares at US$53.02, annual revenue of US$5.97b and a price target sitting higher, is the recent weakness giving you a potential entry point or is the market already baking in much richer future growth?

Most Popular Narrative Narrative: 41% Undervalued

With U-Haul Holding last closing at US$53.02 and the most followed narrative pointing to a fair value of US$89.84, that gap is hard to ignore.

The company is focusing on adding self-storage units and expanding its self-storage footprint. With 8.5 million new square feet being developed, self-storage revenue is anticipated to continue growing, boosting overall revenue and earnings.

Want to understand what is behind that higher value tag? The narrative leans heavily on a step up in profitability and a richer future earnings multiple. Curious which assumptions really carry that outcome and how they fit together over the next few years?

Result: Fair Value of $89.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intense competition in truck rentals and higher personnel or tax expenses could squeeze margins, which may make those projected earnings and valuation multiples harder to justify.

Find out about the key risks to this U-Haul Holding narrative.

Another View: Earnings And Multiples Send A Different Signal

The analyst narrative leans on future earnings growth and a higher fair value, but the current numbers tell a tougher story. Earnings have declined by 51.6% over the past year and by 14.8% per year over five years, with profit margins falling from 8.5% to 3.9%.

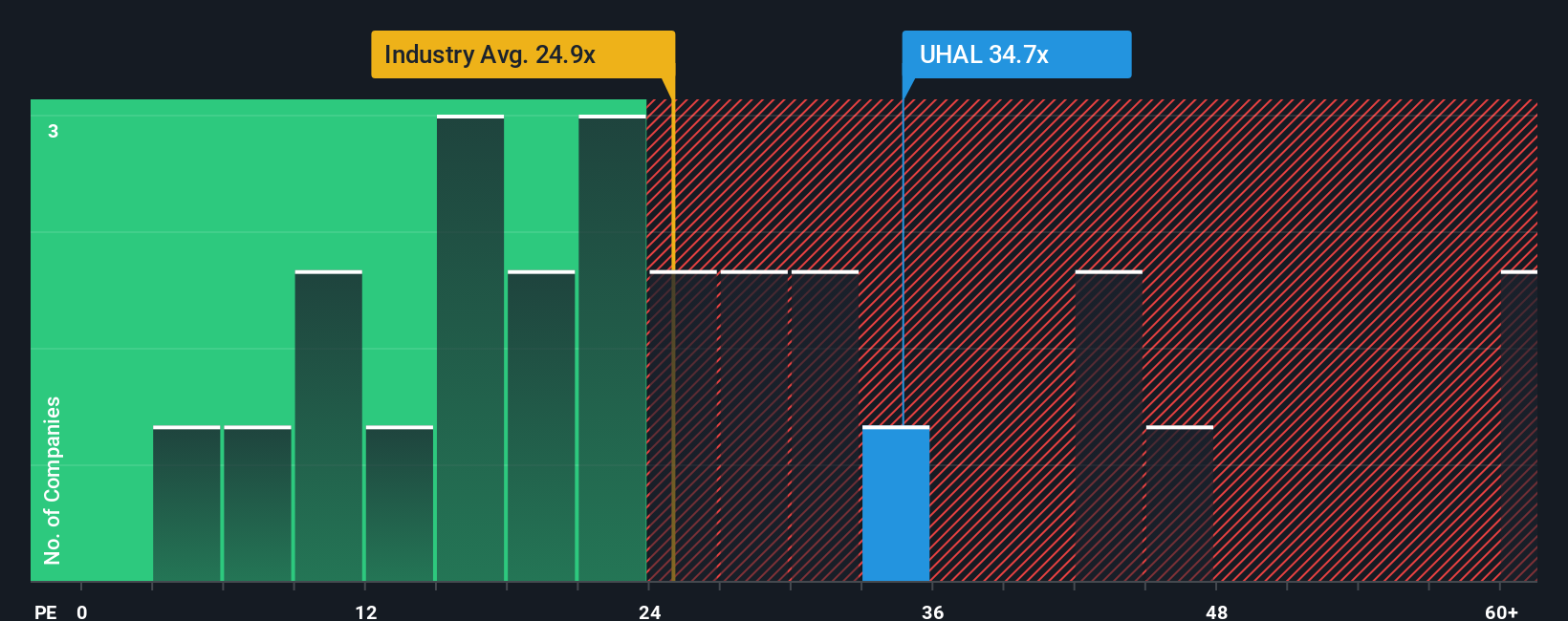

On top of that, U-Haul Holding trades on a P/E of 44.7x, compared with 31.5x for the US Transportation industry and 32.8x for peers. Simply Wall St’s own work flags the shares as expensive on this basis. For you, the real question is whether those richer multiples are a risk or a bet you are comfortable taking.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own U-Haul Holding Narrative

If you see the numbers differently or prefer to test your own assumptions, you can create a custom view in minutes with Do it your way.

A great starting point for your U-Haul Holding research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If U-Haul is on your radar, do not stop there. Casting a wider net of ideas now can help you spot opportunities you might otherwise overlook.

- Scan for potential value by checking out these 880 undervalued stocks based on cash flows that could offer more attractive entry prices based on their current cash flow profiles.

- Target income-focused opportunities by reviewing these 14 dividend stocks with yields > 3% that might appeal if you want potential yield alongside share price movement.

- Ride emerging themes by investigating these 25 AI penny stocks that are tied to artificial intelligence trends and may suit higher risk portions of your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal