Assessing Bechtle (XTRA:BC8) Valuation After Revenue Growth And AI-Focused Expansion

Bechtle (XTRA:BC8) is back in focus after recent revenue growth and improved cash flow, coupled with a continued €0.70 dividend and reinvestment into AI-enabled consulting, cloud, and security services across Europe.

See our latest analysis for Bechtle.

The share price at €44.88 sits alongside a 90 day share price return of 18.29%, while the 1 year total shareholder return of 47.96% contrasts with a weaker 5 year total shareholder return of a 16.99% decline. This suggests momentum has recently picked up as investors reassess Bechtle’s AI focused expansion and cash generation.

If Bechtle’s AI push has caught your eye, it may be a moment to scan other high growth tech and AI names using our high growth tech and AI stocks.

With Bechtle trading at €44.88, a 90 day return above 18% and an intrinsic value framework suggesting a 15% discount, investors are left asking whether there is still an opportunity here or whether anticipated AI-related developments are already reflected in the price.

Most Popular Narrative: 1.8% Overvalued

With Bechtle last closing at €44.88 against a fair value estimate of about €44.08, the most followed narrative sees only a small valuation gap and ties that to expectations for a gradual earnings build over time.

Analysts are assuming Bechtle's revenue will grow by 6.6% annually over the next 3 years. Analysts assume that profit margins will increase from 3.4% today to 3.9% in 3 years time.

Curious what lifts margins in a low single digit growth story? The narrative leans on compounding earnings, steadier cash flows and a future P/E that needs only a small step up from today. Want to see exactly how those moving parts add up to the current fair value line?

Result: Fair Value of $44.08 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, earnings pressure in 2024 and uncertainty around SME IT budgets in Germany and France could still upset the gradual margin lift that this narrative leans on.

Find out about the key risks to this Bechtle narrative.

Another View: P/E Says Good Value, Industry Says Pricey

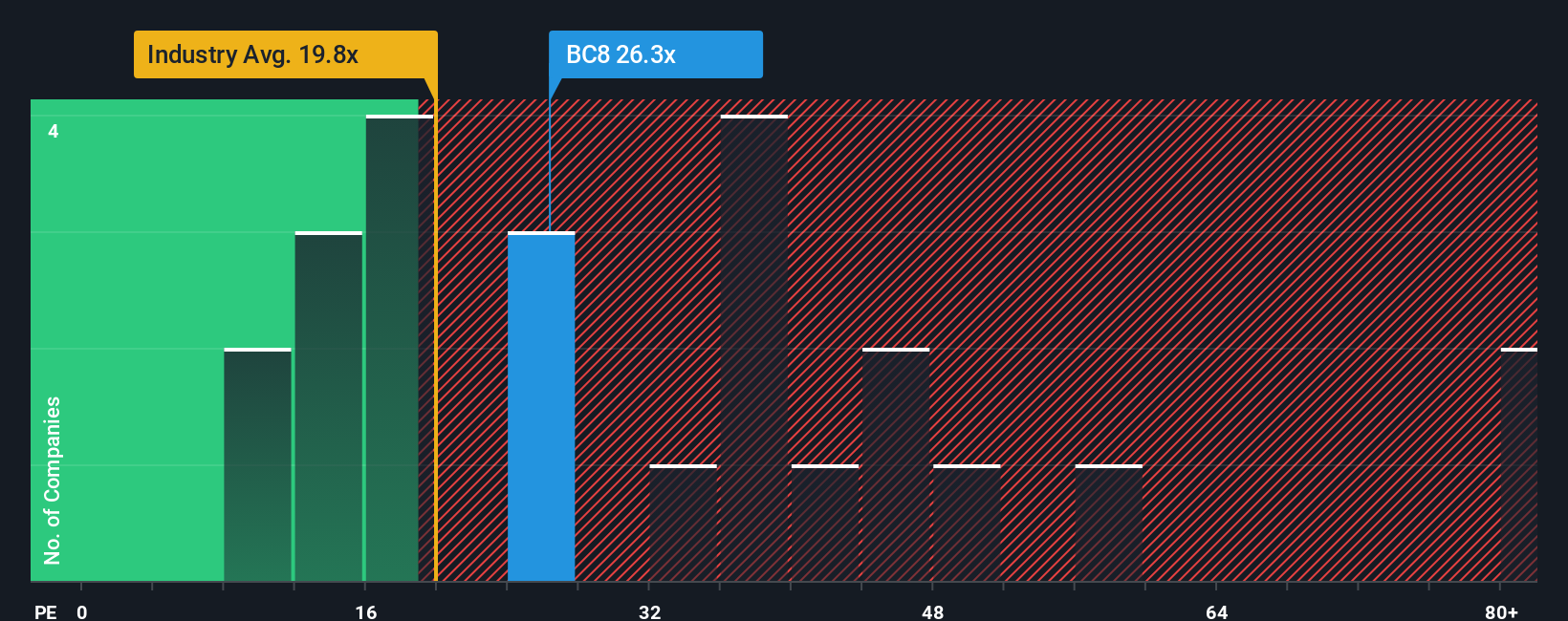

Our fair value work suggests Bechtle is only 1.8% overvalued at €44.88. Its current P/E of 26.3x is lower than its fair ratio of 28x and below the peer average of 29.4x, while still above the broader European IT industry at 19.1x. Is that a cushion or a warning sign for you?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bechtle Narrative

If you see the numbers differently or prefer to build your own view from the ground up, you can shape a fresh Bechtle story in minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Bechtle.

Ready for more investment ideas?

If Bechtle has sharpened your thinking, do not stop here. Your next smart move could be sitting in another corner of the market.

- Target potential mispricing by scanning these 880 undervalued stocks based on cash flows that align with your view on cash flows and long term value.

- Spot emerging themes in artificial intelligence by zeroing in on these 25 AI penny stocks that fit your growth and risk preferences.

- Add a different flavour of risk and opportunity by checking out these 79 cryptocurrency and blockchain stocks tied to blockchain and digital asset trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal