3 Undervalued Small Caps With Insider Buying Across Regions

As the U.S. market experiences a surge, with major indexes like the Dow Jones Industrial Average reaching all-time highs following geopolitical developments, small-cap stocks are drawing attention amidst this buoyant economic backdrop. In such a dynamic environment, identifying promising small-cap opportunities often involves looking at factors like insider buying and valuation metrics that suggest potential for growth despite broader market volatility.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Wolverine World Wide | 17.4x | 0.8x | 37.16% | ★★★★★☆ |

| First United | 9.7x | 2.9x | 45.57% | ★★★★★☆ |

| Shore Bancshares | 10.4x | 2.8x | 44.52% | ★★★★☆☆ |

| Metropolitan Bank Holding | 12.9x | 3.1x | 33.73% | ★★★★☆☆ |

| Union Bankshares | 9.7x | 2.1x | 21.41% | ★★★★☆☆ |

| S&T Bancorp | 11.5x | 3.9x | 36.70% | ★★★★☆☆ |

| Angel Oak Mortgage REIT | 12.4x | 6.2x | 38.91% | ★★★★☆☆ |

| Farmland Partners | 6.5x | 8.0x | -91.73% | ★★★★☆☆ |

| Vestis | NA | 0.3x | -6.57% | ★★★☆☆☆ |

| Omega Flex | 18.8x | 3.0x | -2.22% | ★★☆☆☆☆ |

We'll examine a selection from our screener results.

Ichor Holdings (ICHR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ichor Holdings is a company that specializes in providing critical fluid delivery subsystems and components for semiconductor capital equipment manufacturers, with a market capitalization of approximately $1.25 billion.

Operations: The company generates revenue primarily from semiconductor equipment and services, with a recent revenue of $957.34 million. The gross profit margin has shown fluctuations, reaching 17.53% in June 2018 before declining to 11.90% by September 2025. Operating expenses have consistently increased over the years, significantly impacting net income figures which turned negative in recent periods, with the latest net income at -$40.76 million as of September 2025.

PE: -17.7x

Ichor Holdings, a company with a volatile share price over the past three months, has demonstrated insider confidence through Iain MacKenzie's purchase of 25,000 shares for US$415,750. Despite facing a net loss of US$22.85 million in Q3 2025 compared to the previous year's US$2.78 million loss, its sales grew from US$211.14 million to US$239.3 million year-over-year. The recent appointment of Philip Barros as CEO may signal strategic shifts aimed at capitalizing on forecasted earnings growth of 75% annually amidst higher-risk external funding sources.

- Click to explore a detailed breakdown of our findings in Ichor Holdings' valuation report.

Evaluate Ichor Holdings' historical performance by accessing our past performance report.

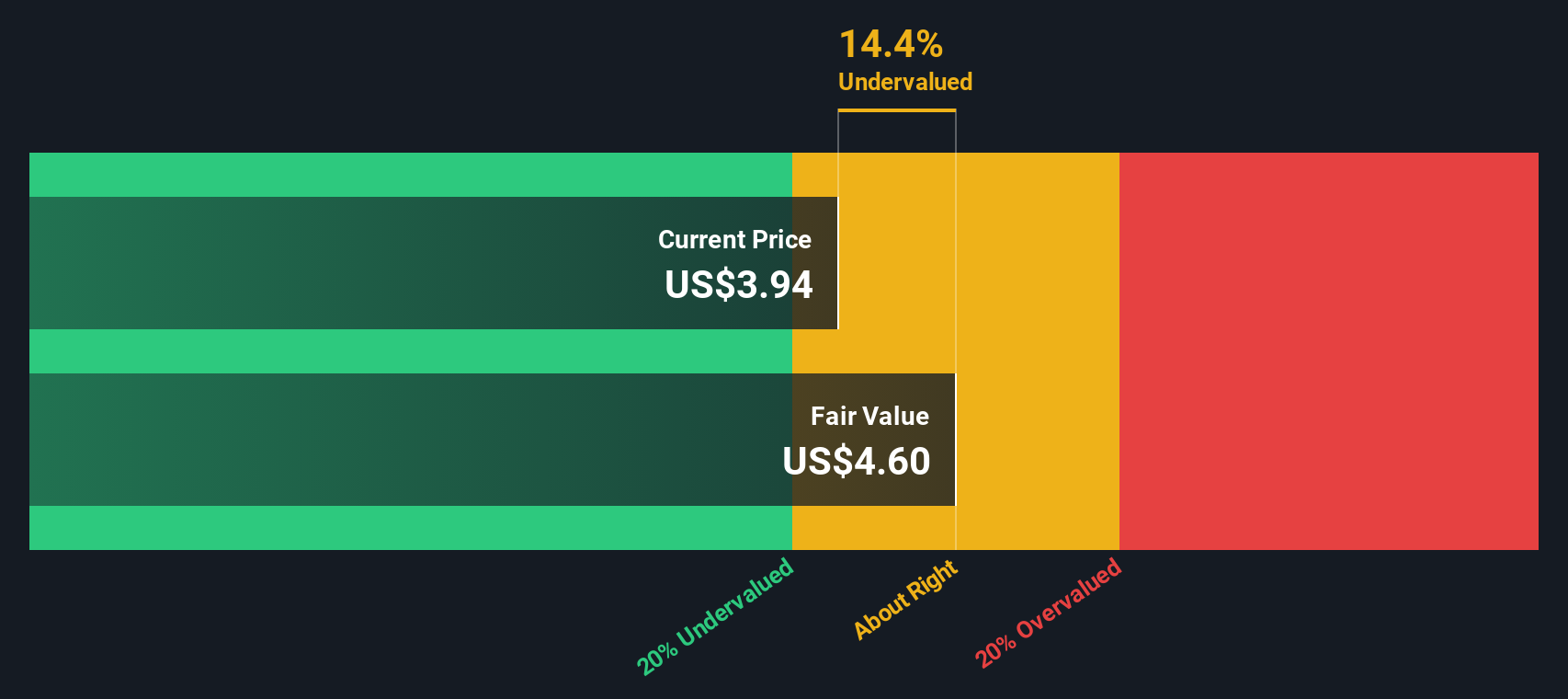

Maravai LifeSciences Holdings (MRVI)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Maravai LifeSciences Holdings specializes in providing critical products and services for nucleic acid production and biologics safety testing, with a market cap of approximately $2.5 billion.

Operations: The company generates revenue primarily from Nucleic Acid Production and Biologics Safety Testing. Over recent periods, the gross profit margin has shown a declining trend, reaching 21.07% in September 2025, down from a peak of 83.34% in March 2022. Operating expenses have consistently been significant, with General & Administrative Expenses being a major component. Net income margins have also turned negative recently, reflecting challenges in maintaining profitability amidst increasing costs and reduced revenues.

PE: -4.5x

Maravai LifeSciences Holdings, a company in the healthcare sector, is drawing attention with its recent insider confidence. Bernd Brust's purchase of 250,559 shares for US$809,010 in December 2025 suggests belief in the company's potential despite challenges. The company reported a Q3 sales drop to US$41.63 million from last year's US$69.03 million but reduced net loss significantly to US$25.56 million from US$97.07 million previously. Revenue guidance for 2025 stands at approximately US$185 million, excluding potential high-volume orders or acquisitions.

- Unlock comprehensive insights into our analysis of Maravai LifeSciences Holdings stock in this valuation report.

Understand Maravai LifeSciences Holdings' track record by examining our Past report.

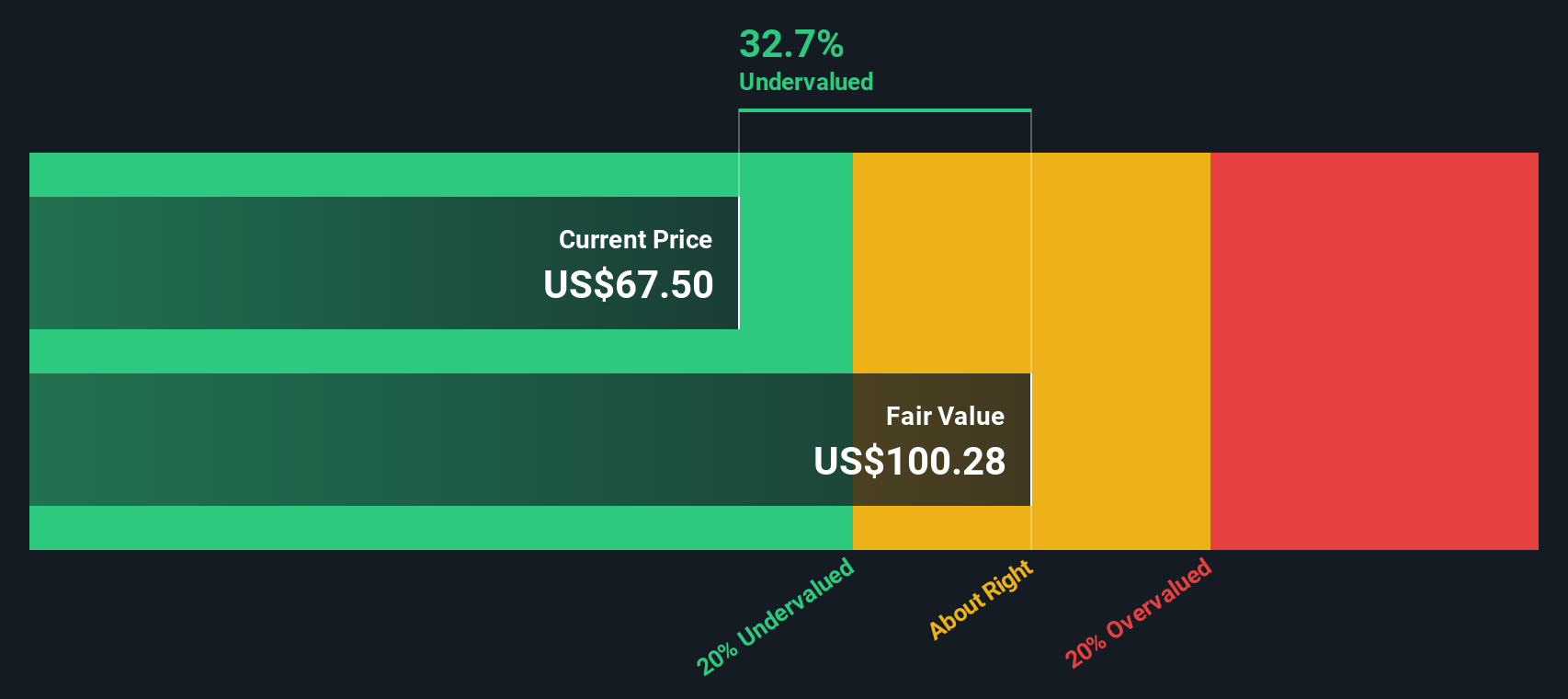

Stock Yards Bancorp (SYBT)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Stock Yards Bancorp operates primarily in commercial banking and wealth management, with a market capitalization of $1.52 billion.

Operations: Stock Yards Bancorp generates revenue primarily from Commercial Banking ($335.33 million) and Wealth Management and Trust ($43.30 million). Over recent periods, the company has consistently achieved a gross profit margin of 100%. Operating expenses are led by General & Administrative costs, which reached $172.48 million in the latest period. The net income margin showed variability, with a recent figure of 35.72%.

PE: 14.7x

Stock Yards Bancorp, a company with a modest market capitalization, shows potential for growth in the financial sector. They reported net interest income of US$77.04 million for Q3 2025, up from US$64.98 million the previous year, highlighting improved profitability. The company's earnings per share rose to US$1.23 from US$1 year-over-year, reflecting solid financial health. Changes in executive leadership bring seasoned expertise to key roles, potentially enhancing strategic direction and operational efficiency moving forward.

Seize The Opportunity

- Take a closer look at our Undervalued US Small Caps With Insider Buying list of 83 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal