3 Penny Stocks With Market Caps Reaching $2B

Major stock indexes in the United States recently surged, with the Dow Jones Industrial Average reaching new heights, driven by geopolitical developments and a rally in oil stocks. Amidst these broader market movements, penny stocks continue to attract attention as potential investment opportunities. Although often associated with higher risk due to their smaller size or newer status, some penny stocks offer solid financial foundations and growth potential that can appeal to investors looking for unique opportunities beyond well-known companies.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.66 | $615.06M | ✅ 3 ⚠️ 1 View Analysis > |

| Waterdrop (WDH) | $1.90 | $687.16M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8438 | $146.58M | ✅ 4 ⚠️ 1 View Analysis > |

| LexinFintech Holdings (LX) | $3.235 | $548.54M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.19 | $1.36B | ✅ 4 ⚠️ 1 View Analysis > |

| CI&T (CINT) | $4.32 | $581.58M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| VAALCO Energy (EGY) | $3.66 | $376.37M | ✅ 2 ⚠️ 3 View Analysis > |

| BAB (BABB) | $0.9891 | $7.21M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.95 | $86.09M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 340 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Clover Health Investments (CLOV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Clover Health Investments, Corp. offers Medicare Advantage plans in the United States and has a market capitalization of approximately $1.34 billion.

Operations: The company generates revenue primarily from its Insurance segment, totaling $1.77 billion.

Market Cap: $1.34B

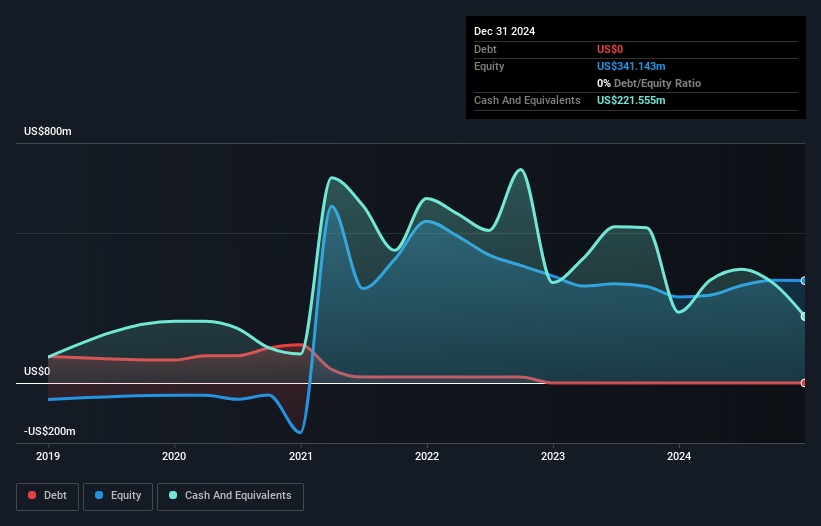

Clover Health Investments, Corp. has a market cap of US$1.34 billion and generates significant revenue from its Insurance segment, reported at US$1.77 billion. Despite being unprofitable with a net loss of US$24.38 million in Q3 2025, the company has reduced losses by 27.1% annually over five years and forecasts earnings growth of 75.85% per year. Clover's short-term assets exceed liabilities, it is debt-free, and maintains a cash runway for over a year based on current free cash flow trends. The company recently raised its full-year revenue guidance to between US$1.85 billion and US$1.88 billion.

- Get an in-depth perspective on Clover Health Investments' performance by reading our balance sheet health report here.

- Gain insights into Clover Health Investments' future direction by reviewing our growth report.

loanDepot (LDI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: loanDepot, Inc. operates in the United States by originating, financing, selling, and servicing residential mortgage loans with a market cap of approximately $739.78 million.

Operations: The company's revenue is primarily derived from the originating, financing, and selling of mortgage loans, amounting to $1.10 billion.

Market Cap: $739.78M

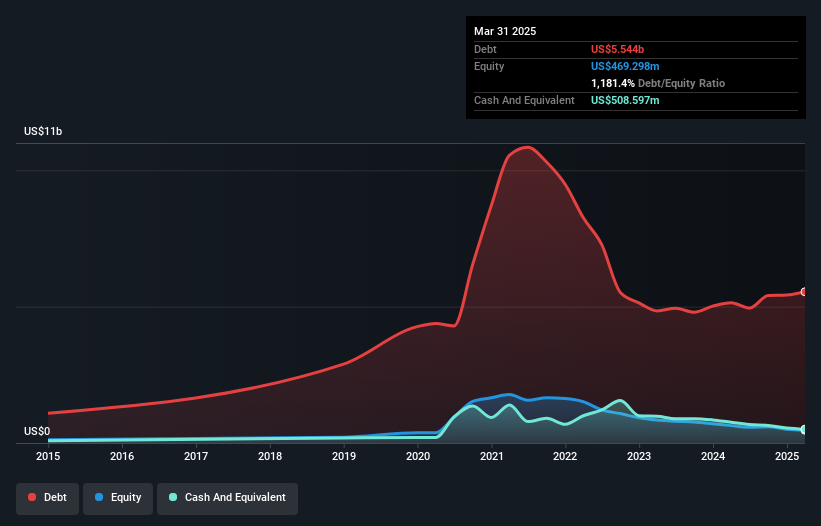

loanDepot, Inc. faces challenges typical of penny stocks, with high volatility and a significant debt burden reflected in a net debt to equity ratio of 1108.4%. Despite being unprofitable with increased losses over five years, the company maintains a cash runway exceeding three years due to positive free cash flow. Recent leadership changes include appointing Nikul Patel as Chief Growth Officer and Rick Calle's return as Chief Strategy Officer, focusing on growth opportunities and AI integration. While short-term assets cover liabilities comfortably, insider selling has been significant recently, adding uncertainty to its investment appeal.

- Navigate through the intricacies of loanDepot with our comprehensive balance sheet health report here.

- Understand loanDepot's earnings outlook by examining our growth report.

SES AI (SES)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SES AI Corporation focuses on developing and producing AI-enhanced lithium metal and lithium-ion rechargeable battery technologies for various applications including electric vehicles, urban air mobility, drones, robotics, and battery energy storage systems, with a market cap of $777.60 million.

Operations: SES AI Corporation does not report any specific revenue segments.

Market Cap: $777.6M

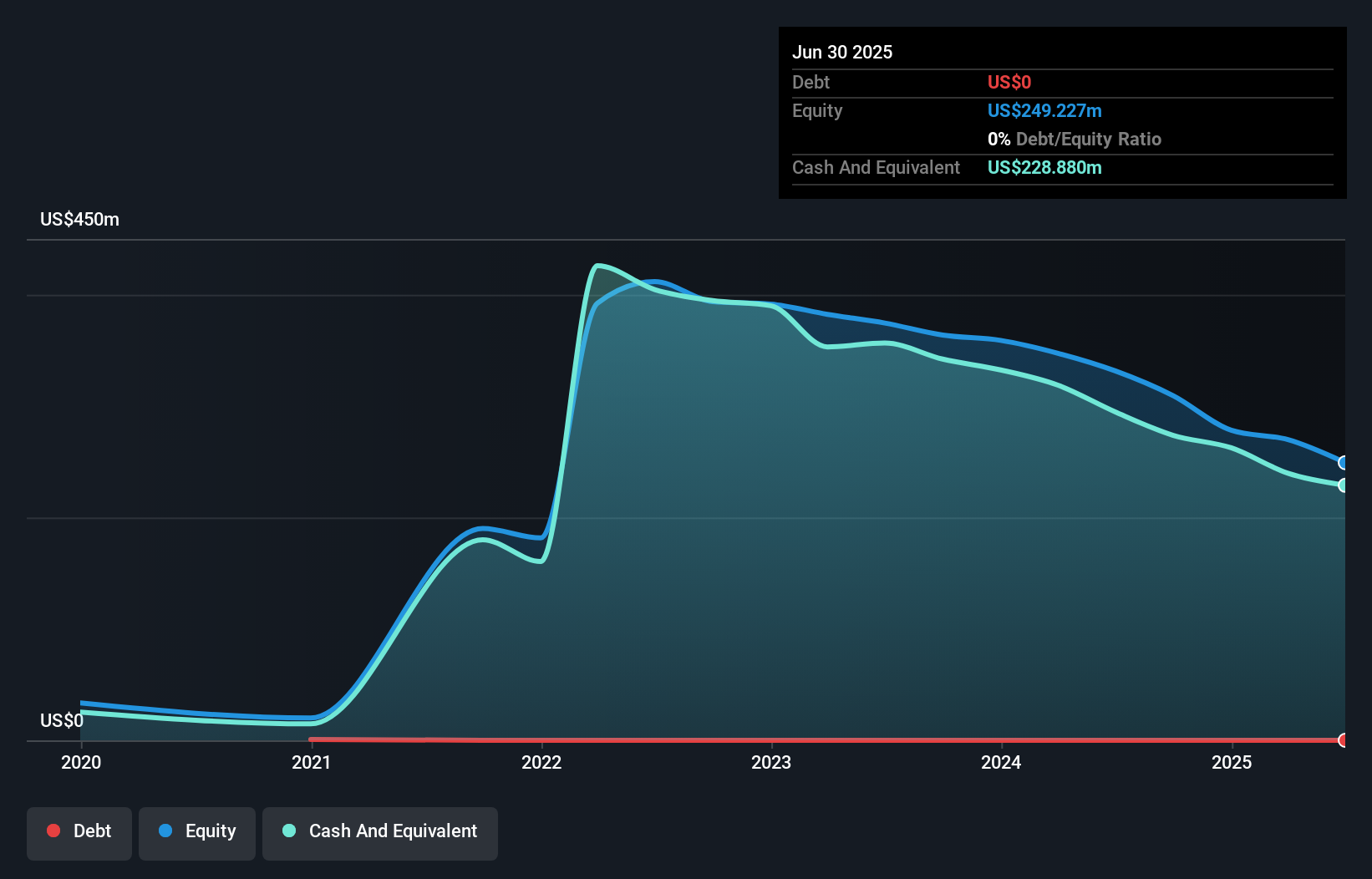

SES AI Corporation, operating within the penny stock domain, is navigating a pre-revenue phase with a market cap of US$777.60 million. The company has made strategic moves by collaborating with Top Material to enhance battery manufacturing capacity in Korea for drone and UAM applications, aligning with NDAA compliance goals. Despite its unprofitability and negative return on equity, SES AI has managed to stabilize weekly volatility and maintain a strong cash position relative to its debt. Recent initiatives include expanding its Molecular Universe platform to accelerate battery material discovery, aiming for new recurring revenue streams through joint ventures in electrolyte production.

- Click here and access our complete financial health analysis report to understand the dynamics of SES AI.

- Examine SES AI's earnings growth report to understand how analysts expect it to perform.

Make It Happen

- Unlock more gems! Our US Penny Stocks screener has unearthed 337 more companies for you to explore.Click here to unveil our expertly curated list of 340 US Penny Stocks.

- Want To Explore Some Alternatives? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal