Dynavax Technologies Corporation (NASDAQ:DVAX) Surges 42% Yet Its Low P/S Is No Reason For Excitement

Dynavax Technologies Corporation (NASDAQ:DVAX) shares have continued their recent momentum with a 42% gain in the last month alone. Taking a wider view, although not as strong as the last month, the full year gain of 20% is also fairly reasonable.

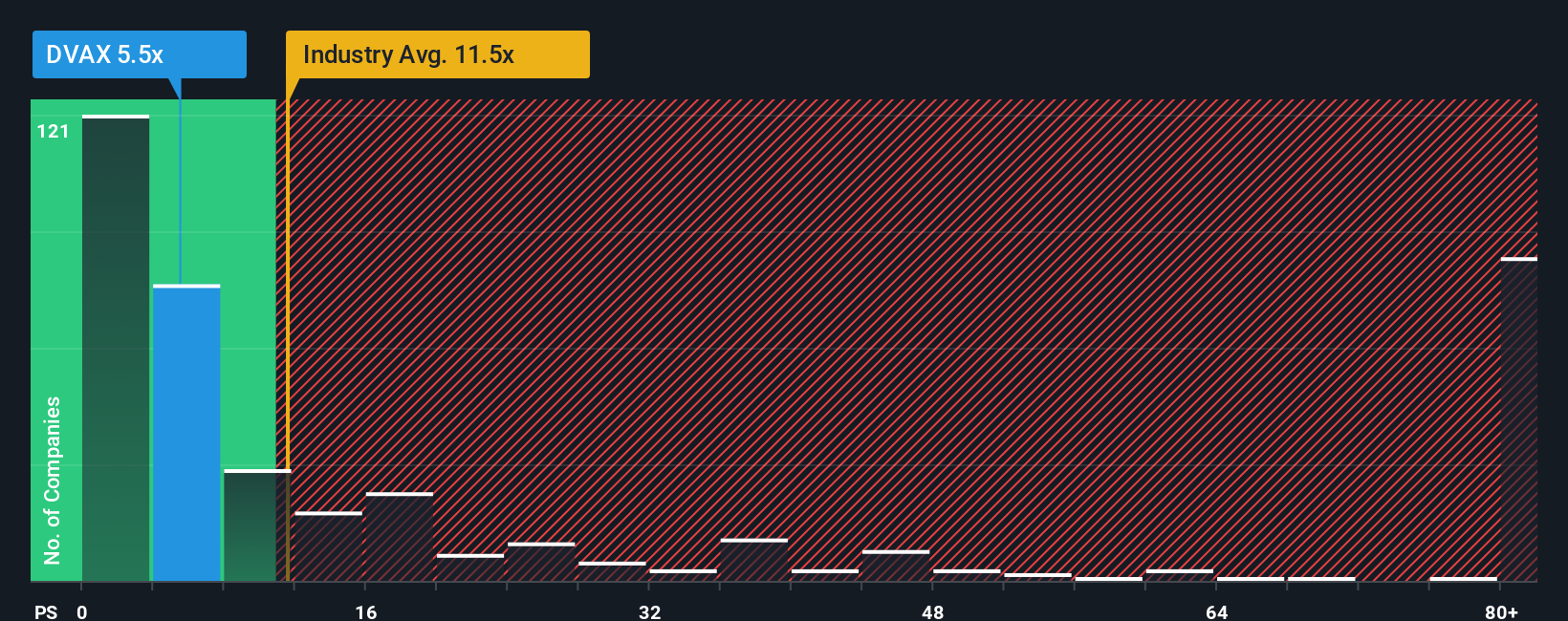

Even after such a large jump in price, Dynavax Technologies may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 5.5x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 11.5x and even P/S higher than 83x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for Dynavax Technologies

What Does Dynavax Technologies' Recent Performance Look Like?

Recent times haven't been great for Dynavax Technologies as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Dynavax Technologies.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Dynavax Technologies would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered an exceptional 27% gain to the company's top line. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 55% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 15% per year during the coming three years according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 123% each year, which is noticeably more attractive.

In light of this, it's understandable that Dynavax Technologies' P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Dynavax Technologies' recent share price jump still sees fails to bring its P/S alongside the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Dynavax Technologies maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Dynavax Technologies that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal