A Look At Casey’s General Stores (CASY) Valuation After Wells Fargo Endorsement And Strong Growth Story

Wells Fargo’s fresh endorsement of Casey's General Stores (CASY) as a Q1 2026 pick, tied to its earnings outlook and growth initiatives, has put the stock’s recent run near highs back in focus.

See our latest analysis for Casey's General Stores.

The latest endorsement comes as Casey's trades near record territory, with the share price at US$564.26 and a one year total shareholder return of 45.59% pointing to momentum that still looks intact despite a softer 30 day share price return and more modest year to date move.

If you are looking beyond convenience retail for what could be working next, this is a useful moment to broaden your watchlist and check out fast growing stocks with high insider ownership.

With Casey’s trading near record highs, a 1 year total return of 45.59% and an intrinsic value estimate implying roughly a 22% discount, you have to ask: is this still a buying opportunity, or is the market already pricing in future growth?

Most Popular Narrative: 6% Undervalued

With Casey's last closing at US$564.26 against a narrative fair value of US$600, the current setup comes down to how sustainable future earnings and margins look.

In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $19.5 billion, earnings will come to $760.7 million, and it would be trading on a PE ratio of 33.6x, assuming you use a discount rate of 7.0%.

Curious what sits behind that earnings jump, margin lift, and still high future P/E? The whole narrative rests on a carefully tuned mix of revenue growth, margin gains, and a premium earnings multiple. The details matter.

In the most widely followed narrative, analysts lift their fair value to US$600 per share using a discount rate of about 7.1%, while assuming steady revenue growth, gradually higher profit margins, and only a modest step down in the future P/E from current levels.

They are also baking in only minimal share count creep each year, which helps support projected earnings per share, and they see that future P/E sitting well above the current Consumer Retailing average, effectively treating Casey's as a premium name within the sector.

The gap between projected earnings in a few years and today is doing much of the work in this story, with the discount rate and slightly lower future multiple acting as a counterweight so that the fair value ends up only modestly ahead of the current share price.

Result: Fair Value of $600 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story can change quickly if fuel demand weakens faster than expected or if integrating acquisitions like CEFCO/Fikes drags on margins longer than analysts model.

Find out about the key risks to this Casey's General Stores narrative.

Another View: High P/E Points To Rich Expectations

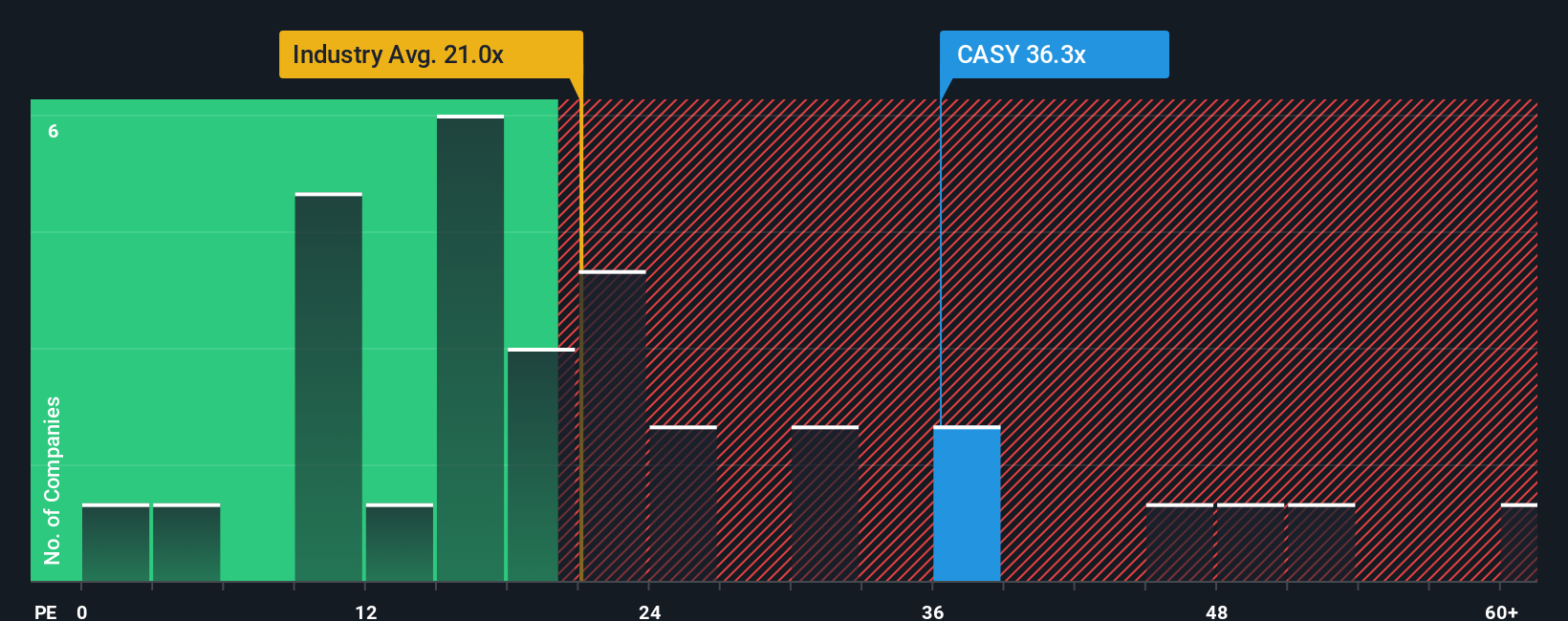

While the narrative fair value and intrinsic value estimates suggest upside, Casey's current P/E of 34.5x is well above both the US Consumer Retailing industry at 22.8x and its peer average of 24.4x, and is higher than its own fair ratio of 22.4x that the market could move toward over time. That gap signals investors are already paying a premium for future growth. The real question is how comfortable you are with paying up for that story to keep playing out.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Casey's General Stores Narrative

If you prefer to weigh the numbers yourself, you can stress test every assumption and build a version of the story that fits your view, then Do it your way.

A great starting point for your Casey's General Stores research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Casey's has your attention, do not stop there. Broaden your opportunity set with a few targeted screens that can surface different kinds of potential winners.

- Spot potential value candidates early by scanning these 878 undervalued stocks based on cash flows that line up with discounted cash flow estimates.

- Explore growth themes by checking out these 25 AI penny stocks positioned around artificial intelligence and automation trends.

- Strengthen your income watchlist by reviewing these 14 dividend stocks with yields > 3% that may offer more dependable cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal