Assessing Pembina Pipeline (TSX:PPL) Valuation As Dividend Stability And Project Progress Draw Fresh Investor Interest

Pembina Pipeline (TSX:PPL) is drawing fresh attention as investors focus on its stable dividend profile, fee-based midstream revenues, and progress on large-scale infrastructure projects in the context of a volatile energy sector.

See our latest analysis for Pembina Pipeline.

The 90-day share price return of an 8.17% decline and 30-day share price return of a 4.48% decline suggest momentum has cooled recently, even as Pembina’s 1-year total shareholder return of 4.69% and 5-year total shareholder return of 103.83% reflect a stronger longer term picture.

If Pembina’s profile has you thinking about income and infrastructure, it can be helpful to broaden your watchlist with fast growing stocks with high insider ownership.

With a recent 90-day share price decline, a 5-year total return above 100%, and analysts’ average target sitting above the current CA$52.26 level, investors have to ask: is Pembina undervalued today, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 11% Undervalued

With Pembina Pipeline last closing at CA$52.26 against a narrative fair value of about CA$58.72, the most followed view suggests some upside based on its long-term contracted earnings profile and project pipeline.

Sustained global demand for energy (particularly from Asian markets) is driving long-term, contract-backed LNG and LPG export capacity growth, increasing asset utilization rates and improving revenue visibility via multiyear take-or-pay agreements, which are seen as catalysts for future revenue and earnings growth.

Want to see what is baked into that price gap? The narrative leans heavily on steady earnings expansion, higher margins, and a richer future earnings multiple. Curious which specific profit and valuation assumptions are doing the heavy lifting here? Take a closer look at how those projections stack up over the next few years.

Result: Fair Value of $58.72 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on major projects like Cedar LNG staying on schedule and within budget, and on Western Canadian Sedimentary Basin volumes remaining stable without policy or egress disruptions.

Find out about the key risks to this Pembina Pipeline narrative.

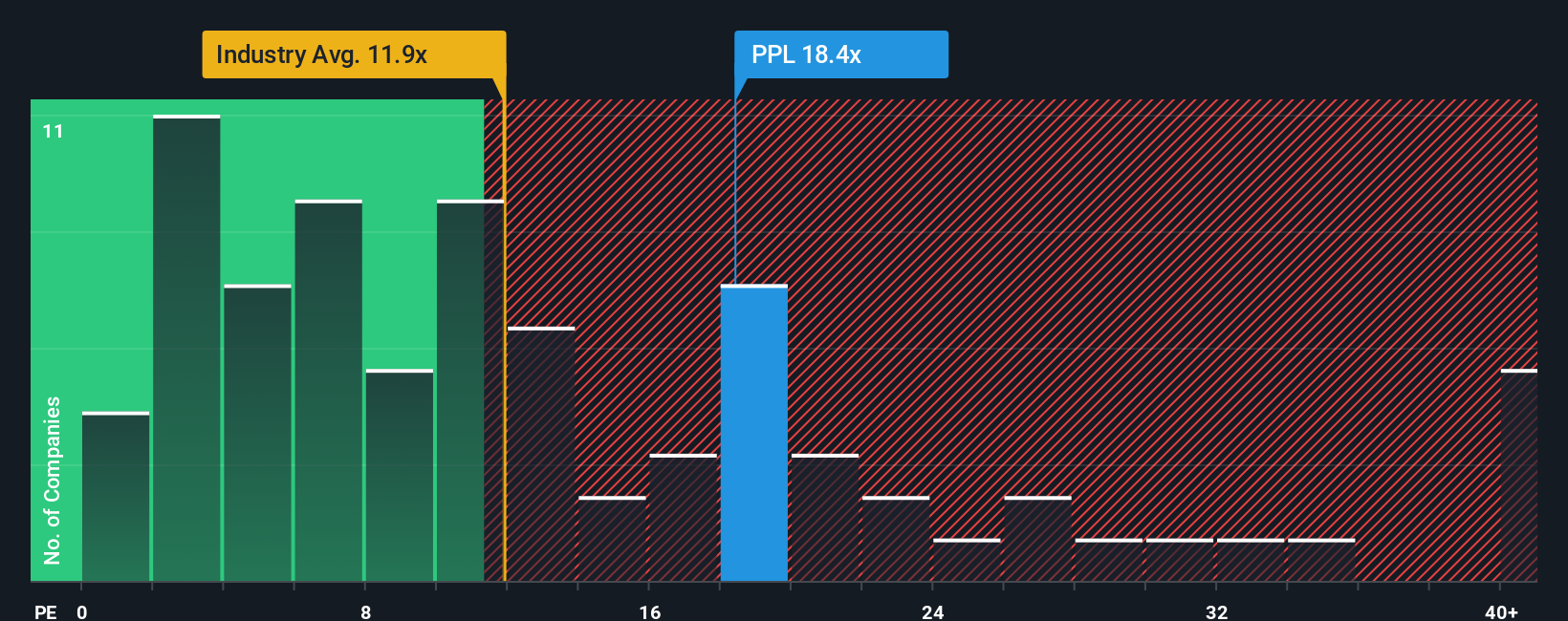

Another View: What Earnings Ratios Are Saying

The narrative fair value of about CA$58.72 points to upside, but the current P/E of 18.6x paints a more mixed picture. Pembina trades richer than the Canadian Oil and Gas industry at 14.5x, cheaper than its peer group at 21.5x, yet slightly above its own fair ratio of 18.1x.

For you, that means the market is already paying a bit of a premium to where the P/E could settle, even if it is not the priciest name in the peer set. This small gap may suggest that expectations are tight, or it may indicate that investors believe the underlying story still has room to develop.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pembina Pipeline Narrative

If this storyline does not match your view and you would rather test the numbers yourself, you can build a full narrative in minutes: Do it your way.

A great starting point for your Pembina Pipeline research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Pembina is on your radar, do not stop there. Broaden your opportunity set with a few focused stock ideas that line up with how you like to invest.

- Target dependable cash flows by scanning these 14 dividend stocks with yields > 3% that may suit an income focused portfolio.

- Chase growth potential in cutting edge technology by reviewing these 25 AI penny stocks shaping the future of automation and data.

- Hunt for potential mispriced opportunities by working through these 878 undervalued stocks based on cash flows that might not be on every investor's screen yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal