IPO News | Borui Biotech Presents Hong Kong Stock Exchange Has Eight Commercialized Products

The Zhitong Finance App learned that according to the Hong Kong Stock Exchange's disclosure on January 6, Zhejiang Borui Biopharmaceutical Co., Ltd. (abbreviation: vRui Biotech) submitted a listing application to the main board of the Hong Kong Stock Exchange, with Huatai International and J.P. Morgan Chase as co-sponsors.

Company profile

vRui Biotech is a leading integrated biopharmaceutical company in China. It is committed to providing comprehensive immunotherapy solutions for patients with autoimmune and inflammatory diseases, oncoimmunological diseases, and malignant tumors of the immune system itself. According to Frost & Sullivan, in terms of revenue from biological agents for autoimmune diseases, vRui Biotech has ranked first among Chinese pharmaceutical companies for two consecutive years since 2023.

vRui Biotech strategically focuses on immunotherapy, a type of targeted treatment that uses immunoscience to regulate immune function to address diseases where immune disorders play a key role. Such immune dysfunctions include overactive immune responses in autoimmune and inflammatory diseases, and impaired immune surveillance function in various malignant tumors and malignant tumors of the immune system.

With the company's deep insight into immune mechanisms and rigorous identification of high-value unmet medical needs, vPro Biotech has established one of the most competitive and comprehensive immunization product portfolios in the industry. The company's product portfolio is underpinned by eight commercialized products, and is powered by an ever-expanding pipeline of innovation with first-of-its-kind and best-in-class potential.

Borui Biotech's innovative portfolio is led by Beijieruo® (Bichizumab), the first and best IL-17A/F inhibitor with the same indications, China's first and only innovative CD20 monoclonal antibody Enrixib (zebetumab), and BR2251 (a potentially first-in-class and best-in-class gout drug with a differentiated mechanism of action). These three cornerstone immunology products not only lay a solid foundation for the company's growth, but also enable the company to reshape treatment models for various autoimmune diseases and oncological indications domestically.

The company already owns a range of biologics with mature commercialization results, which can generate stable income for continued investment in next-generation targeted therapeutics to complement existing therapies. Building on this, the company is strategically transforming from a proven molecule developer to an innovative biopharmaceutical company driven by proprietary technology, including the development of a range of ADC drug candidates with the potential to pioneer similar products using the company's proprietary and differentiated antibody drug conjugate platform.

Financial data

revenue

In 2023, 2024, and 2025 for the nine months ended September 30, the company achieved revenue of approximately RMB 1,257 billion, RMB 1,623 billion, and RMB 1,379 billion, respectively.

Annual/period profit attributable to equity shareholders of the company

For the nine months ended September 30 in 2023, 2024, and 2025, the company recorded annual/period profits attributable to equity shareholders of 19.05 million yuan, 91.295 million yuan, and 122 million yuan, respectively.

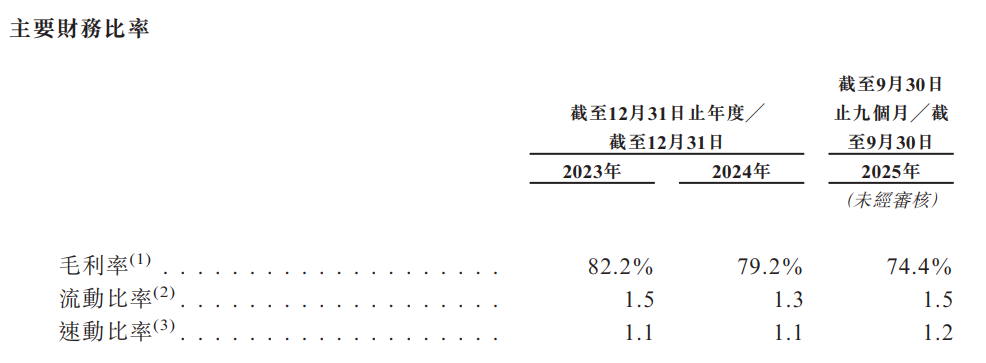

gross profit margin

In 2023, 2024, and 2025 for the nine months ended September 30, the company recorded gross margins of 82.2%, 79.2%, and 74.4%, respectively.

Industry Overview

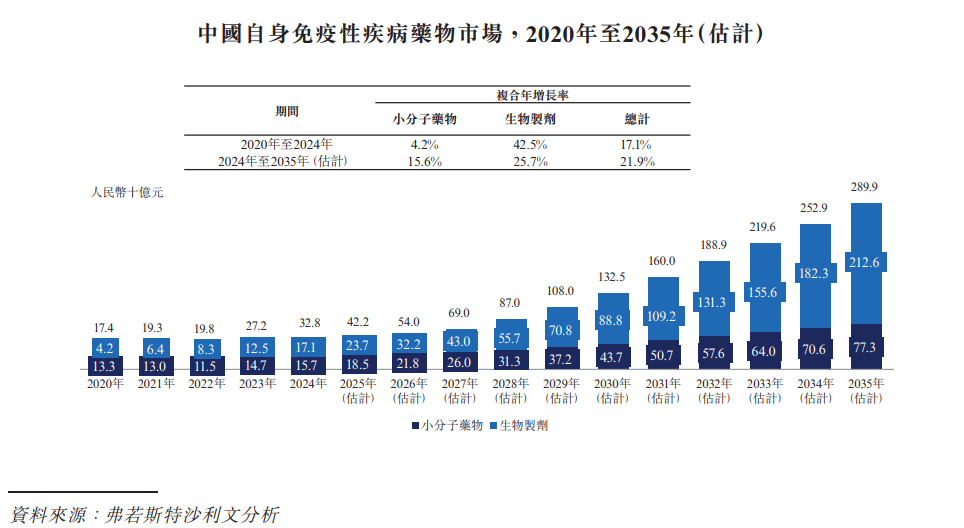

Autoimmune and Inflammatory Diseases Market

The autoimmune disease market is one of the fastest-growing sectors in the global pharmaceutical market. Its star drugs, such as dupriumab®, risazumab®, and usinumab®, each generated more than $10 billion in revenue in 2024. According to Frost & Sullivan, in China, the market size was RMB 17.4 billion in 2020 and will increase to RMB 32.8 billion in 2024. It is expected to reach RMB 289.9 billion in 2035, with a CAGR of 21.9%.

Due to the excellent efficacy of biologics, the market share is rapidly expanding, from RMB 4.2 billion in 2020 to RMB 17.1 billion in 2024, with a compound annual growth rate of 42.5%. It is expected to reach RMB 212.6 billion by 2035, with a CAGR of 25.7%. Despite rapid market growth, the penetration rate of the autoimmune disease market in China is still significantly low compared to developed markets, which brings huge potential development opportunities for innovative pharmaceutical companies focused on solving unmet clinical needs.

Oncology Immunology Market

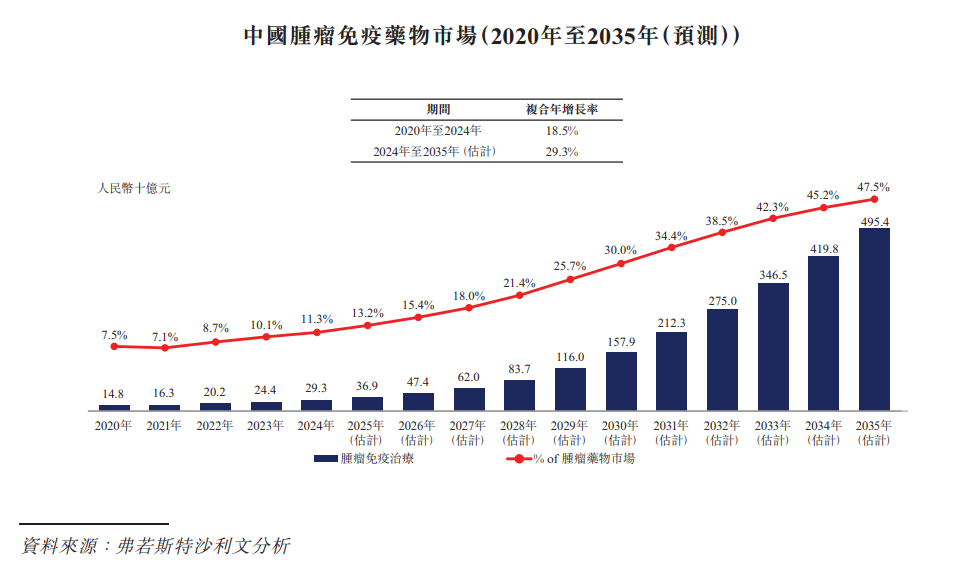

Tumor immunology is a revolutionary and important pillar of modern cancer treatment. It uses the immune system to identify and eliminate cancer cells. Tumor immunology covers models such as cellular immunotherapy, cytokines, cancer vaccines, and antibody therapy, and has reshaped tumor treatment models. The success of immune checkpoint inhibitors not only validated this immunological approach to fighting tumors, but also profoundly changed the pattern of tumor treatment, thus bringing benefits to cancer patients around the world. As next-generation antibody therapeutics, including tumor immunopharmaceuticals and ADCs, continue to advance, it is expected that tumor immunology will play an increasingly central role in cancer treatment.

In China, immuno-oncology drugs will account for 11.3% of the total oncology drug market in 2024 and are expected to reach 47.5% by 2035. Driven by the approval of oncology immunopharmaceuticals and the expansion of clinical indications, the Chinese oncology immunopharmaceuticals market grew from RMB 14.8 billion in 2020 to RMB 29.3 billion in 2024, with a compound annual growth rate of 18.5%, and is expected to expand further to RMB 495.4 billion in 2035, with a compound annual growth rate of 29.3% from 2024 to 2035.

Hematologic Malignancies Market

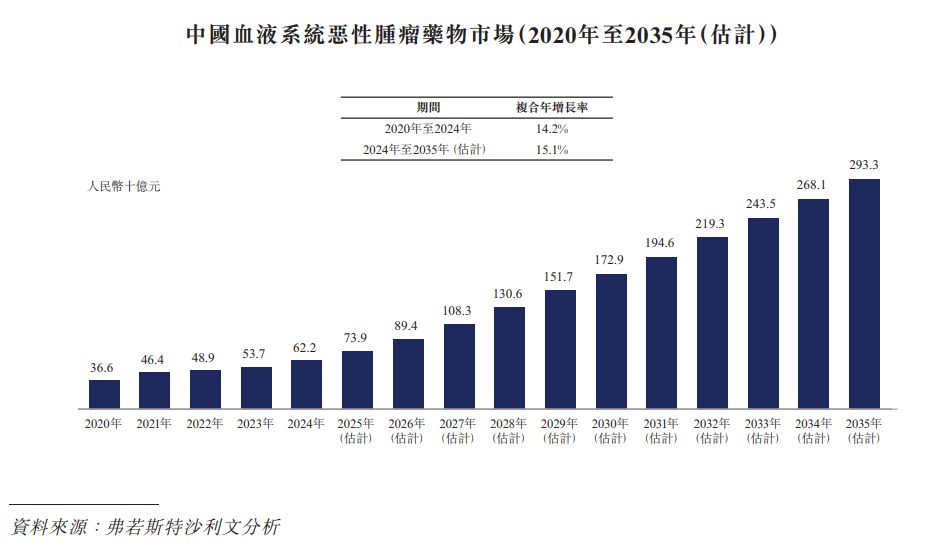

Hematologic malignancies are essentially malignant tumors of the immune system itself. It is the segment of oncology that responds most positively to immunotherapy, and is driven by its origin in the immune system and its well-defined molecular targets. Advances in tumor immunology and molecular biology have changed the treatment model from non-specific chemotherapy to precise immunological therapy, and accelerated the adoption of immune-targeting methods in various indications.

Monoclonal antibodies (such as CD20 antibodies) have reshaped treatment standards for B-cell malignancies and established immunotherapy as the basic treatment model in this field. Despite these breakthroughs, high recurrence rates, treatment resistance, and poor prognosis still exist in progressive refractory patient groups, creating huge unmet medical needs. These dynamics continue to drive strong demand for next-generation therapies, making hematologic malignancies a key engine for continued innovation and growth in the oncology market.

In China, driven by the approval of innovative treatments targeting hematologic malignancies and improved patient survival rates, the hematologic cancer drug market expanded from RMB 36.6 billion in 2020 to RMB 62.2 billion in 2024, with a compound annual growth rate of 14.2%, and is expected to reach RMB 293.3 billion in 2035, with a compound annual growth rate of 15.1% from 2024 to 2035.

Board Information

The company's board of directors consists of nine directors, including 2 executive directors, 4 non-executive directors and 3 independent non-executive directors.

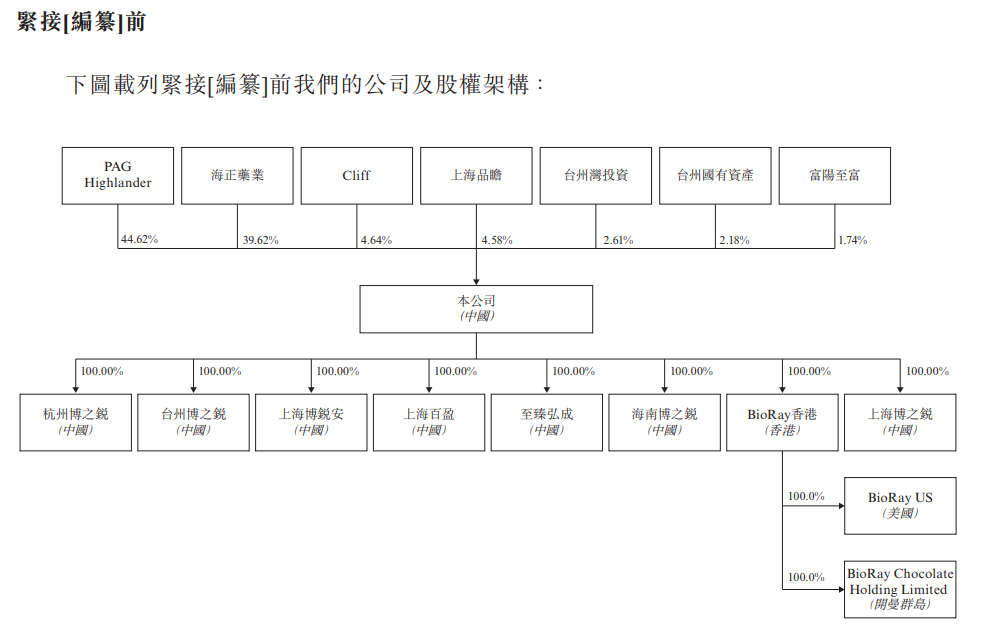

Shareholding structure

As of December 29, 2025, PAG Highlander and Haizheng Pharmaceutical directly owned 44.62% and 39.62% of the company's shares respectively.

Intermediary team

Co-sponsors: Huatai Financial Holdings (Hong Kong) Limited, J.P. Morgan Securities (Far East) Limited

Company Legal Adviser: On Hong Kong and US Law: Kaiyi Law Firm; On Chinese Law: JunHe Law Firm

Co-sponsor Legal Adviser: Related to Hong Kong and US Law: Smith & Phil; Related Chinese Law: Jingtian Gongcheng Law Firm

Reporting Accountants and Independent Auditors: KPMG

Industry Advisor: Frost & Sullivan (Beijing) Consulting Co., Ltd. Shanghai Branch

Compliance Advisor: New Berry Finance Co., Ltd.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal