Cloudflare (NET) Valuation Check As Multi Year Gains Contrast With Recent Share Price Softness

Cloudflare (NET) has caught investor attention after recent trading left the stock roughly flat over the month but lower over the past 3 months, prompting fresh questions about how its current valuation compares.

See our latest analysis for Cloudflare.

Looking beyond the recent softness, Cloudflare’s 1-year total shareholder return of 73.89% and very large 3-year total shareholder return of about 4x contrast with its weaker 90-day share price return of a 10.15% decline. This suggests momentum has cooled after a strong multi year run.

If Cloudflare’s move has caught your eye, it could be a good moment to see how it compares with other high growth tech and AI names using high growth tech and AI stocks.

So with Cloudflare shares roughly flat in the near term but backed by a strong multiyear total return, is the current US$197.66 price leaving upside on the table, or already baking in a lot of future growth?

Most Popular Narrative Narrative: 18.5% Undervalued

With Cloudflare’s fair value estimate at US$242.46 versus a last close of US$197.66, the narrative points to a meaningful valuation gap and leans heavily on future growth expectations to justify it.

Investments in platform scalability, automation, and operational efficiency are resulting in improved net margins and operating leverage, gross margins remain healthy despite competitive pricing, and continued cost management is reducing operating expenses as a percentage of revenue, supporting long-term profitability improvements. Cloudflare's early action building strategic positioning around the emerging Agentic Web and "Act 4" initiatives, leveraging its unique reach across 20% of the Internet and broad AI partnerships, offers significant optionality for new high-margin transaction-based business models that could unlock new revenue streams and expand the addressable market.

Curious what kind of revenue growth, margin lift, and profit multiple are baked into that fair value? The narrative leans on bold earnings and valuation assumptions. Want to see exactly how far those projections stretch future profitability and pricing power?

Result: Fair Value of $242.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story could change quickly if customer concentration takes a toll through a major contract loss, or if rising costs and competition keep margins under pressure.

Find out about the key risks to this Cloudflare narrative.

Another View: Price Tag Looks Stretched

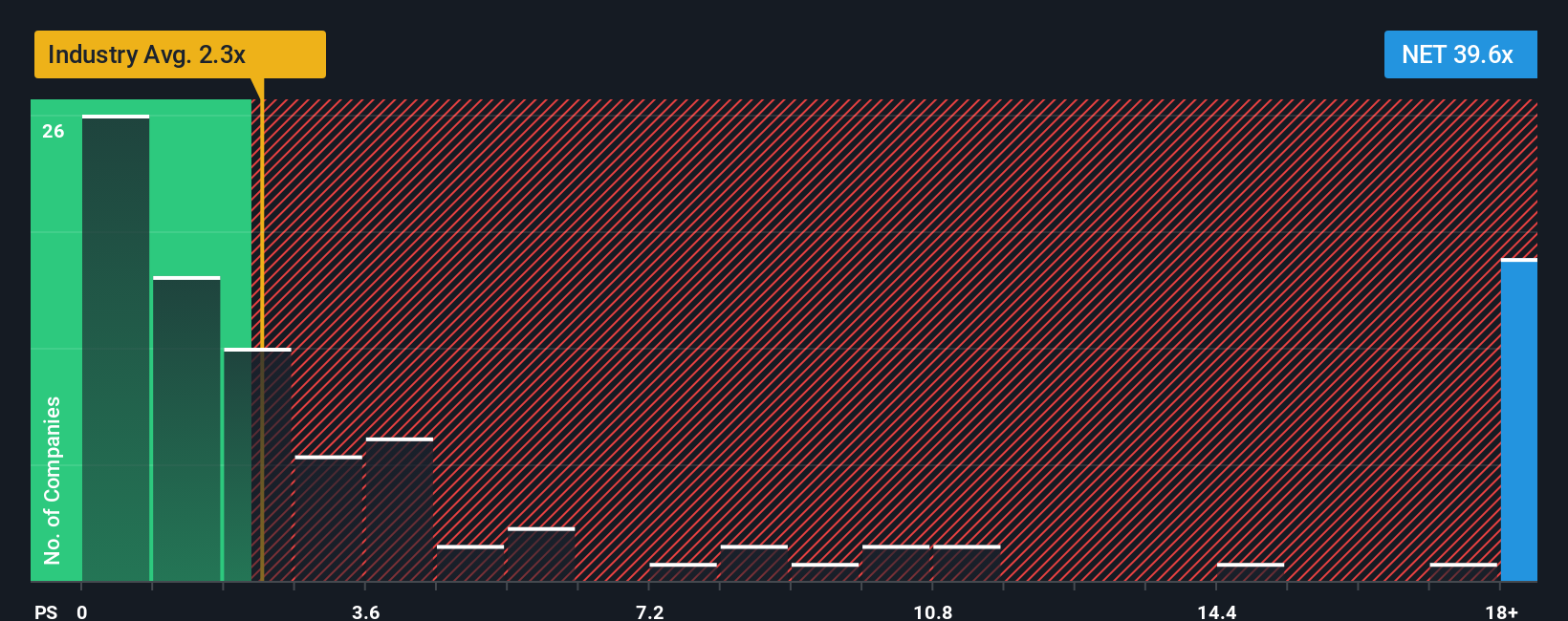

While the narrative points to about 18.5% upside to a US$242.46 fair value, the current P/S ratio of 34.4x tells a very different story. That is more than double the 14.9x fair ratio our model suggests the market could move toward, and well above both peers at 14.2x and the US IT industry at 2.2x. That kind of gap can mean a lot has to go right just to justify today’s price, so which signal do you trust more?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cloudflare Narrative

If you see the numbers differently or prefer to test the assumptions yourself, you can build a fresh view in just a few minutes: Do it your way.

A great starting point for your Cloudflare research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

If Cloudflare has you thinking about what else might be worth a closer look, do not stop here. Broaden your watchlist with a few focused stock themes.

- Target potential value opportunities by scanning these 877 undervalued stocks based on cash flows that line up current prices with underlying cash flows.

- Chase growth stories at the frontier of tech by sorting through these 25 AI penny stocks and see which companies fit your view.

- Hunt for income ideas using these 14 dividend stocks with yields > 3% that offer eye catching yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal