Assessing Rolls-Royce Holdings (LSE:RR.) Valuation After Strong Recent Share Price Gains

What recent returns say about Rolls-Royce Holdings shares

Rolls-Royce Holdings (LSE:RR.) has drawn attention after a 2.9% one day move, adding to gains of 8.3% over the past week and about 13.6% over the past month.

Over the past 3 months the shares show a 6.8% return, with the latest close at £12.32. That sits against a reported £19,538.0m of revenue and £5,788.0m of net income, giving investors concrete figures to weigh.

See our latest analysis for Rolls-Royce Holdings.

Set against a very large 1 year total shareholder return of about 119% and multi year total shareholder returns above 10x, the recent 1 day and 1 month share price gains suggest momentum is still building as investors reassess both growth prospects and risks.

If Rolls-Royce has caught your eye, it can be useful to see what else is moving across aerospace and defense stocks as another way to spot potential ideas in a similar space.

So, with the shares now close to a reported analyst price target of about £12.16 and trading at a premium to some intrinsic estimates, you have to ask: is there still a buying opportunity here, or is future growth already priced in?

Most Popular Narrative Narrative: 3% Overvalued

With the narrative fair value of about £11.98 sitting just below the £12.32 last close, the story hinges on how future earnings are framed and discounted.

The analysts have a consensus price target of £11.357 for Rolls-Royce Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £14.4, and the most bearish reporting a price target of just £2.4.

Want to see what kind of revenue path and margin reset still justify a premium earnings multiple here? The narrative leans on confident growth, shrinking profitability and a punchy future P/E to back its fair value. Curious which assumptions really carry that valuation story, and how tightly it is tied to those earnings forecasts?

Result: Fair Value of $11.98 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still pressure points, including the risk that data center power demand cools or that higher aerospace development costs squeeze the earnings and P/E assumptions underpinning this story.

Find out about the key risks to this Rolls-Royce Holdings narrative.

Another way to look at Rolls-Royce’s valuation

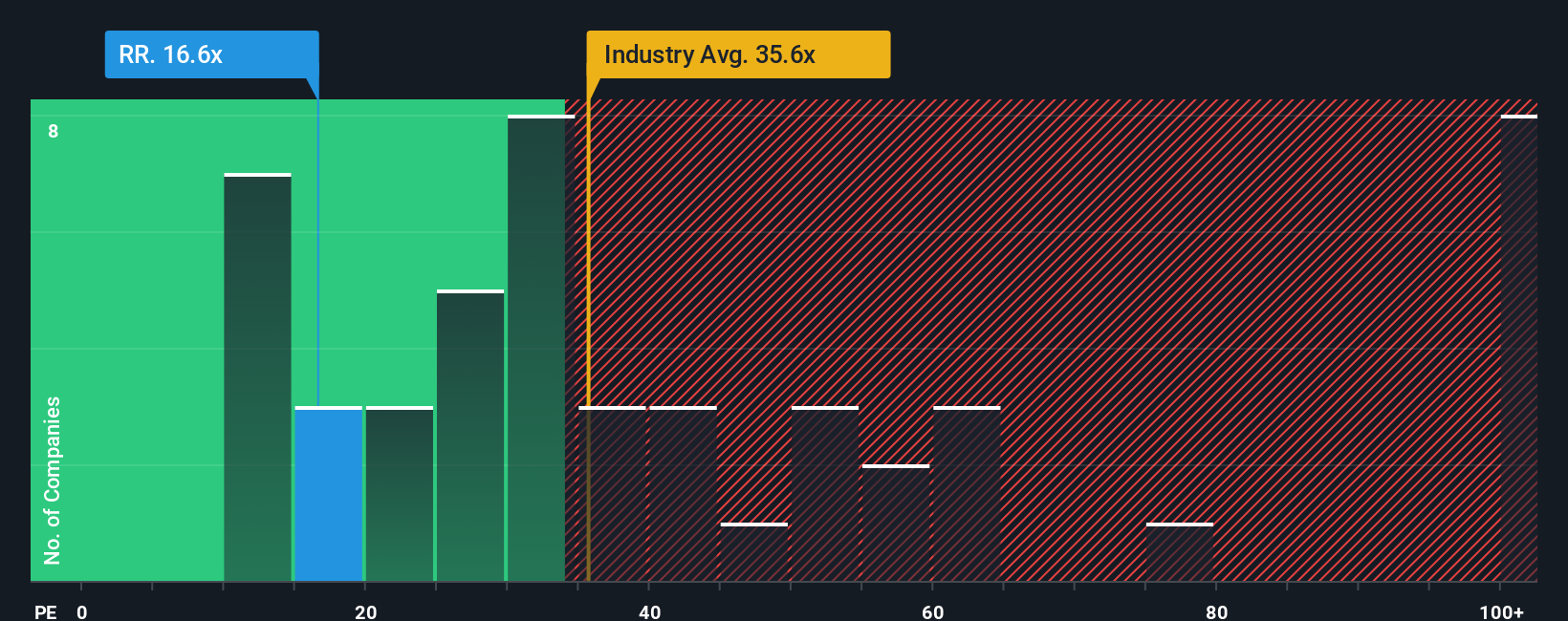

The narrative-based fair value of about £11.98 suggests the shares are around 3% overvalued, but the simple earnings multiple paints a softer picture. Rolls-Royce trades on a P/E of 17.8x, below the European Aerospace & Defense industry at 24.2x and peers at 25.3x, and under a fair ratio of 22.7x. This implies the market might still be leaving some room on the table. The tension is clear, so which signal do you trust more: the story or the straight comparison?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rolls-Royce Holdings Narrative

If you see the numbers differently or simply prefer to test your own assumptions against the data, you can build a custom view in just a few minutes by starting with Do it your way.

A great starting point for your Rolls-Royce Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Rolls-Royce looks interesting, do not stop there. A few minutes with the right screens could surface opportunities you will wish you had seen earlier.

- Hunt for potential value by scanning these 877 undervalued stocks based on cash flows that appear attractively priced based on cash flows rather than headlines.

- Target future focused themes by checking out these 25 AI penny stocks that are tied to advances in artificial intelligence and automation.

- Boost your income watchlist by reviewing these 14 dividend stocks with yields > 3% that offer yields above 3% alongside equity exposure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal