UK Stocks Priced Below Estimated Value In January 2026

The United Kingdom's FTSE 100 index recently experienced a downturn, influenced by weak trade data from China that highlighted ongoing challenges in the global economic landscape. As the market navigates these turbulent waters, investors may find opportunities in stocks that are priced below their estimated value, offering potential for growth despite broader market pressures.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Serabi Gold (AIM:SRB) | £3.28 | £6.23 | 47.3% |

| PageGroup (LSE:PAGE) | £2.35 | £4.53 | 48.1% |

| Nichols (AIM:NICL) | £9.32 | £18.53 | 49.7% |

| Man Group (LSE:EMG) | £2.33 | £4.36 | 46.5% |

| Ibstock (LSE:IBST) | £1.378 | £2.67 | 48.3% |

| Gym Group (LSE:GYM) | £1.524 | £2.94 | 48.2% |

| Fevertree Drinks (AIM:FEVR) | £8.03 | £15.87 | 49.4% |

| CAB Payments Holdings (LSE:CABP) | £0.65 | £1.30 | 49.8% |

| Anglo Asian Mining (AIM:AAZ) | £2.75 | £5.14 | 46.5% |

| Advanced Medical Solutions Group (AIM:AMS) | £2.15 | £4.19 | 48.7% |

We'll examine a selection from our screener results.

Serabi Gold (AIM:SRB)

Overview: Serabi Gold plc is involved in the evaluation, exploration, and development of gold and other metals mining projects in Brazil with a market cap of £248.41 million.

Operations: The company generates revenue primarily through its gold mining and exploration activities, amounting to $128.77 million.

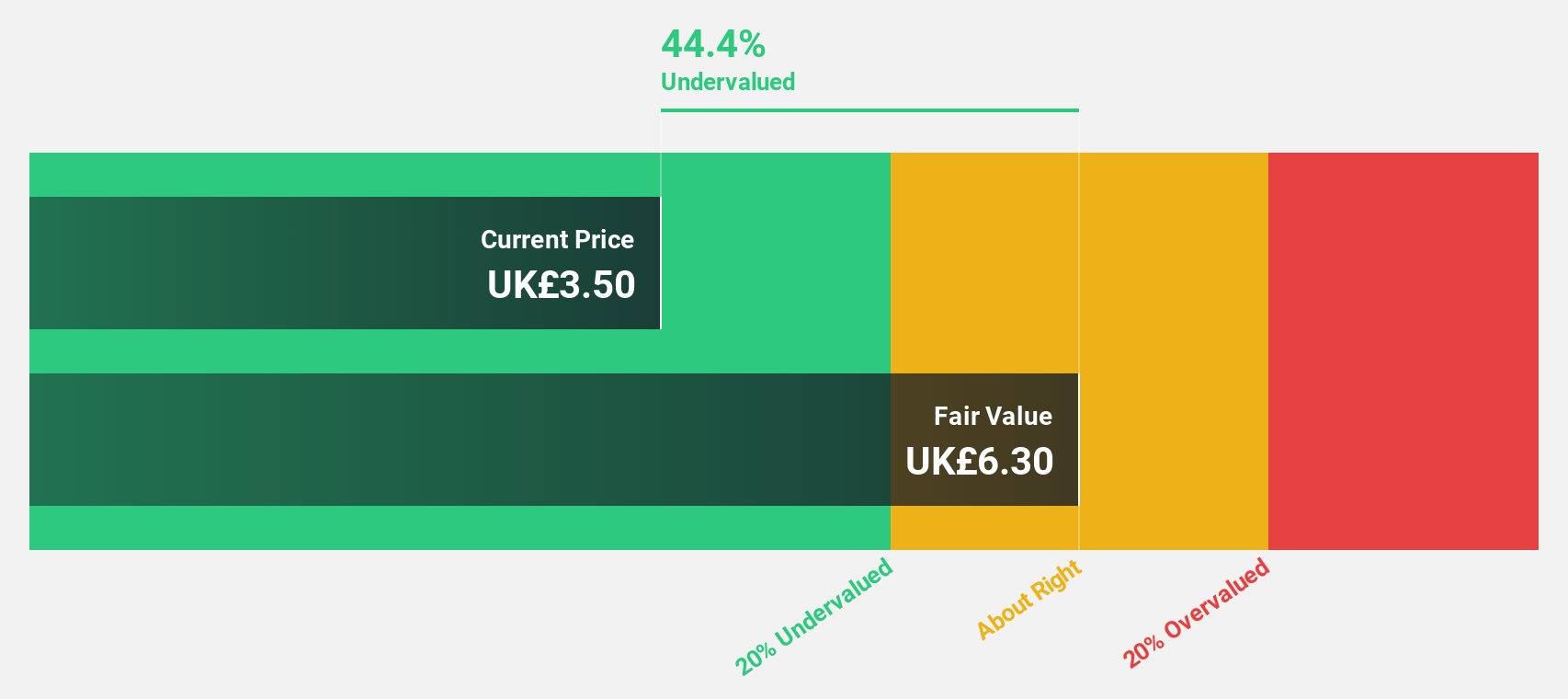

Estimated Discount To Fair Value: 47.3%

Serabi Gold appears undervalued based on discounted cash flow analysis, trading at £3.28, significantly below its estimated fair value of £6.23. The company reported strong financial performance with third-quarter sales of US$42 million and net income of US$15.99 million, reflecting considerable growth from the previous year. Despite recent share price volatility, Serabi Gold's earnings are projected to grow substantially faster than the UK market over the next three years, enhancing its appeal as an investment opportunity.

- The growth report we've compiled suggests that Serabi Gold's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Serabi Gold.

Airtel Africa (LSE:AAF)

Overview: Airtel Africa Plc, with a market cap of £13.29 billion, operates telecommunications and mobile money services across Nigeria, East Africa, and Francophone Africa.

Operations: The company's revenue is derived from three main segments: Mobile Money services contributing $1.15 billion, Nigeria Mobile Services generating $1.25 billion, and East Africa and Francophone Africa Mobile Services bringing in $2.01 billion and $1.41 billion respectively.

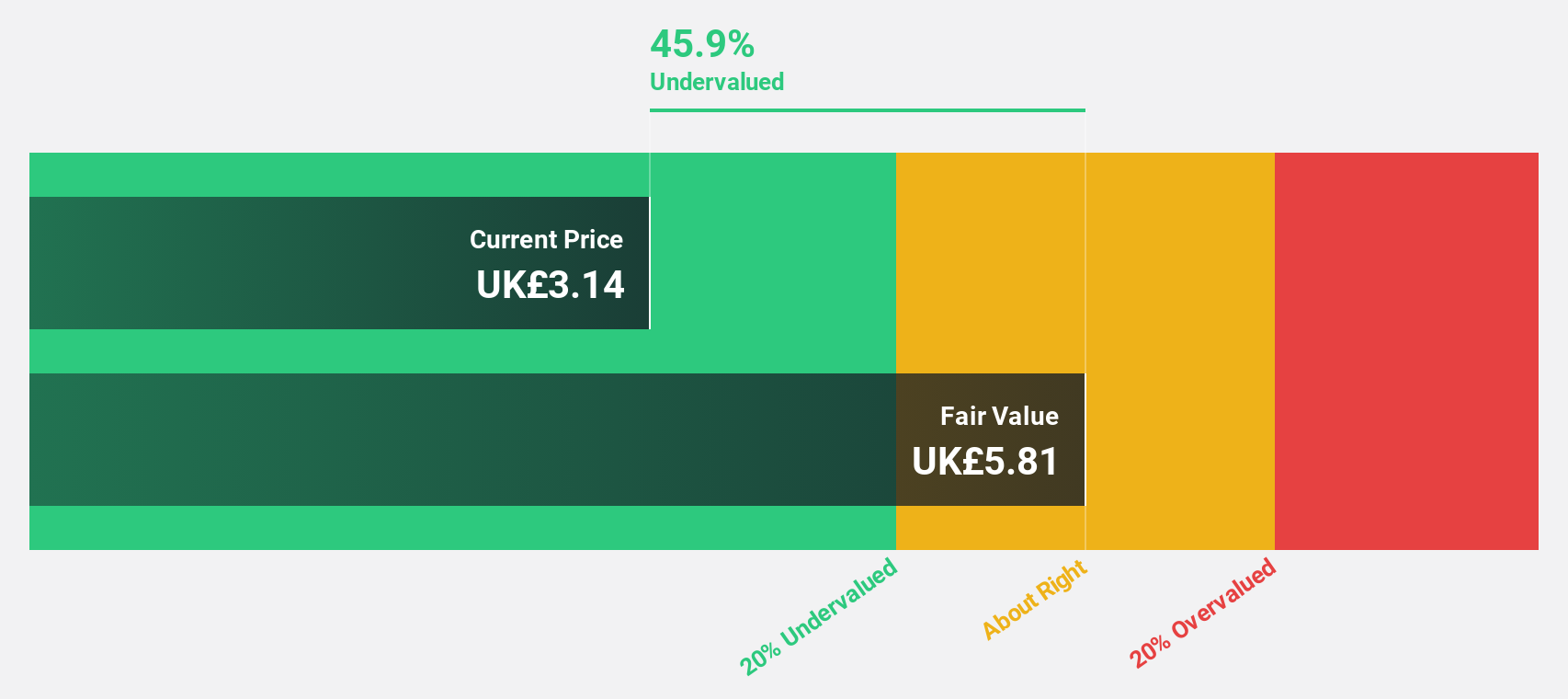

Estimated Discount To Fair Value: 36.5%

Airtel Africa is trading at £3.64, significantly below its estimated fair value of £5.74, suggesting it is undervalued based on cash flows. The company reported strong earnings for the half year ending September 2025, with net income rising to US$303 million from US$31 million a year ago. Despite concerns over interest coverage by earnings, Airtel Africa's earnings are expected to grow significantly faster than the UK market in the coming years.

- Insights from our recent growth report point to a promising forecast for Airtel Africa's business outlook.

- Dive into the specifics of Airtel Africa here with our thorough financial health report.

Ashtead Group (LSE:AHT)

Overview: Ashtead Group plc operates in the construction, industrial, and general equipment rental business under the Sunbelt Rentals brand across the United States, United Kingdom, and Canada, with a market cap of £22.19 billion.

Operations: The company's revenue segments include $912.70 million from the UK, $3.54 billion from North America Specialty, and $6.41 billion from North America General Tool.

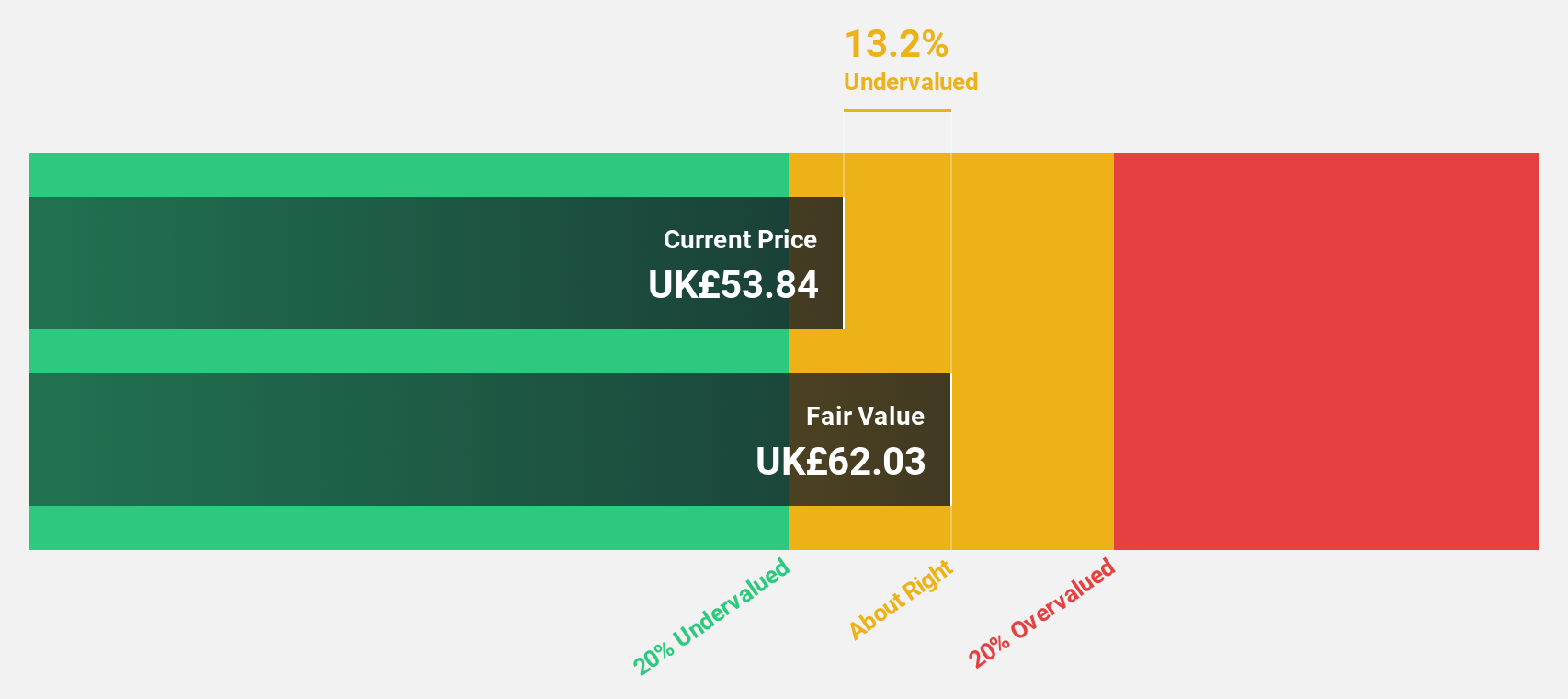

Estimated Discount To Fair Value: 15.4%

Ashtead Group is trading at £53.26, below its estimated fair value of £62.95, indicating it may be undervalued based on cash flows. Recent earnings show stable revenue growth, although net income declined year-on-year to US$425.1 million in the second quarter of 2025. The company has a high debt level but maintains a progressive dividend policy and an active share repurchase program worth up to $1,500 million through April 2027.

- Our growth report here indicates Ashtead Group may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Ashtead Group.

Summing It All Up

- Embark on your investment journey to our 60 Undervalued UK Stocks Based On Cash Flows selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal