Assessing Silicon Labs (SLAB) Valuation After CES 2026 IoT And Wireless Announcements

Silicon Laboratories (SLAB) is back in focus after using CES 2026 to showcase new Internet of Things tools, led by the Simplicity SDK for Zephyr and advanced wireless demonstrations for developers.

See our latest analysis for Silicon Laboratories.

The CES news comes as the stock shows mixed momentum, with a 1-day share price return of 4.55% and a 7-day return of 3.79%, compared with a 30-day share price return decline of 2.54% and a 1-year total shareholder return of 6.82%. This contrasts with a 3-year total shareholder return decline of 8.43%, suggesting that interest may be picking up again after a weaker multi-year stretch.

If the IoT theme around Silicon Labs has caught your attention, it could be a useful moment to scan other high growth tech and AI names through high growth tech and AI stocks.

With CES buzz, double digit annual revenue growth of 16% and triple digit net income growth, plus a recent 3 year total return decline, the key question is whether SLAB is still mispriced or if markets are already factoring in potential future gains.

Most Popular Narrative: 8.3% Undervalued

Compared with the last close at US$137.93, the most followed narrative implies a higher fair value and leans heavily on long term IoT growth assumptions.

Rapid expansion of smart home, healthcare, and industrial IoT deployments including multiple large scale customer production ramps and a deep design win pipeline supports robust, multi year revenue growth as the number of connected devices in these sectors accelerates.

Curious what has to happen for those revenues, margins and future earnings to line up with that price target? The narrative leans on punchy growth, a sharp swing into profitability and a premium earnings multiple rarely seen outside market favourites. Want to see exactly which assumptions carry the weight in this fair value call?

Result: Fair Value of $150.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on IoT demand remaining healthy. Rising competition and potential chip commoditization could squeeze margins and weaken the case for premium pricing.

Find out about the key risks to this Silicon Laboratories narrative.

Another View: Market Ratios Flash A Caution Signal

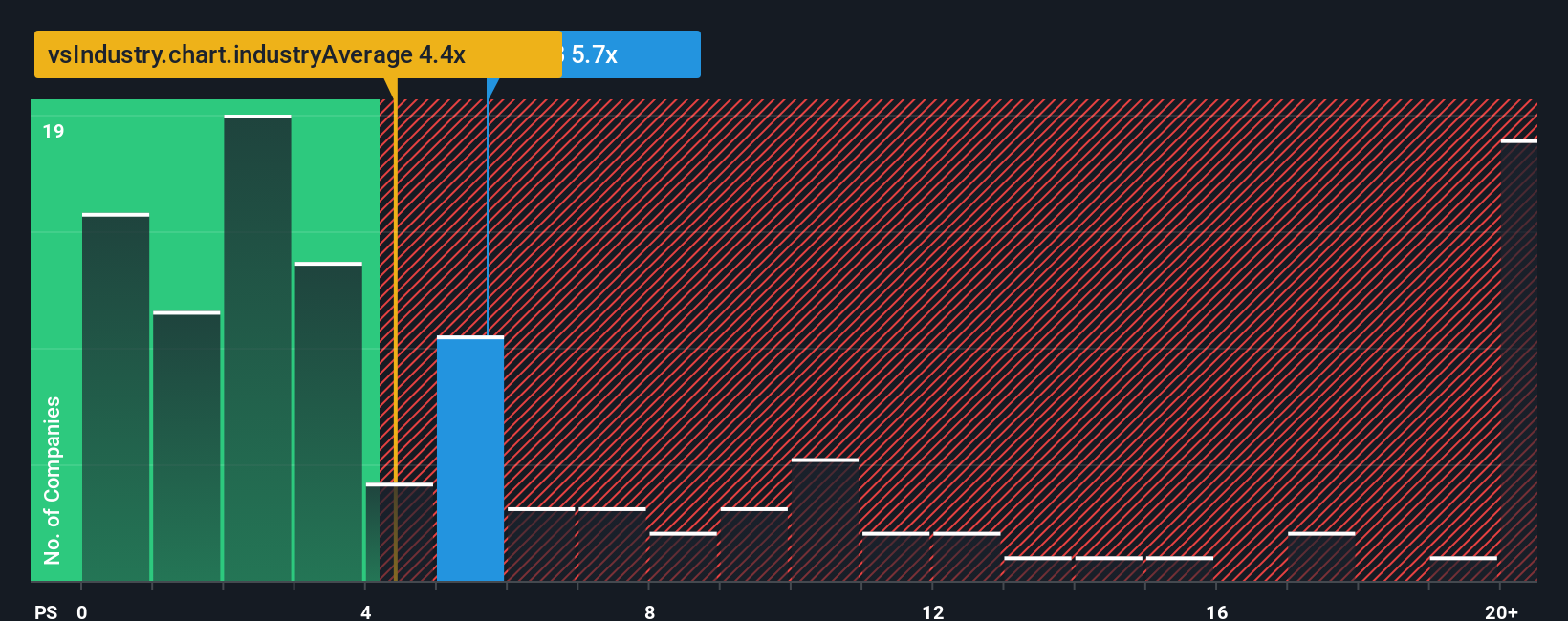

Analyst fair value work points to upside, but the market is currently asking you to pay a rich price for Silicon Labs’ sales. The stock trades on a P/S of 6.1x, compared with a fair ratio of 5.1x, an industry average of 5.6x and a peer average of 3.8x. That gap raises a simple question for you: are you comfortable paying above both peers and the fair ratio for this IoT story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Silicon Laboratories Narrative

If you are not fully convinced by these views or simply prefer to stress test the numbers yourself, you can spin up your own narrative in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Silicon Laboratories.

Ready For More Investment Ideas?

If you stop with just one stock, you could miss opportunities sitting in plain sight, so take a few minutes to see what else matches your checklist.

- Spot potential value gaps by scanning these 877 undervalued stocks based on cash flows where prices and cash flows may be telling two different stories.

- Zero in on future facing themes with these 25 AI penny stocks that link artificial intelligence trends to real businesses and real numbers.

- Collect ideas for income focused portfolios by checking these 14 dividend stocks with yields > 3% that might help you build a more reliable stream of payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal