Undiscovered Gems In Europe To Explore This January 2026

As the European market continues to flourish, with the STOXX Europe 600 Index reaching new highs and closing 2025 with a remarkable annual price return of nearly 17%, investors are increasingly turning their attention to small-cap stocks that may offer unique growth opportunities. In this dynamic environment, identifying promising stocks involves looking for companies that demonstrate strong fundamentals and resilience in an improving economic backdrop.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| FRoSTA | 5.37% | 4.80% | 13.56% | ★★★★★★ |

| Evergent Investments | 3.63% | 11.51% | 22.05% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Dn Agrar Group | NA | 29.02% | 36.03% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Darwin | 3.03% | 50.55% | 46377.71% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Sipef (ENXTBR:SIP)

Simply Wall St Value Rating: ★★★★★★

Overview: Sipef NV operates as an agro-industrial company with a market capitalization of €879.22 million.

Operations: Sipef generates revenue primarily from palm products, contributing $443.03 million, and bananas at $43.98 million. The company's financial performance includes a net profit margin trend that is noteworthy for its variability over recent periods.

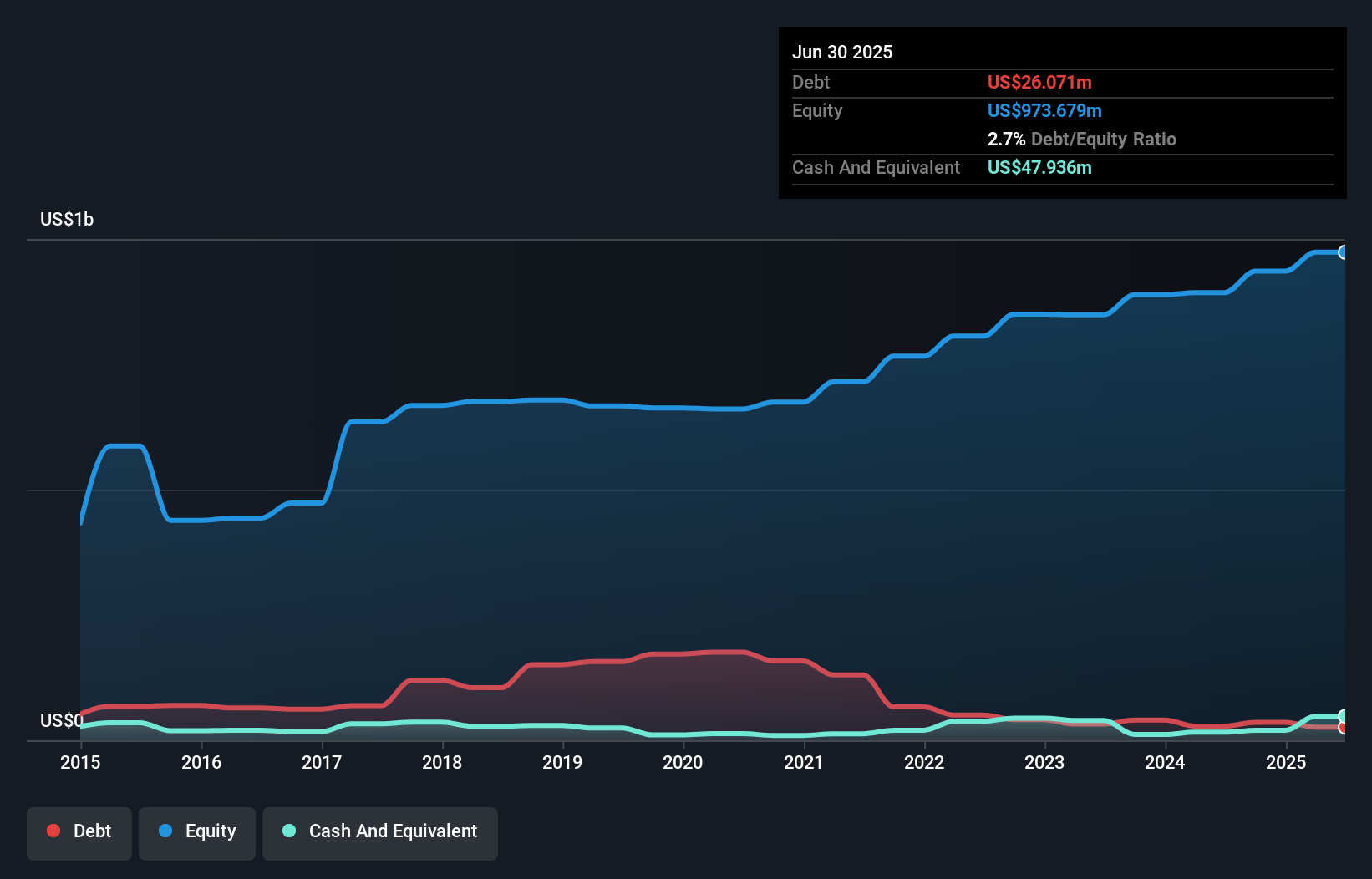

Sipef, a dynamic player in the agricultural sector, has showcased impressive earnings growth of 48.1% over the past year, outpacing the broader food industry’s 30.2%. This robust performance is complemented by its debt management; Sipef's debt to equity ratio has significantly decreased from 26.6% to 2.7% over five years, indicating strong financial health with more cash than total debt. Furthermore, its interest payments are comfortably covered by EBIT at an astonishing 153x coverage. Despite potential earnings decline forecasts of around 0.4% annually for three years, Sipef trades at a substantial discount of about 65% below estimated fair value.

naturenergie holding (SWX:NEAG)

Simply Wall St Value Rating: ★★★★★★

Overview: Naturenergie Holding AG, with a market cap of CHF1.12 billion, operates through its subsidiaries to produce, distribute, and sell electricity under the Naturenergie brand in Switzerland and internationally.

Operations: Naturenergie Holding AG generates revenue primarily from Customer-Oriented Energy Solutions (€912.90 million), Renewable Generation Infrastructure (€845.40 million), and System Relevant Infrastructure (€482.50 million).

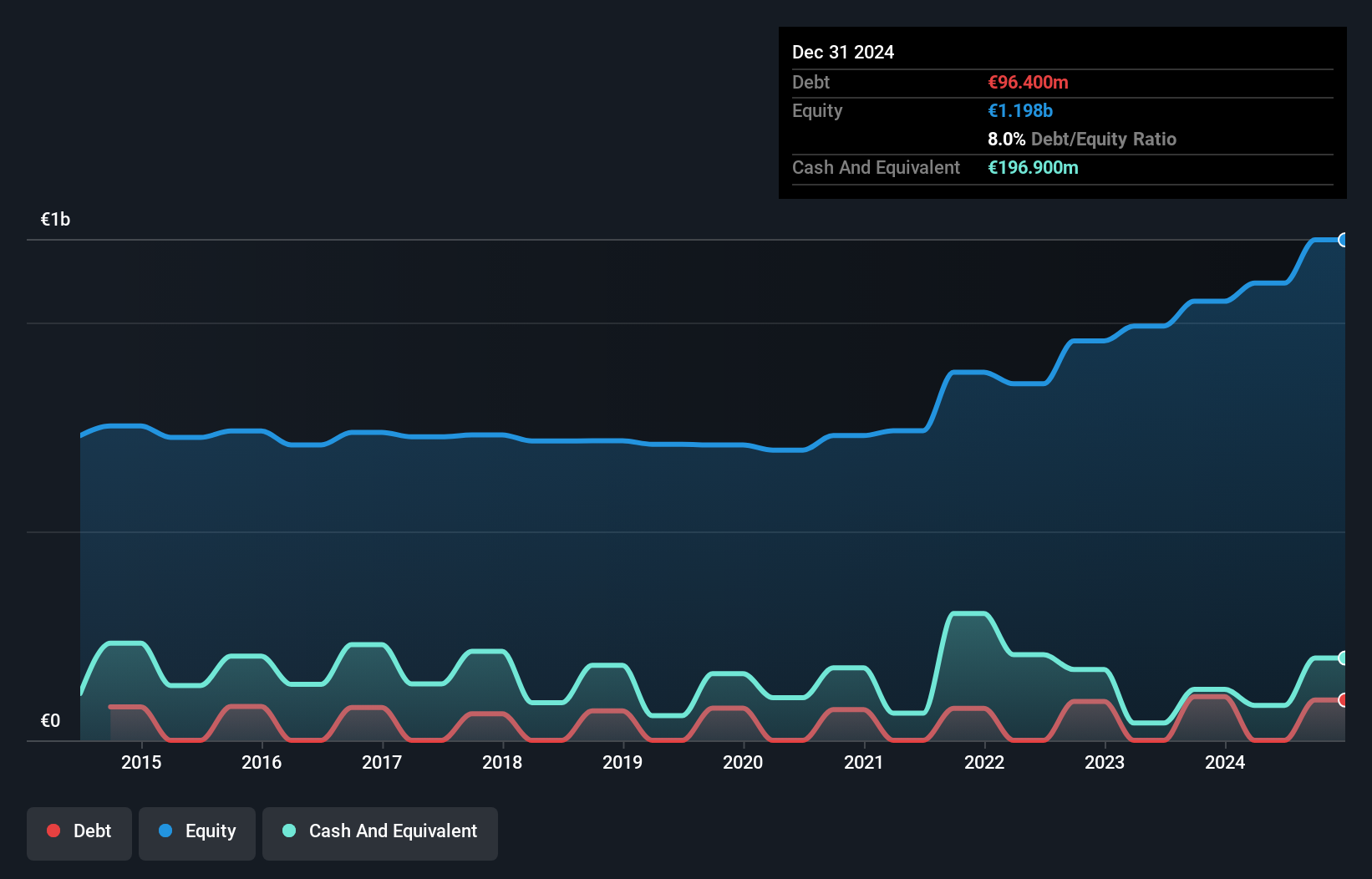

Naturenergie Holding, a small player in the European energy sector, has been making waves with its impressive 48.2% earnings growth over the past year, outpacing the Electric Utilities industry which saw a -1.3% shift. This company operates debt-free and is trading at 36.1% below its estimated fair value, suggesting it might be undervalued compared to peers. Despite forecasts indicating an average earnings decline of 8.5% annually over the next three years, Naturenergie's high-quality earnings and positive free cash flow position it as an intriguing prospect for those seeking value in Europe's energy landscape.

Sygnity (WSE:SGN)

Simply Wall St Value Rating: ★★★★★★

Overview: Sygnity S.A. is a company that manufactures and sells IT products and services both in Poland and internationally, with a market capitalization of PLN2.13 billion.

Operations: Sygnity generates revenue primarily from its IT segment, which recorded PLN333.45 million. The company's financial performance is influenced by its net profit margin trends.

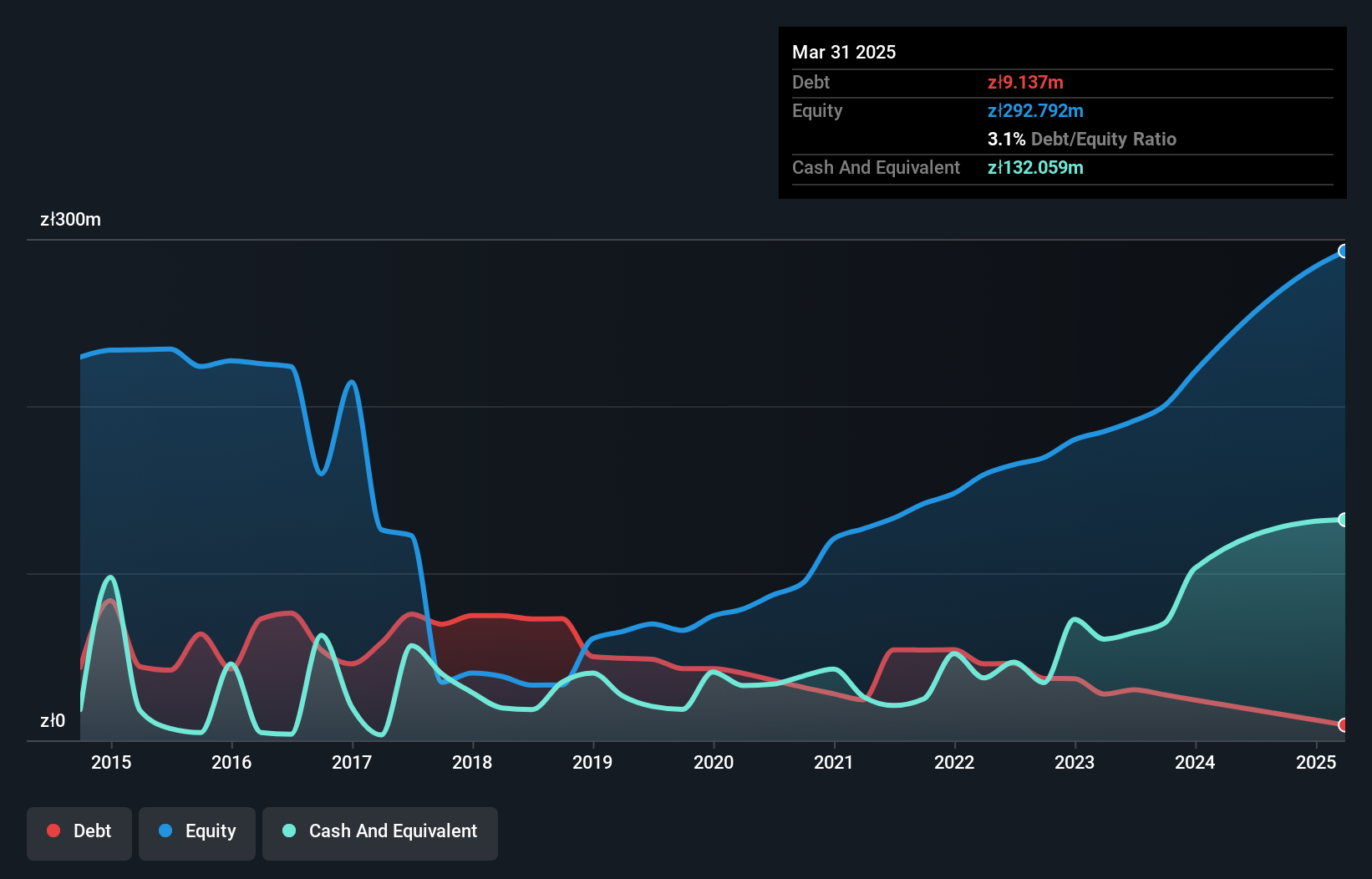

With Sygnity, you're looking at a company that has been on an impressive growth trajectory. Over the past year, its earnings surged by 45.9%, outpacing the IT industry's 38.7% rise, showcasing robust performance in a competitive landscape. The debt to equity ratio dramatically improved from 33.6% to just 0.9% over five years, indicating strong financial management and reduced leverage risk. Trading at approximately 14% below estimated fair value suggests potential upside for investors seeking undervalued opportunities in European markets. Recent quarterly results highlight revenue of PLN 84 million and net income of PLN 18 million, reflecting consistent profitability improvements year-on-year.

- Take a closer look at Sygnity's potential here in our health report.

Gain insights into Sygnity's historical performance by reviewing our past performance report.

Where To Now?

- Navigate through the entire inventory of 298 European Undiscovered Gems With Strong Fundamentals here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal