Assessing Sirius XM Holdings (NasdaqGS:SIRI) Valuation After Stern Deal Renewal And New CFO Appointment

Sirius XM Holdings (SIRI) is back in focus after renewing Howard Stern’s contract through 2028 and installing a new CFO with automotive and consumer finance experience, moves that are directly tied to its ongoing turnaround plan.

See our latest analysis for Sirius XM Holdings.

Those Stern and CFO announcements land after a mixed run for investors, with a 1-year total shareholder return decline of 4.15% and a 3-year total shareholder return decline of 60.43%, even as the 7-day share price return of 4.35% hints at short term momentum picking up.

If Sirius XM’s reset has your attention, it could be a moment to widen your watchlist and check out other audio and media names alongside fast growing stocks with high insider ownership.

With Sirius XM targeting $1.5b in free cash flow by 2027 and trading at a discount to the average analyst price target, the key question is simple: is this a fresh opportunity or is the market already pricing in future growth?

Most Popular Narrative Narrative: 12.1% Undervalued

With Sirius XM Holdings last closing at $21.10 against a narrative fair value of $24.00, the current price sits below that central estimate. This frames a valuation gap that hinges on how its cash generation story plays out.

Rapid growth in podcast advertising (up nearly 50% YoY) and improvements in audio ad tech, such as new measurement and buying tools, are positioning SiriusXM to further capitalize on the secular trend of rising digital audio advertising, which is expected to provide additional upside to overall advertising revenue and future earnings.

Curious what kind of revenue mix, margin lift, and earnings multiple need to line up to reach that valuation? The narrative leans on firm assumptions, a specific earnings path, and a discount rate that together do most of the heavy lifting. The full breakdown shows how those moving parts connect to that fair value line.

Result: Fair Value of $24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shrinking subscription and advertising revenue, alongside heavy reliance on auto sign ups, could pressure Sirius XM’s growth story and challenge the current undervalued narrative.

Find out about the key risks to this Sirius XM Holdings narrative.

Another View: Earnings Multiple Sends a Mixed Signal

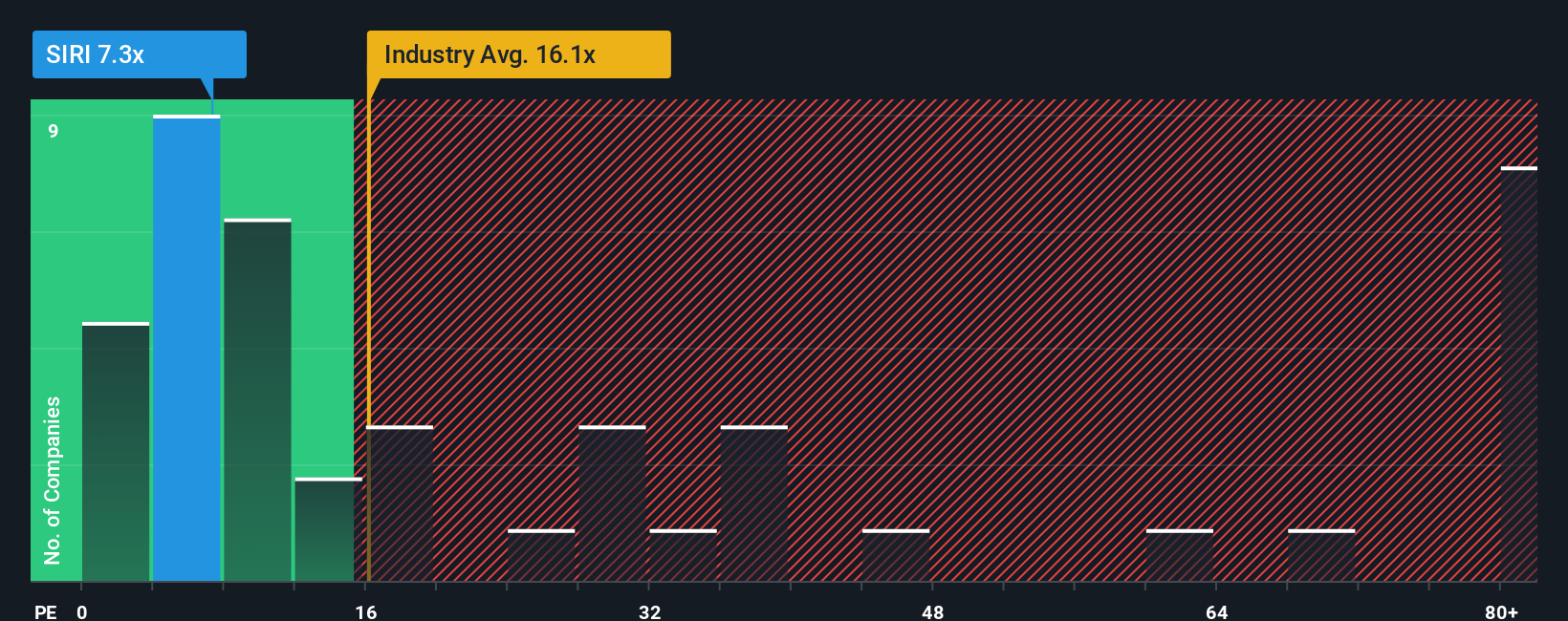

Our DCF work suggests Sirius XM Holdings looks undervalued, yet the earnings multiple paints a more cautious picture. The shares trade on a P/E of 7.2x, which is richer than peers at 5.9x but below the US Media industry on 14.2x. The fair ratio points to 18.1x.

The gap between 7.2x today, 5.9x for peers and a fair ratio of 18.1x raises a practical question: is the market pricing in a margin of safety, or signaling that expectations for future earnings are still too low?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sirius XM Holdings Narrative

If the story here does not quite fit your view, or you prefer to test every assumption against the raw numbers yourself, you can build a custom narrative in just a few minutes with Do it your way.

A great starting point for your Sirius XM Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Sirius XM has sharpened your focus on value and future potential, do not stop here. Broaden your radar and pressure test your thinking against other opportunities.

- Target potential mispricings across the market by scanning these 877 undervalued stocks based on cash flows that may offer more compelling entry points.

- Explore next generation technology by checking out these 25 AI penny stocks that are pushing real use cases in artificial intelligence.

- Position your portfolio for income potential by reviewing these 14 dividend stocks with yields > 3% that meet a yield threshold of more than 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal