A Look At Planet Fitness (PLNT) Valuation As Longer Term Returns Contrast With A High P/E Multiple

Planet Fitness (PLNT) has drawn fresh attention as investors reassess the gym operator’s recent performance, with shares showing mixed shorter term returns alongside multi year gains and solid reported revenue and net income figures.

See our latest analysis for Planet Fitness.

At a share price of $109.73, Planet Fitness has seen a 90 day share price return of 13.36%, while its 1 year total shareholder return of 8.33% sits alongside a 3 year total shareholder return of 33.23%, suggesting momentum has been building over the longer term.

If Planet Fitness has you reassessing consumer focused names, it could be a useful moment to broaden your watchlist with fast growing stocks with high insider ownership for fresh ideas.

With Planet Fitness posting reported annual revenue of US$1.2b and net income of US$205.8m at a share price of US$109.73, is the current valuation still leaving room for upside, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 15.9% Undervalued

Compared with Planet Fitness’s last close of US$109.73, the most followed narrative points to a fair value of about US$130.41, framing the current price as discounted on its own assumptions.

“The analysts have a consensus price target of $122.812 for Planet Fitness based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $175.0, and the most bearish reporting a price target of just $105.0.”

Want to see what supports that higher fair value? The narrative focuses on faster earnings growth, rising margins and a higher earnings multiple. Curious which assumptions really move the valuation needle?

Result: Fair Value of $130.41 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are also pressure points to watch, including higher attrition linked to online cancellations and the risk that rapid club expansion could strain franchisee economics.

Find out about the key risks to this Planet Fitness narrative.

Another View: Richer Valuation on Earnings

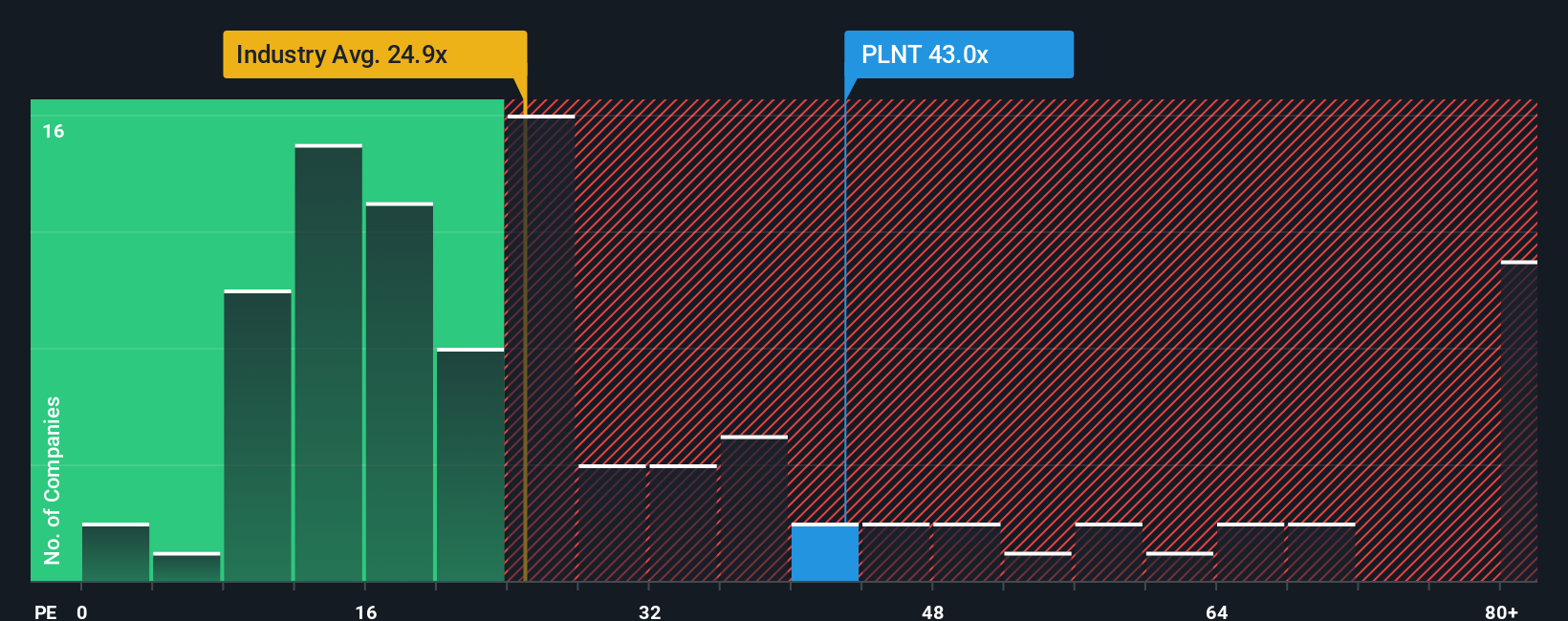

That 15.9% gap to the narrative fair value tells one story, but the current P/E of 44.2x paints a different picture. It is roughly double the US Hospitality average of 21.7x, slightly below the peer average of 49.5x, and well above a fair ratio of 24.1x that our model suggests.

Practically, that means a lot of good news already sits in the price and leaves less room if earnings or growth assumptions slip. The question for you is simple: do you think Planet Fitness has enough staying power to keep justifying such a rich earnings multiple?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Planet Fitness Narrative

If you look at the same numbers and reach a different conclusion, or simply prefer your own work, you can build a full narrative in just a few minutes, Do it your way.

A great starting point for your Planet Fitness research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Planet Fitness has sharpened your focus, do not stop here; use the Simply Wall Street Screener to uncover more opportunities that might suit your style.

- Spot potential value by checking out these 876 undervalued stocks based on cash flows, which our filters highlight based on their cash flow profiles.

- Chase cutting edge themes through these 25 AI penny stocks, which are tied to artificial intelligence and related tech trends.

- Target higher income potential with these 14 dividend stocks with yields > 3%, which offer yields above 3% and may complement growth focused positions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal