IPO News | Grandpa's farm submitted the Hong Kong Stock Exchange ranked second in total trading volume of baby snacks and food products in 2024

The Zhitong Finance App learned that according to the Hong Kong Stock Exchange's disclosure on January 5, Grandpa's Farm International Holdings Co., Ltd. (Grandpa's Farm for short) submitted a listing application to the main board of the Hong Kong Stock Exchange, and CMB International is the sole sponsor.

Company profile

According to the prospectus, according to Frost & Sullivan's data, Grandpa's farm is a leader in the baby snack food industry in China, and has expanded into the Chinese household food industry. The company is committed to providing high-quality health food with real ingredients, few additives, and nutrients. The company launched its first baby food supplement product in 2018. In just eight years since its establishment, Grandpa's Farm has grown into a leading brand in the baby snack market in China. In 2024, the company ranked second in terms of total product transactions for baby snacks in China. Among the top five companies in total commodity transactions, the company achieved the highest compound annual growth rate from 2022 to 2024. In 2024, the company also ranked first in terms of total product transactions for organic baby snacks in China.

The company provides (i) edible oil, condiments, cereal supplements, juice, puree and puree yogurt products and snacks in the field of baby snacks; and (ii) liquid milk products, convenience foods, rice products, condiments and cooking oil in the household food sector. During the track record period, the company's SKUs increased from 158 on December 31, 2023 to 179 on December 31, 2024, and further increased to 269 as of September 30, 2025 to meet changing consumer needs and cope with fierce market competition. In 2023, 2024, and the 12-month period ending September 30, 2025, the consumer repurchase rates for the company's products at Tmall's own flagship stores (which continued to account for the main share of the company's direct sales during the record period) were 29%, 31% and 34%, respectively, showing a continuous upward trend.

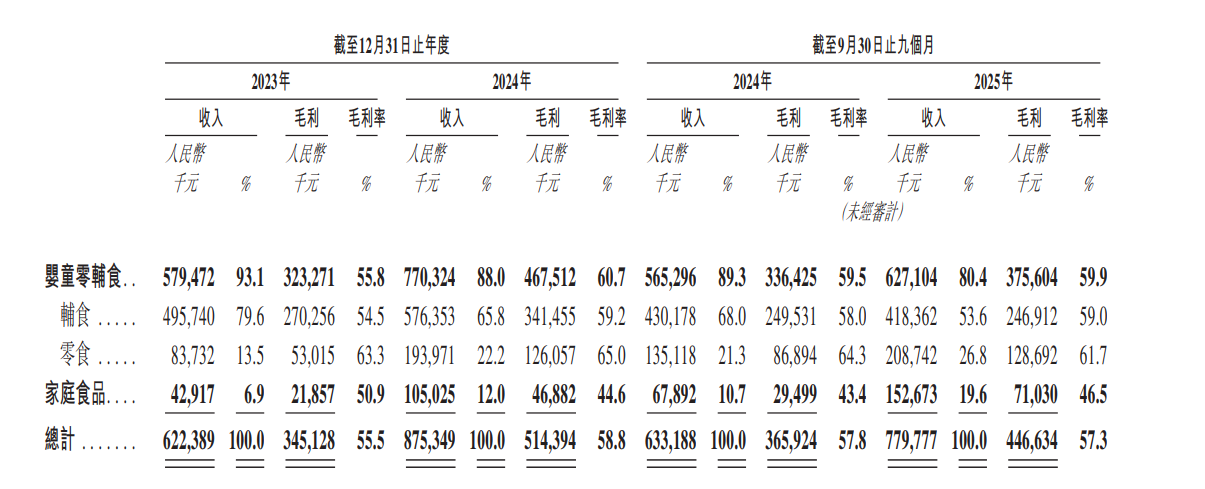

The breakdown of revenue by product category is as follows:

China's baby snack food companies are in a highly fragmented competitive landscape. According to Frost & Sullivan, in 2024, the top five market participants traded a total of about 6.530 billion yuan in product transactions, accounting for about 14.2% of the baby snack food market in China. In 2024, the company ranked second with a total transaction volume of about 1.5 billion yuan in baby snack food products, with a market share of about 3.3%. Furthermore, among the top five companies in terms of total commodity transactions, the company's compound annual growth rate from 2022 to 2024 was the highest of 42.6%.

Financial data

Revenue:

In 2023, 2024, 2024, and 2025 for the nine months ended September 30, the company achieved revenue of approximately 622 million yuan, 875 million yuan, 633 million yuan, and 780 million yuan respectively.

Profit:

For the nine months ended September 30 in 2023, 2024, 2024, and 2025, the company's annual/period profits were 754.64 million yuan, approximately 103 million yuan, 78.08 million yuan, and 87.42 million yuan, respectively. The adjusted net interest rates for the same period were 12.2%, 11.8%, 12.4% and 11.6%, respectively.

Industry Overview

In the baby food supplement market, the three major market segments of cereal supplements, dietary supplements, and flavored food supplements showed different development trends. Grain-based food supplements are still the core category, showing a steady growth trend. The market size increased from about RMB 21 billion to about RMB 25.1 billion between 2020 and 2024. In contrast, dietary supplements and flavored food supplements are rapidly expanding market segments. From 2020 to 2024, the market size of dietary supplements and seasoned food supplements grew from approximately RMB 6.1 billion and approximately RMB 4.6 billion to approximately RMB 8.1 billion and RMB 6.2 billion respectively. The compound annual growth rates for the same period were approximately 7.3% and 8.1%, respectively. It is estimated that by 2029, the market size of dietary supplements and seasoned food supplements will reach approximately RMB 11 billion and RMB 9.2 billion respectively. The compound annual growth rates from 2024 to 2029 are about 6.3% and 8.0%, respectively, showing a rapid growth trend, reflecting the transformation of the entire industry towards specialization and additional functionality.

Family food covers a wide range of food categories, which comprehensively meet the daily dietary and nutritional needs of the family. It includes fresh ingredients, condiments, and dairy products that meet basic cooking and nutritional intake needs, as well as snacks that provide casual enjoyment and emotional satisfaction, and further extends to health functional foods that help manage health and achieve specific nutritional goals. The expansion of infant snack food brands from the field of infant snack food to the field of family food is a rational strategic decision based on clear strategic planning and extension of core competencies. The following three categories are considered to be priority categories for expansion: buffalo mixed milk, organic condiments, and specialty edible vegetable oils.

In 2024, China's liquid buffalo mixed milk consumer market grew to about RMB 6.6 billion, with a compound annual growth rate of about 18.0% from 2020 to 2024. Looking forward to the future, increasing buffalo stocks, advancing breeding technology, promoting large-scale standardized farming, and improving cold chain technology will improve the quality and quantity of raw milk supply and expand the consumption area. At the same time, deepening market education is expected to increase demand for buffalo milk blends among people with nutritional needs. Supported by these factors, the market size is expected to reach RMB 13.5 billion by 2029, with a compound annual growth rate of about 15.4% from 2024 to 2029.

In 2024, the organic condiment market reached RMB 7 billion, accounting for 3.7% of the total household condiment market. The compound annual growth rate from 2020 to 2024 was about 17.9%. As leading brands continue to launch organic products, consumer awareness gradually increases, and the consumption base gradually stabilizes, the organic condiment market will expand further. It is expected to reach RMB 19.8 billion by 2029, with a compound annual growth rate of 23.2% between 2024 and 2029.

In 2022, due to geopolitical issues, China's edible oil imports fell from 1,040 tons to 650 tons. Furthermore, repeated outbreaks of COVID-19 have boosted public demand for large packages of soybean oil and peanut oil, which has further curtailed consumption of specialty edible vegetable oils. As a result, the market size of specialty edible vegetable oils plummeted to RMB 36.5 billion. With the gradual recovery of import and export activities and the increase in the self-sufficiency rate of domestic edible oil, the market size of specialty edible vegetable oils will return to RMB 75.5 billion in 2024. Looking forward to the future, with the gradual clarification of standards and policies relating to specialty edible vegetable oils and the increase in the proportion of mechanized cultivation of oil-containing crops, the supply of specialty edible vegetable oils will also increase at the same time. This will be in line with the trend of domestic consumption upgrading and push the market size to RMB 87.7 billion by 2029.

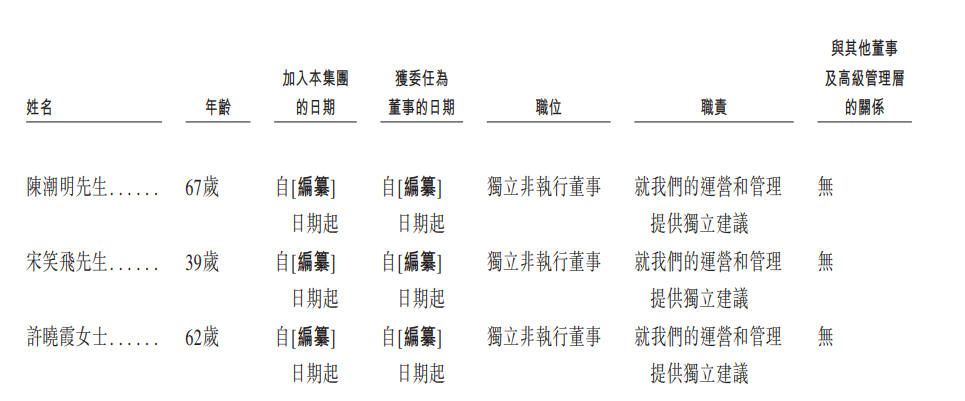

Board Information

The company's board of directors consists of seven directors, including four executive directors and three independent non-executive directors. The term of office of directors is three years; upon expiration, they must be re-elected.

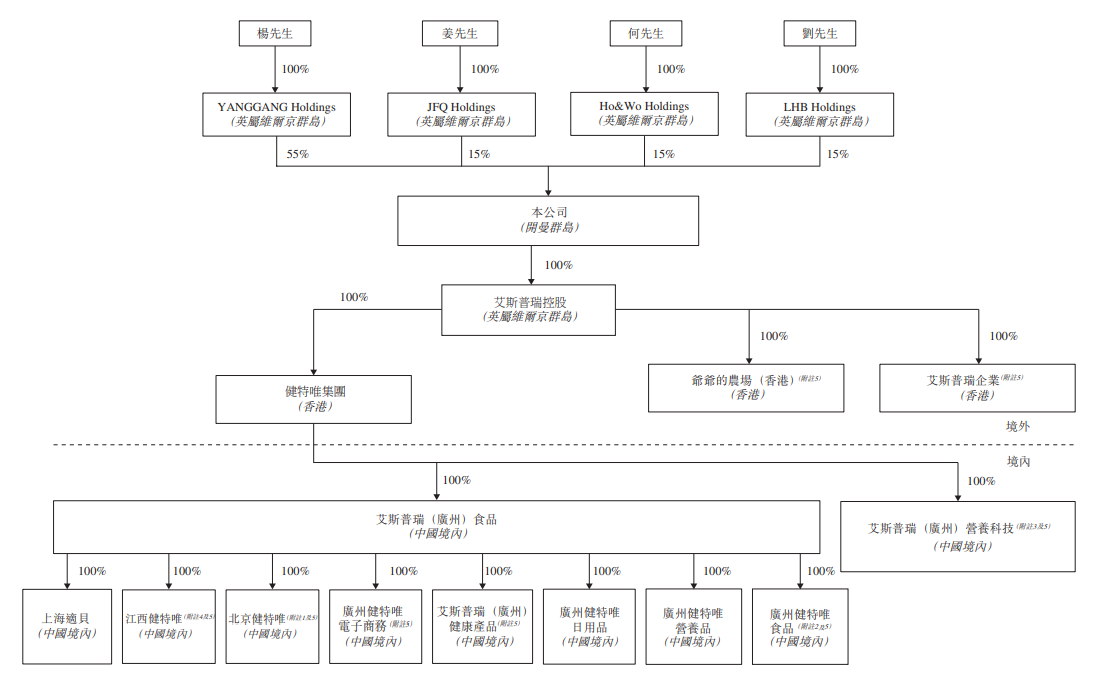

Shareholding structure

Grandpa's farm is mainly controlled by his parent company Esprit Enterprise Co., Ltd. (Hong Kong, China) and operated in mainland China through Esprit (Guangzhou) Food Co., Ltd.

Intermediary team

Sole sponsor: CMB International Finance Co., Ltd.

Company Legal Adviser: On Hong Kong Law: Jun He Law Firm; On Chinese Law: Jun He Law Firm; On Cayman Islands Law: Harney Westwood & Riegels

Sole sponsor's legal adviser: On Hong Kong Law: Zhou Junxuan Law Firm and Beijing International Commerce Law Firm; On Chinese Law: Jingtian Gongcheng Law Firm

Auditor and reporting accountant: KPMG

Industry Advisor: Frost & Sullivan (Beijing) Consulting Co., Ltd. Shanghai Branch

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal