Assessing Whether BP (LSE:BP.) Shares Look Undervalued After Recent Mixed Price Moves

BP shares: recent performance snapshot

BP (LSE:BP.) has drawn investor attention after recent share price moves, with the stock showing a small 1 day decline and mixed returns over the past week, month, and past 3 months.

See our latest analysis for BP.

Looking beyond the latest moves, BP’s share price return since the start of the year has been slightly negative, while a 1 year total shareholder return of 11.33% points to momentum that is still broadly positive for long term holders.

If BP’s recent swings have you reassessing your exposure to energy, it could be a good moment to widen your watchlist and check out fast growing stocks with high insider ownership.

With BP trading at £4.35, a value score of 2 and an estimated 58% intrinsic discount, the big question is whether the shares are genuinely cheap today or if the market is already pricing in future growth.

Most Popular Narrative: 8.7% Undervalued

BP’s most followed narrative points to a fair value of £4.77 per share compared with the last close around £4.35, framing the shares as modestly undervalued on that view.

Portfolio high-grading and disciplined capital allocation via active divestment of lower-quality or stranded assets and focus on best-in-class project returns will streamline BP's asset base and support more stable, higher-margin earnings as carbon pricing and ESG pressures increase, consolidating the position of large incumbents.

Curious how a business with slim recent margins still supports a higher fair value? The narrative leans heavily on faster profit growth, rising margins, and a future earnings multiple that assumes investors will pay more per pound of earnings than they do today.

Result: Fair Value of £4.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could quickly change if planned divestments stall or if further write downs in hydrogen or biofuels raise fresh questions over capital allocation.

Find out about the key risks to this BP narrative.

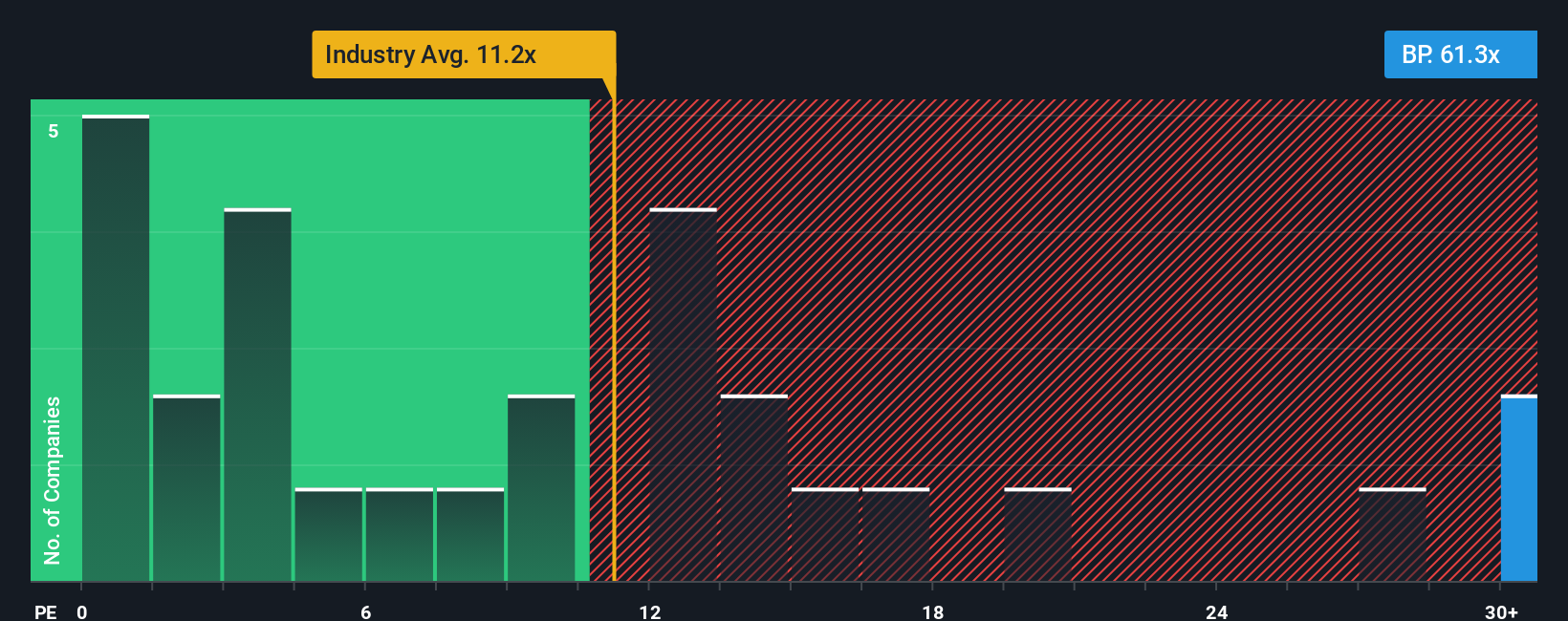

Another View: Earnings Multiple Sends A Different Signal

That 8.7% undervaluation story sits awkwardly next to BP’s current P/E of 59x. This is far higher than both the European oil and gas average of 11.7x and a fair ratio of 19.3x. If earnings fall short, could that premium turn today’s “discount” into valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BP Narrative

If you look at the numbers and reach a different conclusion, or simply prefer to test your own assumptions, you can build a personalised view in just a few minutes with Do it your way.

A great starting point for your BP research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If BP does not fully match what you are after, it is worth casting a wider net and testing a few focused stock ideas built from real data.

- Target potential mispricings by checking out these 878 undervalued stocks based on cash flows that may offer more attractive entry points based on their current cash flow profiles.

- Explore technology-related opportunities by scanning these 25 AI penny stocks that are tied to artificial intelligence themes.

- Refine an income-focused approach by reviewing these 14 dividend stocks with yields > 3% that currently offer yields above 3% on market prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal