Assessing Mobileye (MBLY) Valuation After Major EyeQ6H Surround ADAS Win With Top U.S. Automaker

Mobileye Global (MBLY) is back in the spotlight after securing a top tier U.S. automaker that plans to roll out its EyeQ6H powered Surround ADAS as standard equipment across millions of vehicles.

See our latest analysis for Mobileye Global.

The new contract arrives after a difficult stretch for investors, with the 1 year total shareholder return down about 48.6% and the 3 year total shareholder return down roughly 66.4%. At the same time, the 1 day share price return of 7.6% and 7 day share price return of 5.6% suggest short term momentum has picked up from a lower base.

If this ADAS deal has you thinking about where else automation and AI are gaining traction in transport, it could be a good moment to look at auto manufacturers as a way to spot other car makers being reshaped by these technologies.

With the shares still well below their recent highs, analyst targets implying upside, and revenue growing while the company remains loss making, you have to ask: is there genuine value here, or is the market already pricing in future growth?

Most Popular Narrative: 40.7% Undervalued

Mobileye Global's most followed narrative places fair value well above the recent US$11.23 close, framing the stock as meaningfully discounted against its long term potential.

The partnership with leading platforms like Uber and Lyft for the integration of Mobileye Drive is positioned to significantly enhance Mobileye’s revenue streams through upfront sales and recurring license fees tied to utilization rates.

Curious what kind of revenue ramp, margin shift, and future earnings multiple are baked into that fair value? The full narrative lays out a growth and profitability path, backed by detailed forecasts and a specific discount rate that drive its US$18.94 estimate.

Result: Fair Value of $18.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still clear pressure points, including uncertainty around global light vehicle production and tariffs that could cut volumes for key customers by 3% to 7%.

Find out about the key risks to this Mobileye Global narrative.

Another View: Revenue Multiple Paints A Tougher Picture

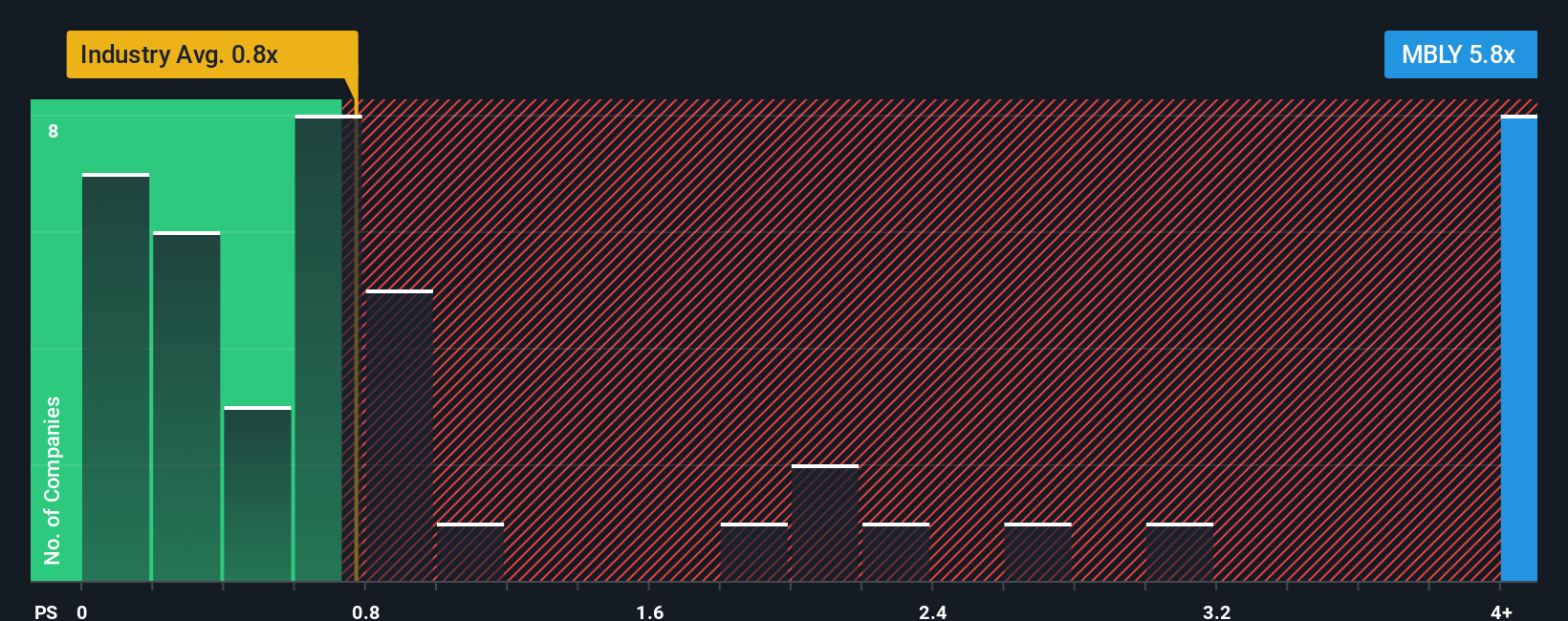

The fair value narrative suggests Mobileye Global is trading at a 38.6% discount, yet its P/S of 4.7x sits well above the US Auto Components industry at 0.8x and peers at 1x, and even above a 3.8x fair ratio. That gap points to valuation risk rather than a clear bargain. The question is which signal you weigh more heavily.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mobileye Global Narrative

If you look at the numbers and reach a different conclusion, or just prefer to test your own assumptions, you can build a custom view in minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Mobileye Global.

Looking for more investment ideas?

If Mobileye has caught your attention, do not stop here. Use this momentum to broaden your watchlist with other focused ideas that match your style.

- Target dependable income by scanning these 14 dividend stocks with yields > 3% that may offer more consistent cash returns than many high growth names.

- Chase growth potential at the cutting edge of automation and data by reviewing these 25 AI penny stocks shaping the next wave of technology.

- Hunt for pricing gaps using these 585 undervalued stocks based on cash flows that could trade below their estimated cash flow value based on current fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal