Assessing Newmark Group (NMRK) Valuation After Recent Share Price Momentum Cools

Without a specific headline event driving attention today, Newmark Group (NMRK) still offers plenty for investors to weigh, including recent share performance, valuation signals and how its commercial real estate services business is currently positioned.

See our latest analysis for Newmark Group.

The recent 1 day share price return decline of 2.13% and 7 day share price return decline of 3.74% come after a strong longer run, with 1 year total shareholder return of 33.14% and 5 year total shareholder return of 150.78%. This suggests earlier momentum has cooled near the current US$16.97 level.

If Newmark has you rethinking your real estate exposure, it could be a good moment to broaden your watchlist with fast growing stocks with high insider ownership.

With Newmark trading at US$16.97 and reference values like analyst targets and intrinsic estimates sitting higher, the real question is whether the stock still trades at a discount or if the market already prices in future growth.

Most Popular Narrative Narrative: 18.5% Undervalued

With Newmark Group last closing at US$16.97 against a narrative fair value of about US$20.83, the current pricing gap is hard to ignore.

Global platform buildout, especially in Europe and Asia, is opening significant new addressable markets and providing runway for further market share gains, which supports multi-year revenue and EBITDA growth potential.

Want to see what kind of revenue path and profit lift would justify that higher value? The narrative leans on faster earnings compounding and a richer future multiple. Curious which assumptions really move the fair value line here and how much execution room they leave? The full story joins those pieces together.

Result: Fair Value of $20.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story can change quickly if expansion in Europe and Asia drags on profitability, or if sectors like data centers swing from strong demand to oversupply.

Find out about the key risks to this Newmark Group narrative.

Another Angle On Valuation

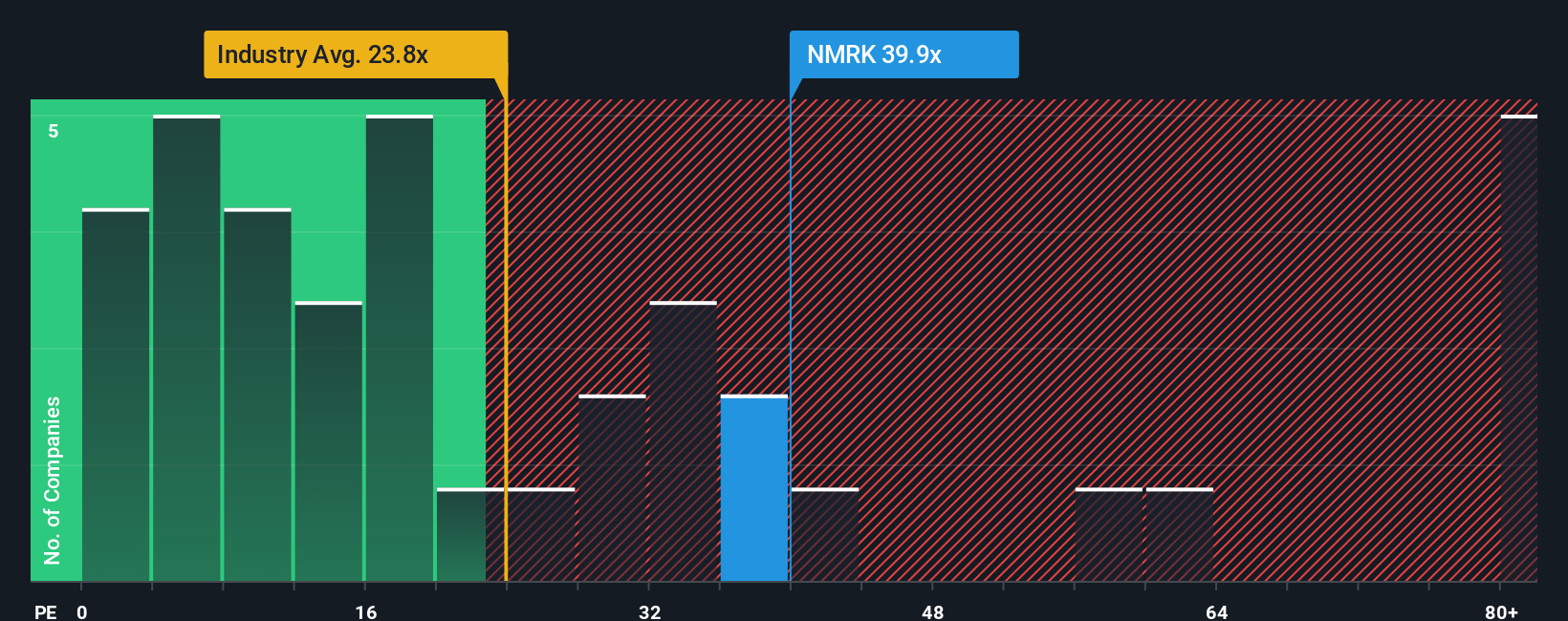

While the narrative fair value points to Newmark Group being about 18.5% undervalued, the current P/E of 29.6x paints a tighter picture. It is roughly in line with the US Real Estate industry at 29.6x, yet above the fair ratio of 23.4x, which suggests less margin for error if expectations slip.

Put simply, the share price looks cheap against one set of assumptions and stretched against another, so which yardstick do you trust most for your own thesis?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Newmark Group Narrative

If parts of this story do not quite fit your view, or you would rather test the numbers yourself, you can build a custom thesis in just a few minutes, starting with Do it your way.

A great starting point for your Newmark Group research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Newmark has sparked your interest, do not stop here. Use the screener to uncover other angles where pricing, quality and long term potential line up.

- Spot underappreciated opportunities by checking out these 870 undervalued stocks based on cash flows that align with stricter valuation and cash flow filters.

- Ride powerful technology trends by scanning these 25 AI penny stocks that tie real business models to artificial intelligence themes.

- Tap into income focused names by reviewing these 14 dividend stocks with yields > 3% that combine yield with business fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal