How UBS’s Bullish View on Construction Demand and Specialty Rentals Will Impact United Rentals (URI) Investors

- UBS analyst Steven Fisher recently upgraded United Rentals from Neutral to Buy, citing expected expansion in U.S. non-residential construction and projected EBITDA growth in late 2026.

- The upgrade also highlights United Rentals’ push into higher-margin specialty rentals and potential acquisition activity as important levers for future earnings power.

- We’ll now examine how UBS’s focus on non-residential construction strength and specialty rental expansion could influence United Rentals’ broader investment narrative.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

United Rentals Investment Narrative Recap

To own United Rentals, you need to be comfortable with a business tied closely to U.S. non residential construction cycles and heavy capital needs, while believing its scale and specialty rentals can support resilient earnings over time. The UBS upgrade leans into that construction thesis and specialty growth, but it does not materially change the near term catalyst of specialty expansion or the key risk that large project activity could slow and weigh on rental revenue.

Among recent announcements, the US$1.5 billion share repurchase program stands out in this context, as it sits alongside ongoing investments in specialty fleets and technology while the company maintains substantial capital expenditure commitments. For investors, that mix of returning cash and funding growth can look attractive, but it also makes the existing risk around high capex and potential pressure on free cash flow more important to monitor if conditions soften.

Yet behind the appeal of specialty growth and buybacks, investors should still be aware of how dependent United Rentals is on large project activity and...

Read the full narrative on United Rentals (it's free!)

United Rentals' narrative projects $18.8 billion revenue and $3.5 billion earnings by 2028. This requires 6.1% yearly revenue growth and a $1.0 billion earnings increase from $2.5 billion today.

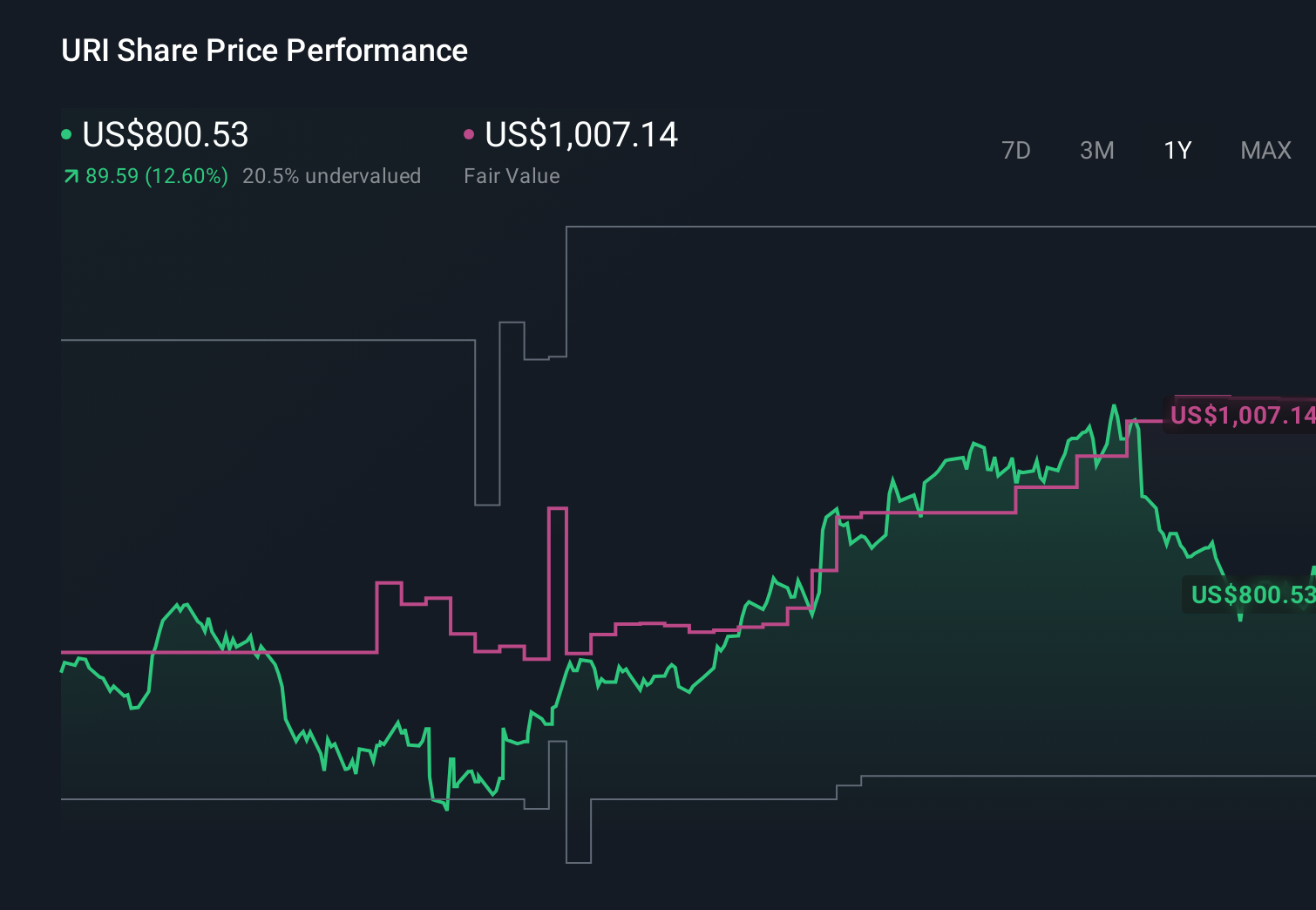

Uncover how United Rentals' forecasts yield a $1007 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community span roughly US$533 to US$1,222 per share, underscoring how far apart individual views can be. Against that wide range, the company’s dependence on large projects for growth reminds readers that differing opinions often reflect very different assumptions about how resilient that project driven revenue will be over time, so it is worth exploring several viewpoints before forming a view.

Explore 5 other fair value estimates on United Rentals - why the stock might be worth as much as 45% more than the current price!

Build Your Own United Rentals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Rentals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free United Rentals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Rentals' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 29 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal