Assessing Entergy (ETR) Valuation After Mixed Short Term Moves And Strong Long Term Returns

Entergy stock snapshot

Entergy (ETR) has drawn investor attention after a recent move in its share price, with the stock closing at $93.86 and showing mixed short term returns over the past week and month.

See our latest analysis for Entergy.

Beyond the recent uptick, Entergy’s 1 year total shareholder return of 28.23% and 5 year total shareholder return of 139.15% contrast with a relatively flat year to date share price. This suggests that long term momentum has been stronger than recent trading implies.

If Entergy’s move has you thinking about other utilities, it could be a good moment to scan a wider set of regulated and renewable-focused healthcare stocks for comparison.

Entergy’s recent share moves, long term total returns, and current valuation metrics paint a mixed picture. So is the stock quietly cheap after a flat year to date, or is the market already pricing in future growth?

Most Popular Narrative: 9.4% Undervalued

Compared with Entergy's last close at $93.86, the most followed narrative points to a fair value of $103.61, framing the stock as modestly undervalued.

Capital investment of $40 billion over four years (with an expanded pipeline for renewables, grid modernization, and resilience upgrades) is expected to grow the company's rate base and support above-average EPS and earnings growth for several years. Expedited regulatory frameworks and legislative support for economic development, storm cost recovery, and infrastructure riders (especially in Arkansas, Louisiana, and Texas) are likely to accelerate cash flow and enhance earnings consistency, limiting regulatory lag and improving overall credit metrics.

Curious what earnings path, margin uplift, and future P/E multiple need to come together to reach that higher fair value? The full narrative lays out a detailed financial roadmap built on specific growth, profitability, and valuation assumptions that go well beyond a simple price target.

Result: Fair Value of $103.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on heavy capital spending and Gulf South weather risk, where cost overruns, financing pressures, or storm damage could challenge earnings and the current valuation story.

Find out about the key risks to this Entergy narrative.

Another View: Multiples Point To A Richer Price

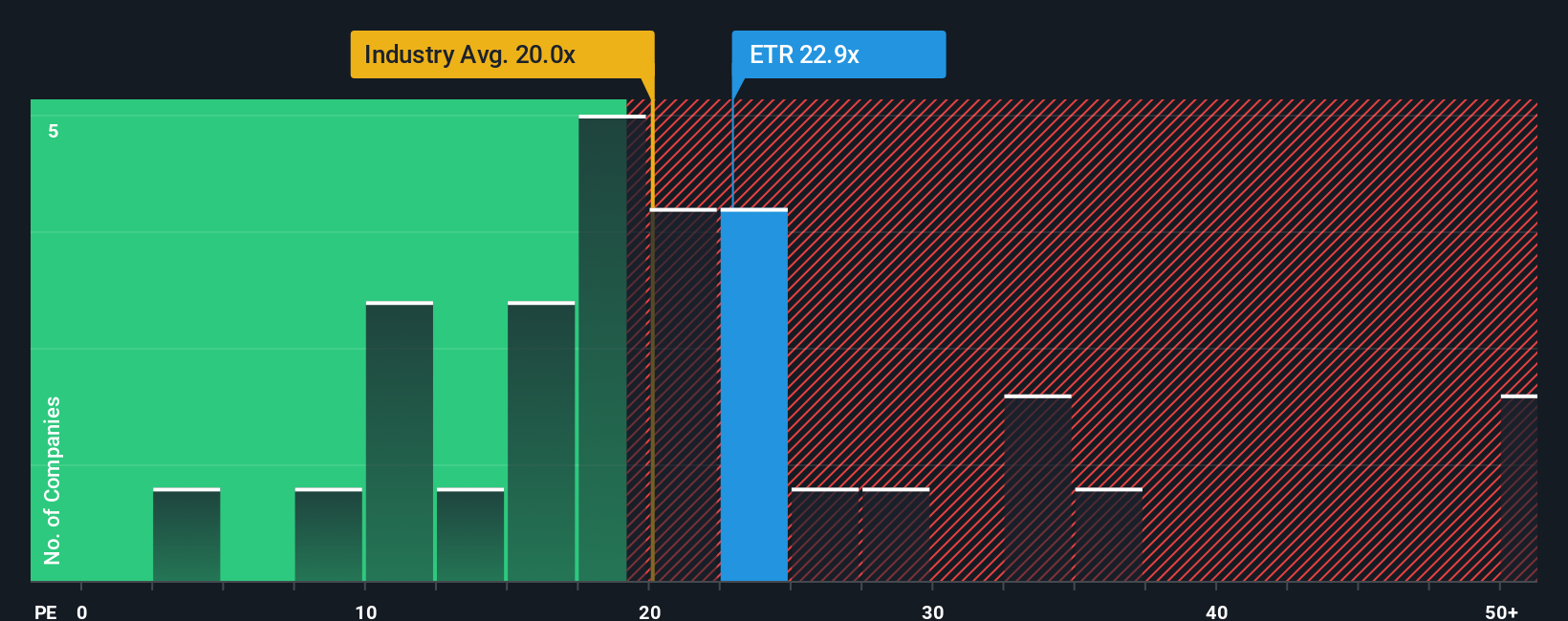

Our fair value work suggests Entergy is attractive, but the P/E of 23.5x tells a different story. It sits above both peers at 18.9x and the US Electric Utilities average of 19.7x. Its fair ratio of 24.4x hints the market might still push the valuation higher. Is that gap a cushion or a warning sign for you?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Entergy Narrative

If you look at this and think the assumptions do not quite fit your view, you can stress test the numbers yourself and build a custom storyline in minutes: Do it your way.

A great starting point for your Entergy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Entergy has sparked your interest, do not stop here. Broaden your watchlist with focused screens that surface very different kinds of opportunities in minutes.

- Target potential mispricings by scanning these 870 undervalued stocks based on cash flows that trade below their estimated cash flow value.

- Explore major technology themes by reviewing these 25 AI penny stocks that are tied to artificial intelligence.

- Support an income-oriented approach by looking at these 14 dividend stocks with yields > 3% offering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal