Kerui Real Estate: In 2025, the value and amount of land acquired by typical housing enterprises increased by 2% and 3% year-on-year, and land acquisition sales rebounded steadily compared to 3%

The Zhitong Finance App learned that in 2025, Kerui Real Estate published an article stating that in 2025, the value and amount of land acquisition by typical housing enterprises will increase slightly by 2% or 3%, the area will decrease by 5%, and the investment area will focus on Tier 1 and 2 cities. Leading enterprises are strong, and their investment concentration exceeds 70%. Among them, central enterprises maintain leading investment, and the confidence of private enterprises continues to recover as the market underpins. It is expected that investment will continue to be cautious in 2026, focusing on central state-owned enterprises under the core city strategy, which is still the main force in land acquisition.

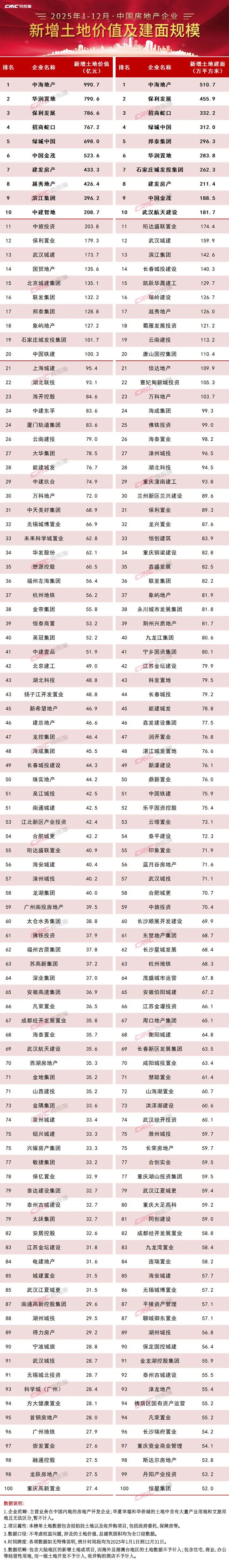

The value and amount of land acquired by typical enterprises for the whole year increased by 2% and 3% year-on-year

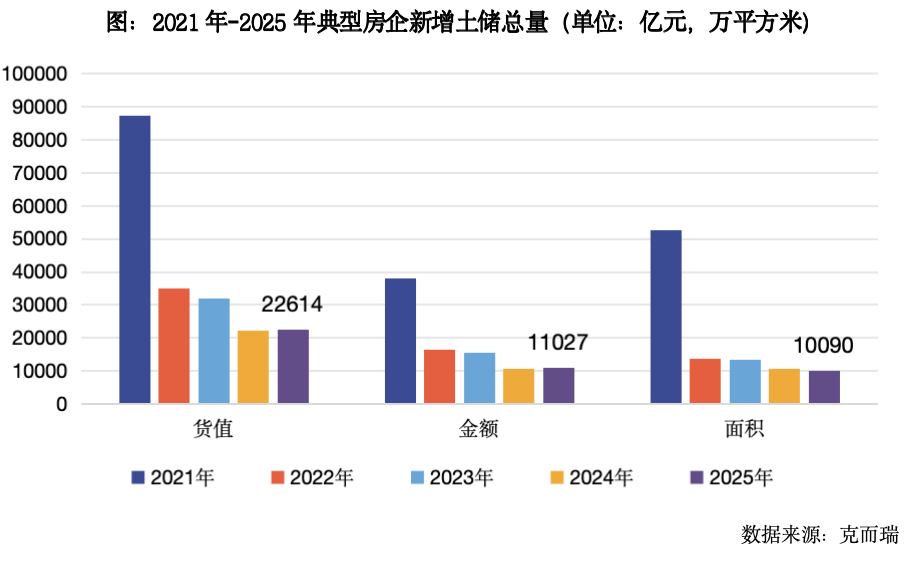

In 2025, the sum of the additional land acquisition value, total price, and construction area of the 100 enterprises monitored will reach 2261.4 billion yuan, 1102.7 billion yuan, and 10.9 million square meters, respectively. Among them, the value and amount of goods increased by 2% and 3%, respectively, and the construction area decreased by 5% year on year.

The value and amount of land reserves added by typical enterprises rebounded year-on-year while the area declined slightly. On the one hand, it shows a positive trend of corporate investment bottoming up and rebounding. On the other hand, it also confirms that current investment is mainly focused on Tier 1 and 2 cities.

The concentration of leading companies exceeded 70%, and the land acquisition sales ratio rebounded steadily

Corporate investment in 2025 is characterized by two distinct characteristics:

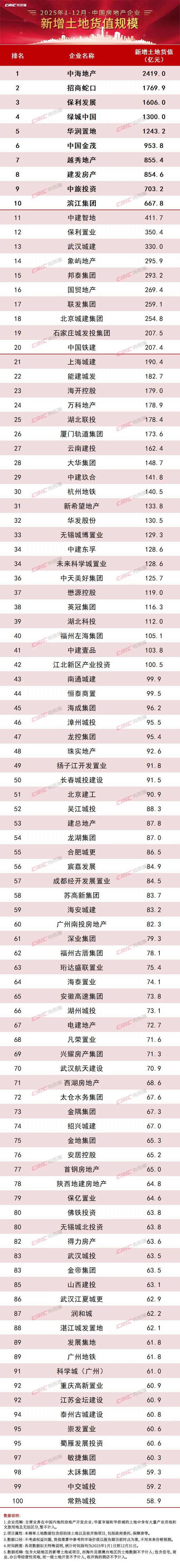

First, there is a high level of concentration. The top ten companies with investment amounts are mainly state-owned enterprises and state-owned enterprises. Among them, the four major central enterprises in Zhonghai Real Estate, China Resources Land, Poly Development, and China Merchants Shekou account for more than 30% of the investment amount of typical enterprises, while the top ten account for more than 70% of the amount;

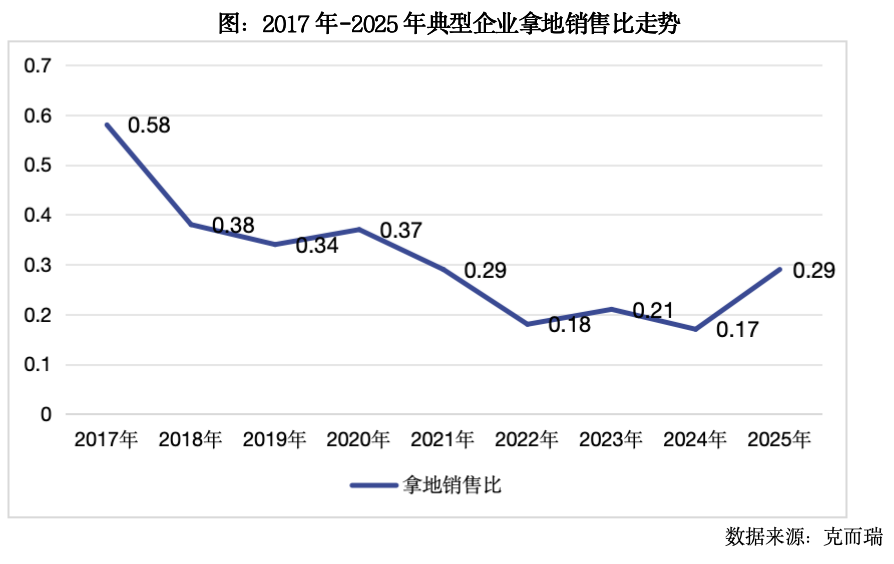

Second, the overall land acquisition sales ratio rebounded steadily from the bottom. The average land acquisition sales ratio of the top 100 full-caliber sales companies in 2025 was 0.29, up 0.12 from 2024, and returned to the level of investment intensity in 2021. Of course, this is mainly driven by the active investment of large-scale housing enterprises. At the same time, we have also detected that nearly 50% of the top 100 companies still have no land accounts in 2025.

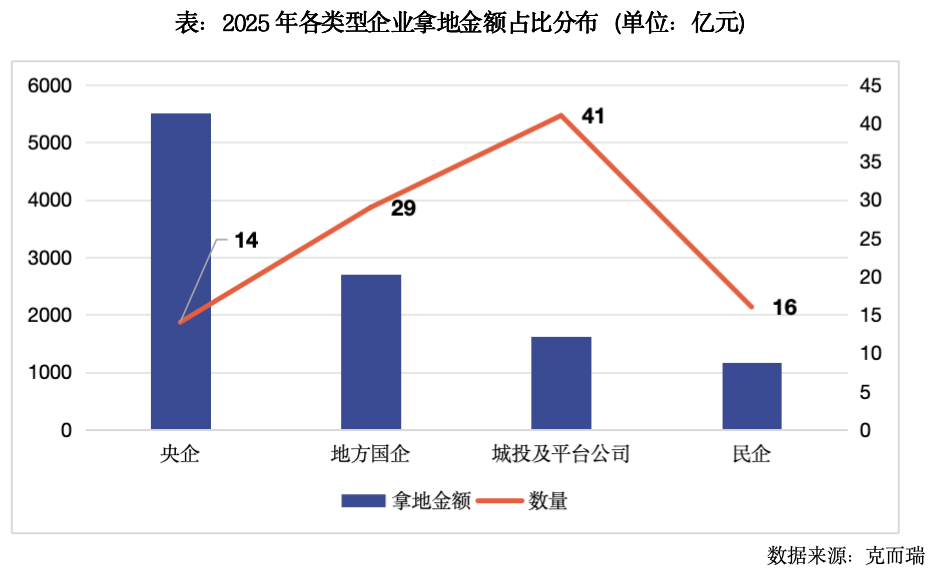

Investment by central enterprises remains leading, and confidence in private enterprises has recovered marginally

Of the 100 enterprises monitored, 14 central enterprises accounted for 50% of the land acquisition amount, an increase of 7 percentage points over last year. Currently, high-quality, high-priced land plots in the land market are mainly involving large-scale central enterprises. This can also be seen from the 20% increase in the amount of land acquired by central enterprises over the same period last year. Zhonghai Real Estate, Poly Development, China Resources Land, and China Merchants Shekou have maintained leading positions in land acquisitions.

Meanwhile, private enterprise investment confidence is recovering. Although the share of land acquisition amounts is still low, the amount has improved markedly. The total amount of land acquired in 2025 exceeded 100 billion dollars, an increase of 8% over the previous year. Branded private enterprises represented by Binjiang and small enterprises with deep cultivation in some regions have carried the “big flag” to acquire land.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal