Dominion Energy (D) Valuation Check As Coastal Virginia Offshore Wind Project Faces Temporary Halt

Dominion Energy (D) is under fresh regulatory pressure after the U.S. Department of the Interior ordered a temporary halt to its Coastal Virginia Offshore Wind Project, a centerpiece of the company’s Virginia power expansion plans.

See our latest analysis for Dominion Energy.

The regulatory setback comes at a time when Dominion Energy’s share price, at US$59.24, has been relatively muted in recent months. The 1 year total shareholder return of 15.66% points to steadier gains over a longer period and suggests momentum has been rebuilding rather than accelerating sharply.

If the CVOW pause has you rethinking where growth and regulation intersect, it may be worth scanning other regulated power names and related infrastructure through healthcare stocks to see how different business mixes compare.

With the share price sitting at US$59.24 and a 1 year total return of 15.66%, the key question is whether Dominion’s regulated profile and growth projects are already reflected in the valuation, or if the CVOW setback has opened a genuine opportunity that markets are not fully pricing in.

Most Popular Narrative Narrative: 7.1% Undervalued

Against a last close of US$59.24, the most followed narrative pegs Dominion Energy’s fair value at about US$63.73, flagging a modest valuation gap that hinges heavily on its long term earnings path.

Large scale investments in regulated renewables, especially the Coastal Virginia Offshore Wind (CVOW) project, position Dominion to benefit from the accelerating energy transition, earning stable regulated returns and expanding rate base, with a positive impact on long term earnings.

For readers curious about what kind of revenue pace and margin profile are implied to reach that future earnings target, and which earnings multiple supports the valuation, the full narrative lays out the numbers that connect today’s price to that higher fair value.

Result: Fair Value of $63.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative only holds if CVOW costs stay manageable and regulators continue to allow timely recovery of spending. Otherwise, earnings visibility and future returns could come under pressure.

Find out about the key risks to this Dominion Energy narrative.

Another View: What Our DCF Model Says

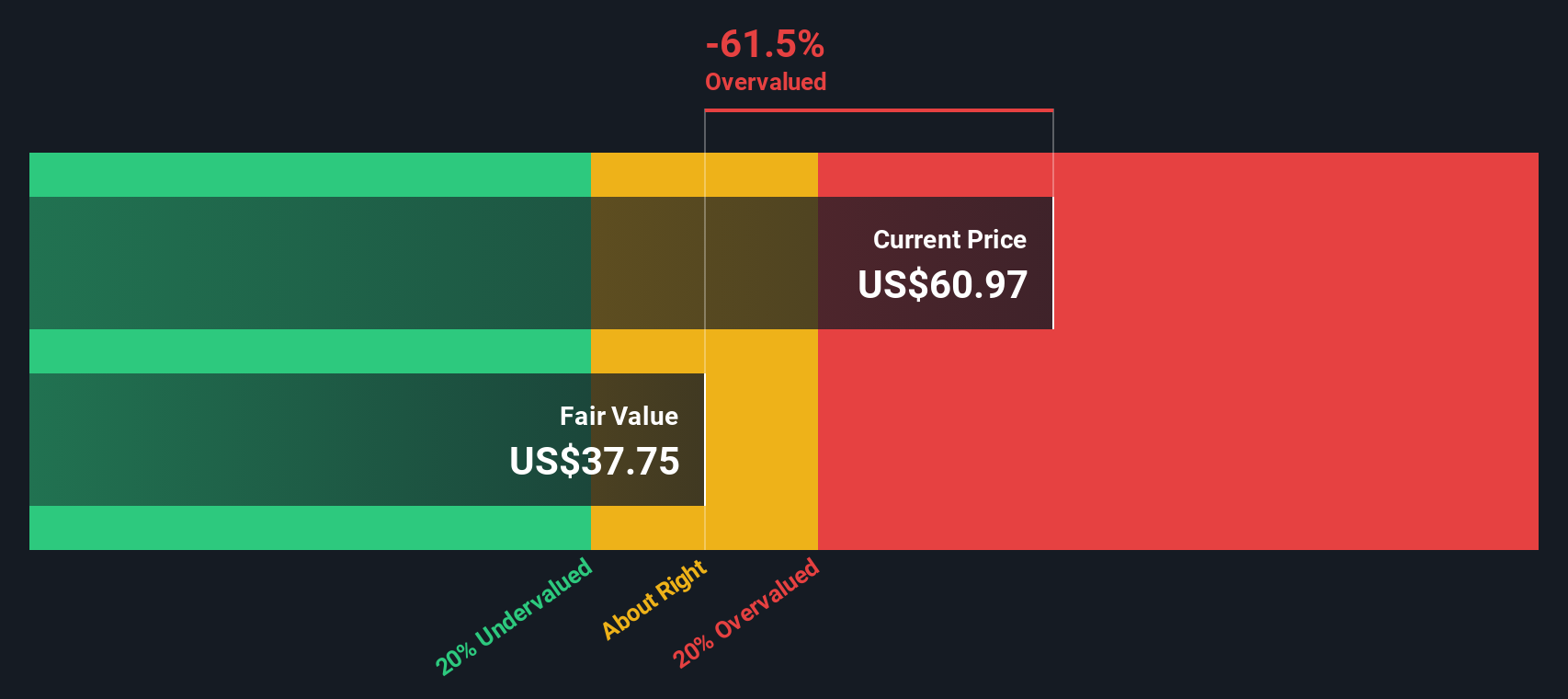

While the popular narrative sees Dominion Energy as about 7.1% undervalued at US$63.73 per share, the Simply Wall St DCF model lands in a very different place. In that framework, the estimated fair value is US$36.80, which would frame today’s US$59.24 price as rich rather than cheap. Which story do you think lines up better with your own expectations for cash flows and risk?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dominion Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dominion Energy Narrative

If you see the numbers differently, or simply prefer to test your own assumptions, you can build a personalized view in just a few minutes with Do it your way

A great starting point for your Dominion Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Dominion has you thinking more broadly about where to put fresh capital, do not stop here. Use focused stock screens to uncover ideas that better fit your goals.

- Target potential mispriced opportunities by scanning these 870 undervalued stocks based on cash flows that line up with your view on quality, cash flows and balance sheet strength.

- Spot income ideas by reviewing these 14 dividend stocks with yields > 3% that may suit a portfolio built around regular payouts and moderate risk.

- Back high growth potential by checking out these 25 AI penny stocks that tie their prospects to real revenue, research depth and clear use cases.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal