TSX Penny Stocks To Watch In January 2026

As we step into 2026, investors are encouraged to consider their strategies in light of recent economic developments, such as the unexpected strength in Canada's employment figures and the evolving interest rate landscape. Penny stocks, though an older term, remain a relevant investment area for those seeking growth opportunities at lower price points. These stocks often represent smaller or newer companies that can offer significant potential when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.24 | CA$56.63M | ✅ 3 ⚠️ 4 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.32 | CA$253.17M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.30 | CA$131.03M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.42 | CA$3.51M | ✅ 2 ⚠️ 3 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.35 | CA$52.48M | ✅ 3 ⚠️ 1 View Analysis > |

| FP Newspapers (TSXV:FP) | CA$0.73 | CA$5.04M | ✅ 2 ⚠️ 3 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.27 | CA$844.93M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.19 | CA$23.59M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.45 | CA$175M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.97 | CA$186.41M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 383 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Mega Uranium (TSX:MGA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Mega Uranium Ltd. is a uranium mining and investment company focused on exploring uranium properties mainly in Canada and Australia, with a market cap of CA$218.97 million.

Operations: Mega Uranium Ltd. does not report specific revenue segments.

Market Cap: CA$218.97M

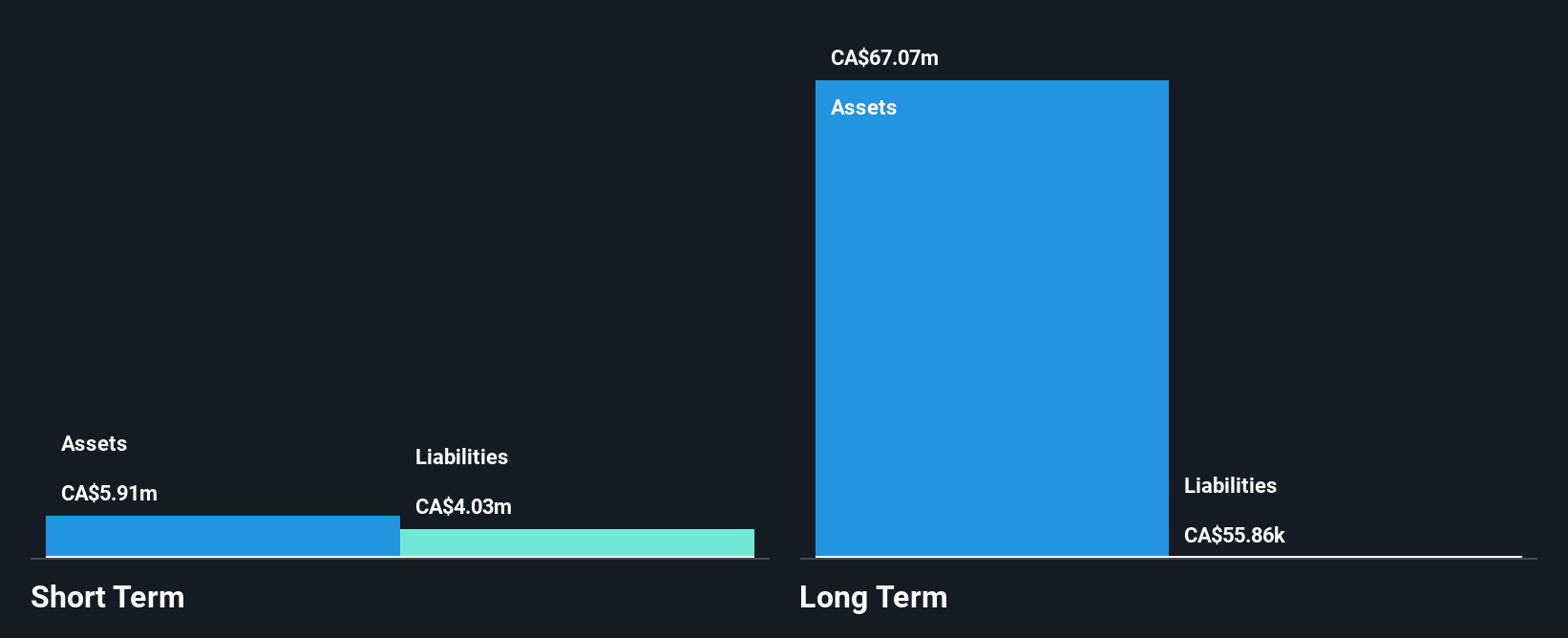

Mega Uranium Ltd. is a pre-revenue company with a market cap of CA$218.97 million, focusing on uranium exploration in Canada and Australia. Despite being unprofitable, it has managed to reduce its net loss from CA$6.12 million to CA$4.64 million over the past year, while maintaining a stable cash runway exceeding three years due to positive free cash flow growth of 28.5% annually. The management and board are seasoned, with average tenures of 10.8 and 9.8 years respectively, providing experienced leadership amidst high volatility in the penny stock sector without significant shareholder dilution recently.

- Click to explore a detailed breakdown of our findings in Mega Uranium's financial health report.

- Gain insights into Mega Uranium's historical outcomes by reviewing our past performance report.

Aurion Resources (TSXV:AU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Aurion Resources Ltd. focuses on acquiring, exploring, and evaluating mineral properties in Finland with a market cap of CA$221.92 million.

Operations: Aurion Resources Ltd. does not report any specific revenue segments as it is primarily engaged in the acquisition, exploration, and evaluation of mineral properties in Finland.

Market Cap: CA$221.92M

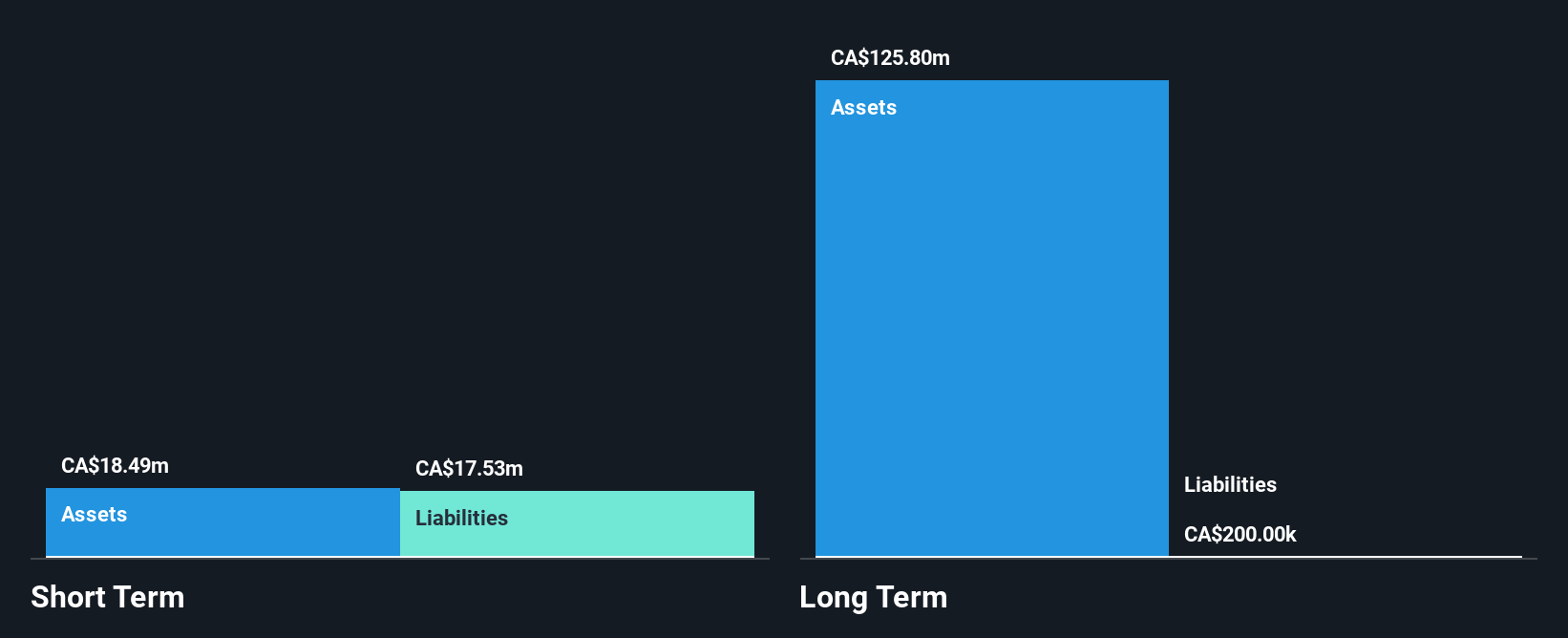

Aurion Resources Ltd., with a market cap of CA$221.92 million, is a pre-revenue company focused on mineral exploration in Finland. The company is debt-free and has not diluted shareholders recently. Despite being unprofitable, it has reduced losses by 2.5% annually over five years and maintains sufficient cash runway for over a year based on current free cash flow trends. Recent drilling results at the Risti property indicate promising gold mineralization, with ongoing efforts to explore potential extensions at Kaaresselka. The experienced management team and board provide stability amidst high volatility typical of penny stocks.

- Navigate through the intricacies of Aurion Resources with our comprehensive balance sheet health report here.

- Explore Aurion Resources' analyst forecasts in our growth report.

Eco (Atlantic) Oil & Gas (TSXV:EOG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Eco (Atlantic) Oil & Gas Ltd. is involved in identifying, acquiring, and exploring oil and gas assets in Guyana, Namibia, and South Africa with a market cap of CA$192.29 million.

Operations: Eco (Atlantic) Oil & Gas Ltd. has not reported any specific revenue segments.

Market Cap: CA$192.29M

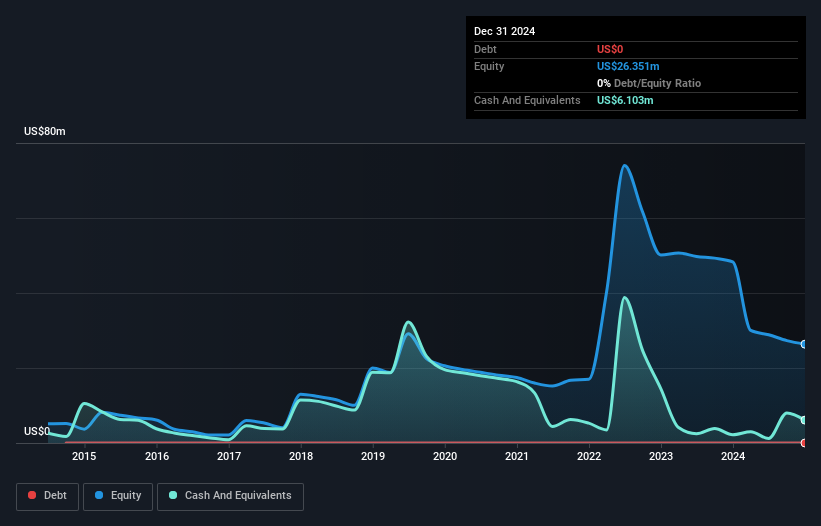

Eco (Atlantic) Oil & Gas Ltd., with a market cap of CA$192.29 million, is a pre-revenue company engaged in oil and gas exploration across Guyana, Namibia, and South Africa. The company remains debt-free and has not significantly diluted shareholders recently. Despite its unprofitability and increased losses over the past five years, it has secured strategic partnerships to potentially enhance asset development. A recent agreement with Navitas Petroleum LP involves options for farm-in opportunities in Guyana and South Africa, which could accelerate growth if successful. However, Eco faces high volatility with a short cash runway under current conditions.

- Click here to discover the nuances of Eco (Atlantic) Oil & Gas with our detailed analytical financial health report.

- Understand Eco (Atlantic) Oil & Gas' earnings outlook by examining our growth report.

Make It Happen

- Access the full spectrum of 383 TSX Penny Stocks by clicking on this link.

- Searching for a Fresh Perspective? AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal