Undiscovered Gems In Canada Featuring 3 Promising Small Caps

As the Canadian market navigates a landscape of recovering employment figures and evolving economic indicators, investors are keenly observing small-cap stocks for potential opportunities. In this environment, identifying promising small-cap companies requires a focus on those with robust fundamentals and growth potential that align with broader market trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pulse Seismic | NA | 13.62% | 30.86% | ★★★★★★ |

| Itafos | 20.68% | 9.86% | 37.00% | ★★★★★★ |

| Soma Gold | 37.84% | 26.84% | 22.13% | ★★★★★★ |

| Mako Mining | 5.29% | 37.41% | 60.51% | ★★★★★★ |

| Melcor Developments | 47.67% | 8.75% | 12.05% | ★★★★☆☆ |

| Corby Spirit and Wine | 54.56% | 11.67% | -4.04% | ★★★★☆☆ |

| Queen's Road Capital Investment | 7.68% | -3.30% | -0.82% | ★★★★☆☆ |

| Dundee | 1.46% | -35.04% | 52.59% | ★★★★☆☆ |

| Kiwetinohk Energy | 23.09% | 21.68% | 30.98% | ★★★★☆☆ |

| Grown Rogue International | 37.38% | 28.22% | 14.92% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Birchcliff Energy (TSX:BIR)

Simply Wall St Value Rating: ★★★★★☆

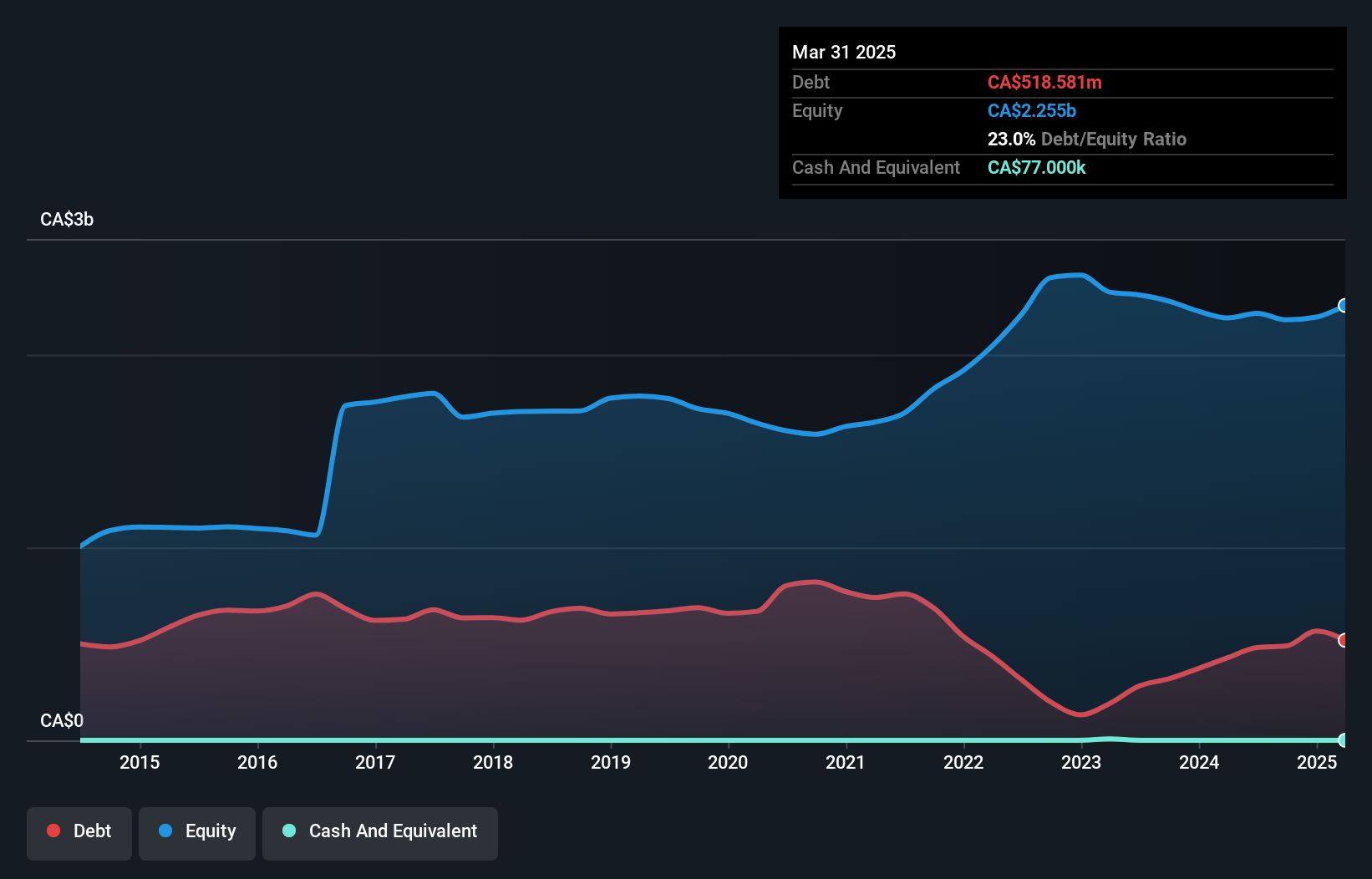

Overview: Birchcliff Energy Ltd. is an intermediate oil and natural gas company focused on the exploration, development, and production of natural gas, light oil, condensate, and other natural gas liquids in Western Canada with a market cap of CA$2.03 billion.

Operations: Birchcliff Energy generates revenue primarily from its oil and gas exploration and production segment, amounting to CA$666.41 million. The company has a market capitalization of CA$2.03 billion.

Birchcliff Energy, a notable player in Canada's energy sector, has demonstrated impressive financial metrics. Over the past year, earnings surged by 375%, significantly outpacing the oil and gas industry average of -3.2%. The company's debt to equity ratio improved from 51.7% to a satisfactory 23.6% over five years, reflecting sound financial management. Trading at about 54% below its estimated fair value suggests potential for investors seeking undervalued opportunities. Recent announcements include a share repurchase program for up to approximately 27 million shares and revised production guidance indicating robust operational performance with expected significant free funds flow in Q4 of 2025.

- Click here to discover the nuances of Birchcliff Energy with our detailed analytical health report.

Examine Birchcliff Energy's past performance report to understand how it has performed in the past.

Total Energy Services (TSX:TOT)

Simply Wall St Value Rating: ★★★★★★

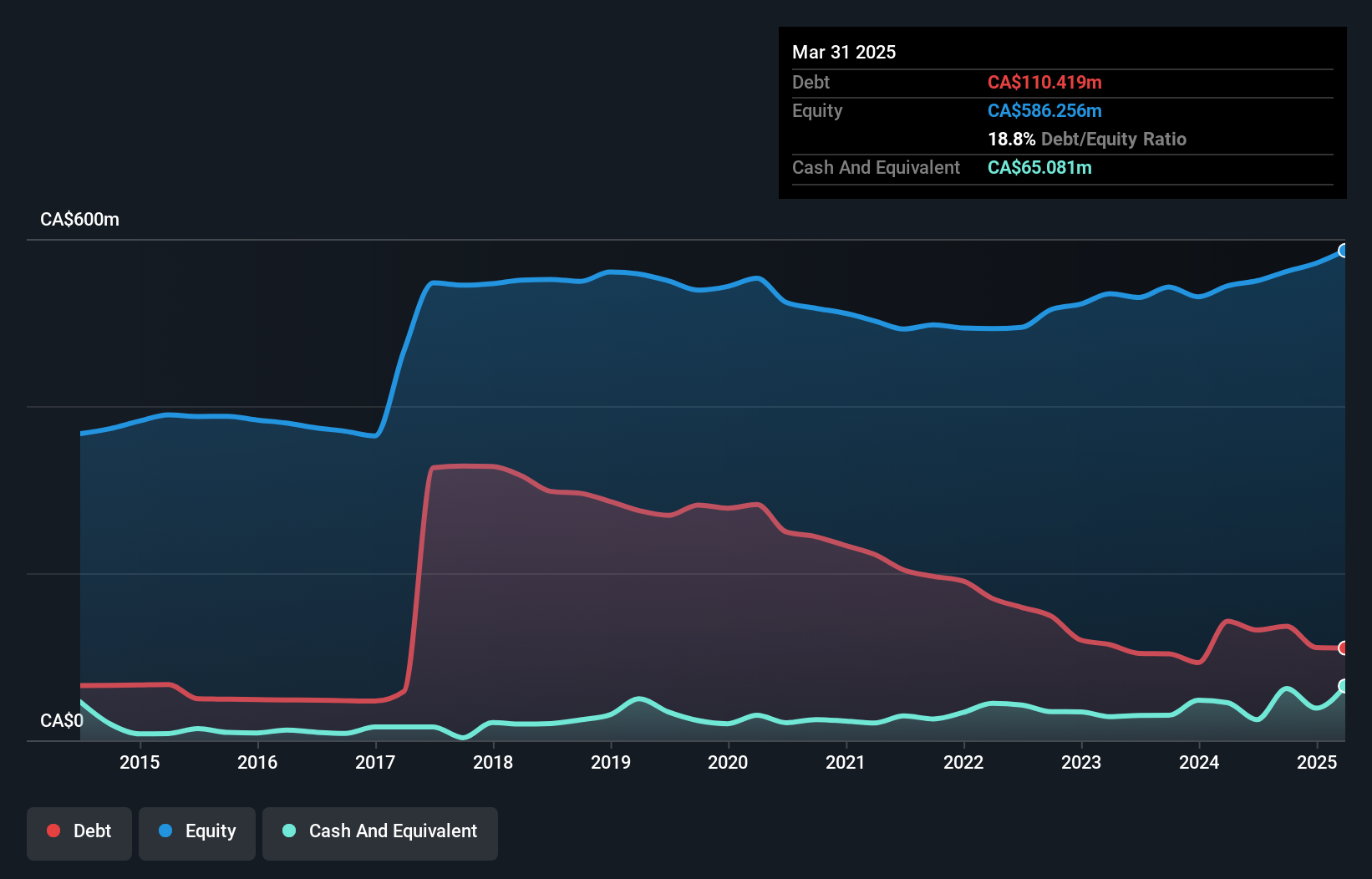

Overview: Total Energy Services Inc. is an energy services company with operations in Canada, the United States, Australia, and internationally, and has a market capitalization of approximately CA$560.13 million.

Operations: Total Energy Services generates revenue through four primary segments: Compression and Process Services (CA$481.65 million), Contract Drilling Services (CA$328.56 million), Well Servicing (CA$120.41 million), and Rentals and Transportation Services (CA$79.22 million).

Total Energy Services, a nimble player in the energy sector, has demonstrated robust earnings growth of 41.7% over the past year, outpacing its industry peers. The company's debt to equity ratio has impressively decreased from 47.1% to 15.1% in five years, highlighting effective financial management. Trading at a significant discount of 89% below estimated fair value suggests potential upside for investors considering its solid fundamentals. Recent strategic moves include a share buyback program with CAD 23.21 million spent on repurchasing shares and extending a $170 million credit facility until January 2029, enhancing financial flexibility for future endeavors.

- Dive into the specifics of Total Energy Services here with our thorough health report.

Assess Total Energy Services' past performance with our detailed historical performance reports.

Heliostar Metals (TSXV:HSTR)

Simply Wall St Value Rating: ★★★★★★

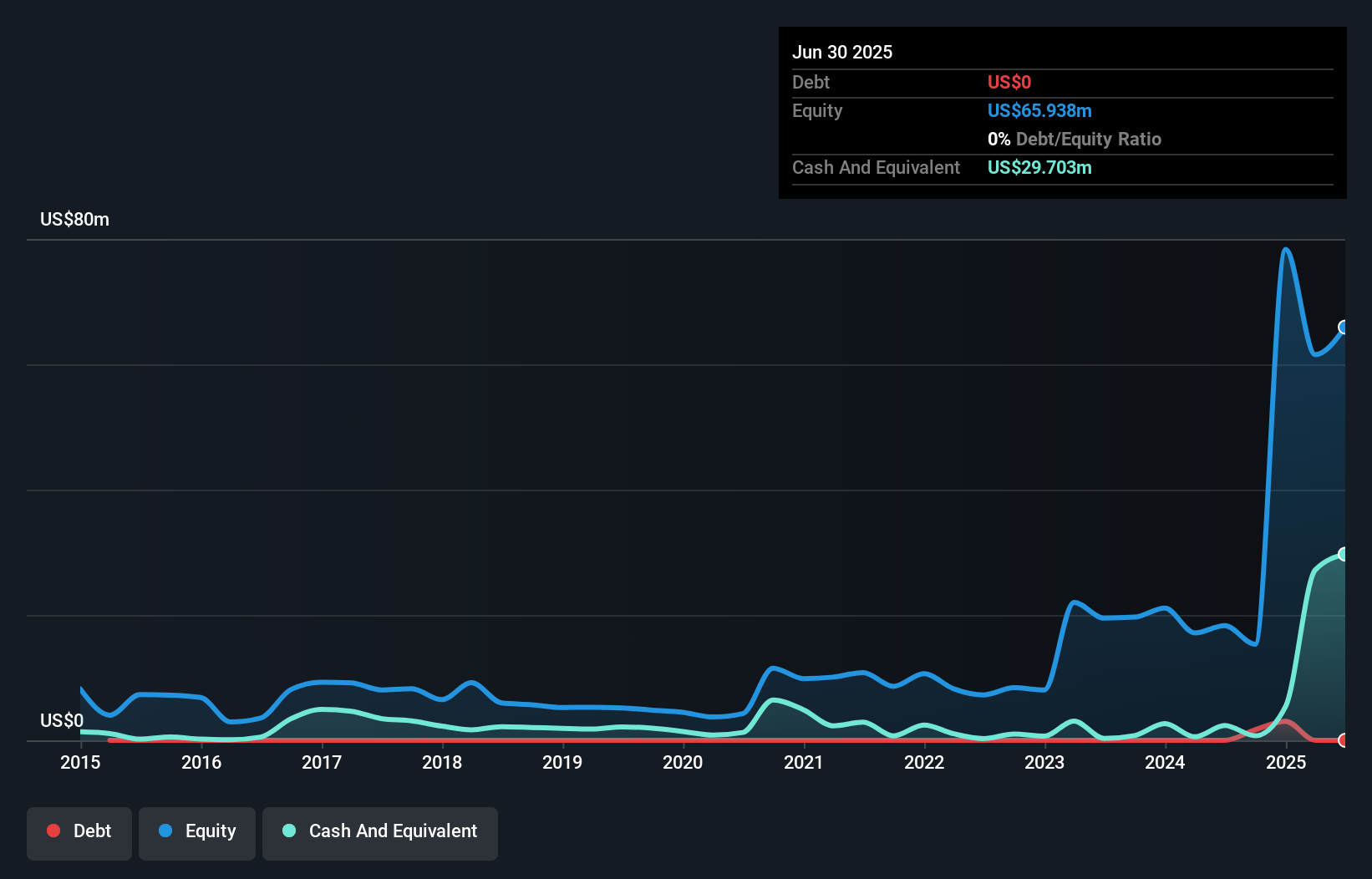

Overview: Heliostar Metals Ltd. focuses on the identification, acquisition, evaluation, and exploration of mineral properties in North America with a market cap of CA$658.44 million.

Operations: Heliostar Metals does not currently generate revenue from its operations, as it is focused on the exploration and evaluation of mineral properties.

Heliostar Metals, a nimble player in the mining sector, has recently turned profitable and is debt-free, with a price-to-earnings ratio of 15.9x compared to the Canadian market's 16.4x. The company forecasts a revenue growth of 36.71% annually and has been actively expanding its operations at multiple sites including San Agustin and La Colorada in Mexico. Recent developments include recommencing mining activities expected to generate US$40 million in cash flow from San Agustin and advancing drilling programs at Ana Paula aimed at resource conversion, which could enhance future production capabilities significantly.

- Take a closer look at Heliostar Metals' potential here in our health report.

Review our historical performance report to gain insights into Heliostar Metals''s past performance.

Where To Now?

- Click this link to deep-dive into the 47 companies within our TSX Undiscovered Gems With Strong Fundamentals screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal