Riot Platforms (RIOT) Valuation Check As Leadership Changes Refocus Growth On Data Centers

Riot Platforms (RIOT) is back in focus after the company reshaped its leadership and incentives, naming Jason Chung as incoming CFO and tying executive pay more closely to data center growth beyond Bitcoin mining.

See our latest analysis for Riot Platforms.

Riot’s latest 1-day share price return of 11.76% to US$14.16 sits against a 90-day share price return of 34.05% decline, while the 3-year total shareholder return of 189.57% and 5-year total shareholder return of 37.46% decline highlight how momentum has swung sharply over different time frames as investors reassess growth potential and funding risks around its pivot toward data centers and recent equity offerings.

If this leadership shift has you thinking about where digital infrastructure could go next, it might be worth scanning high growth tech and AI names through high growth tech and AI stocks.

With the share price still well below recent highs despite a very large 3 year gain, and analysts’ average target sitting above US$26, the key question is whether Riot is on sale today or if future data center growth is already baked in.

Most Popular Narrative: 48.5% Undervalued

With Riot Platforms last closing at US$14.16 and the most followed narrative pointing to fair value of US$27.50, valuation views are clearly more optimistic than the market price suggests.

The analysts have a consensus price target of $17.279 for Riot Platforms based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $22.0 and the most bearish reporting a price target of just $11.0.

Curious what kind of revenue ramp, margin shift, and future earnings multiple are required to support that gap to fair value and price targets? The narrative leans on fast compounding sales, a swing from losses to solid profitability, and a premium valuation usually reserved for high growth software leaders. Want to see exactly how those moving parts stack up over the next few years?

Result: Fair Value of $27.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside story still runs into real pressure points, including heavy capital needs for the data center buildout and Riot’s ongoing sensitivity to Bitcoin price swings.

Find out about the key risks to this Riot Platforms narrative.

Another Angle on Riot’s Valuation

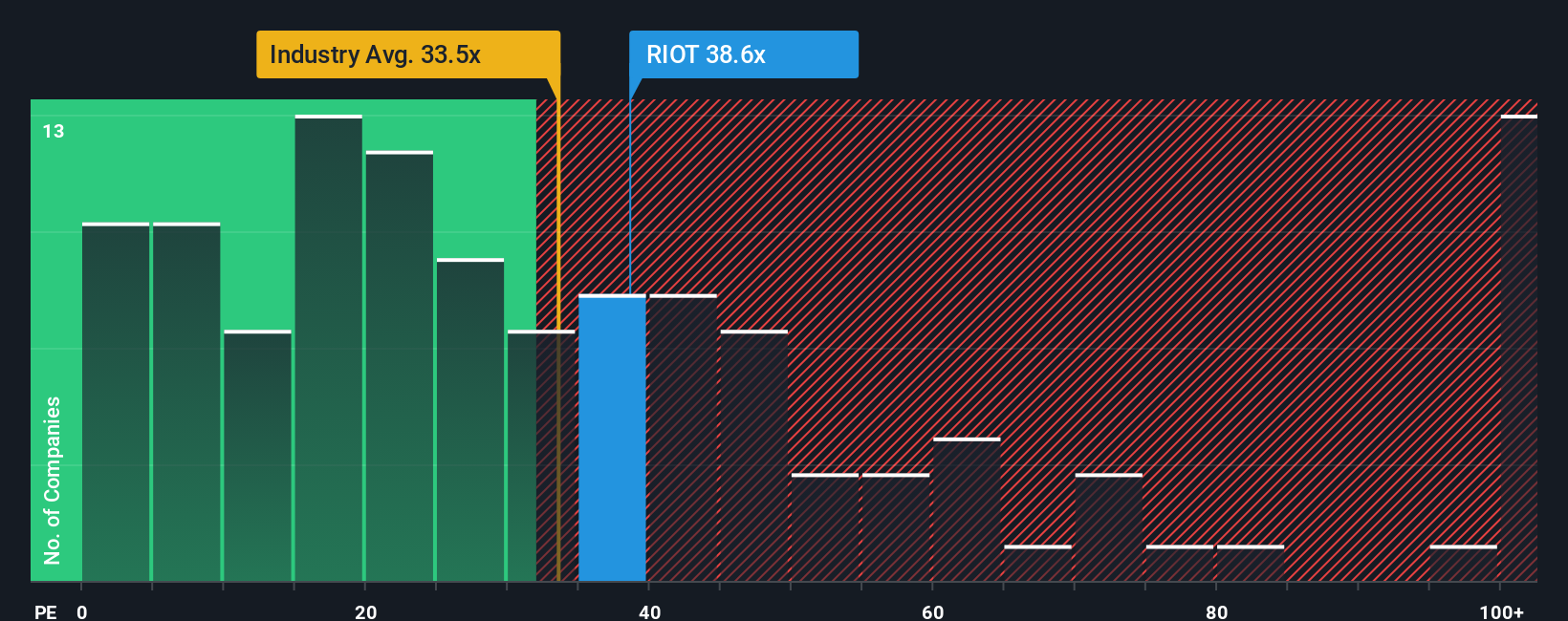

If you put the community fair value of US$27.50 to one side and just look at today’s earnings, Riot trades on a P/E of 32.1x versus 31.7x for the wider US software group and 47x for close peers, while our fair ratio sits far lower at 8.2x. That gap suggests the market is already paying up for future growth, so the real question is whether you think earnings can catch up to the price or the P/E could drift closer to that fair ratio over time.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Riot Platforms Narrative

If you look at these numbers and reach a different conclusion, or simply prefer to test your own assumptions directly, you can build a custom thesis in just a few minutes with Do it your way.

A great starting point for your Riot Platforms research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Riot is on your radar, consider building a broader watchlist by identifying more ideas that align with the types of opportunities you care about.

- Scan these 870 undervalued stocks based on cash flows that fit your criteria to spot potential value plays before they become widely followed.

- Explore these 25 AI penny stocks at the intersection of software and machine learning, where business stories are directly connected to real-world AI adoption.

- Review these 14 dividend stocks with yields > 3% to add a different risk and return profile focused on regular income rather than only price movements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal