A Look At CapitaLand China Trust (SGX:AU8U) Valuation After Multicurrency Debt Programme Update

CapitaLand China Trust (SGX:AU8U) has amended its S$1b multicurrency debt issuance programme to allow securities to settle through the Hong Kong Monetary Authority’s Central Moneymarkets Unit, with Deutsche Bank’s Hong Kong branch appointed as programme agent.

See our latest analysis for CapitaLand China Trust.

The amended debt programme lands as the unit price sits at $0.785, with a 1 year total shareholder return of 14.65% contrasting with a 5 year total shareholder return of 23.91%, indicating relatively weak long term momentum.

If you are considering how this type of funding move compares with other income focused ideas, it could be a good moment to scan fast growing stocks with high insider ownership for potential standouts.

With the unit price close to its analyst price target and a 5 year total shareholder return well behind the 1 year figure, investors are left asking whether CLCT is quietly undervalued or if the market is already pricing in future growth.

Most Popular Narrative: 1% Overvalued

With CapitaLand China Trust last closing at $0.785 against a narrative fair value of $0.78, the valuation gap is narrow and puts the focus on the earnings story behind that figure.

The completion of major asset enhancement initiatives (AEIs), such as supermarket upgrades and the launch of an experiential, animation-themed street (with 100% pre-leasing and 13% rental uplift), is set to increase shopper traffic and tenant sales, reinforcing the long-term trend of rising urban middle-class demand for experiential retail, supporting higher occupancy, stronger rental reversions, and top-line revenue growth.

Curious how a small revenue contraction view can sit beside steep earnings growth, soaring margins and a much lower future P/E assumption? The full narrative spells out those moving parts.

Result: Fair Value of $0.78 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still clear pressure points, with rental reversions in retail and business parks under strain and gearing at 42% keeping financing and refinancing risk firmly in view.

Find out about the key risks to this CapitaLand China Trust narrative.

Another View: Multiples Signal Deeper Discount

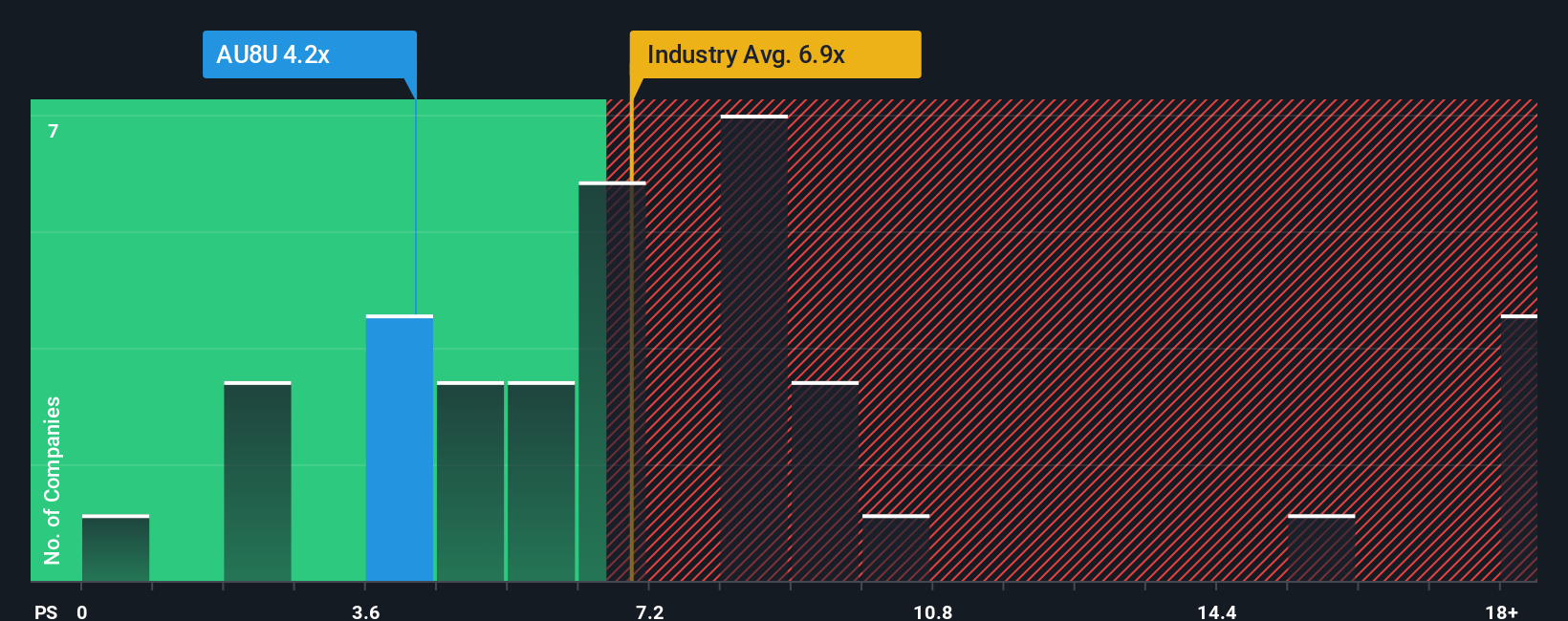

While the consensus narrative suggests CapitaLand China Trust is about 1% overvalued versus its fair value of $0.78, our P/S work paints a very different picture. On 4.2x sales versus 6.8x for Asian retail REITs and 8.4x for peers, the trust screens as much cheaper. The fair ratio of 5.1x also sits well above today’s level, indicating that the market might move closer to that benchmark over time. Is this discount a warning about the risks you have seen, or a margin of safety you are comfortable with?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CapitaLand China Trust Narrative

If this view does not quite fit how you see the numbers, you can test the assumptions yourself and build a fresh narrative in minutes, starting with Do it your way.

A great starting point for your CapitaLand China Trust research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If CLCT has sparked a few questions, do not stop here. Broaden your watchlist with fresh ideas that match how you like to invest.

- Spot potential value plays early by scanning these 870 undervalued stocks based on cash flows that may line up with your return expectations and risk comfort.

- Ride powerful tech trends by checking out these 25 AI penny stocks that connect artificial intelligence themes with listed businesses you can actually track.

- Add income focused ideas to your shortlist with these 14 dividend stocks with yields > 3% that fit your preference for regular cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal