A Look At DroneShield’s Valuation After Record A$61.6 Million Contract And Very Large Quarterly Revenue Jump

DroneShield (ASX:DRO) is back in focus after securing a record A$61.6 million contract with a European military customer in June 2025 and reporting a very large year on year jump in second quarter revenue.

See our latest analysis for DroneShield.

DroneShield’s latest contract news comes after a sharp 73.75% 1 month share price return. However, the 90 day share price return of a 45.38% decline and flat year to date move suggest that momentum has been choppy, despite a very large 1 year total shareholder return of over 300% and a very large 5 year total shareholder return.

If this kind of defence technology story has your attention, it could be a good moment to see what else is available across aerospace and defense stocks.

With DroneShield reporting strong recent revenue growth and the shares sitting below both analyst price targets and some intrinsic value estimates, is this still a buying opportunity or is the market already pricing in future growth?

Most Popular Narrative: 35.7% Undervalued

With DroneShield last closing at A$3.31 against a narrative fair value of A$5.15, the current price sits well below that valuation anchor.

Substantial ongoing investment in proprietary AI-driven detection, sensor fusion, and subscription-based (SaaS) offerings fortifies DroneShield's margin profile and earnings quality, enabling premium pricing and recurring revenue streams as the business pivots beyond hardware-only sales.

Curious what kind of revenue ramp, margin lift, and earnings profile are baked into that A$5.15 figure? The narrative leans on aggressive scaling, richer software mix, and a future earnings multiple that usually belongs to mature, high quality franchises. Want to see exactly how those moving parts combine to support this valuation?

Result: Fair Value of $5.15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on large defence contracts and high R&D spend remaining aligned, since delays, cancellations or cost blowouts could quickly weaken the thesis.

Find out about the key risks to this DroneShield narrative.

Another View: Pricing Looks Stretched On Sales

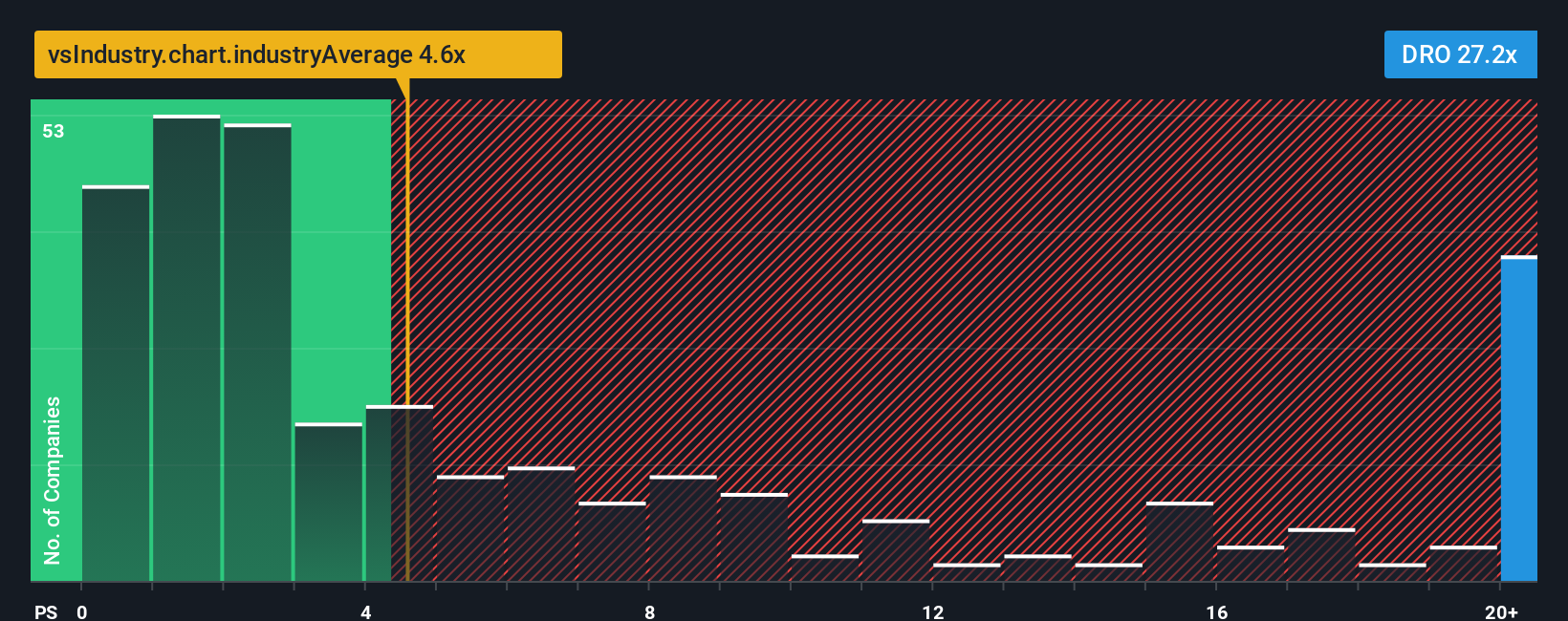

Those fair value numbers suggest DroneShield is deeply undervalued, but its P/S ratio of 28.2x tells a very different story. That is well above the estimated fair ratio of 23.5x, the global Aerospace & Defense average of 4.7x, and the 5x peer average, which points to real valuation risk if sentiment cools.

When a stock trades this far ahead of both its fair ratio and its peer group, any wobble in contract timing or growth expectations can matter a lot for the share price. How comfortable are you with paying up for this kind of growth story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DroneShield Narrative

If you think the current narratives miss something or you would rather analyze the numbers yourself, you can build a fresh view in minutes with Do it your way.

A great starting point for your DroneShield research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about sharpening your investment watchlist, do not stop at one stock. Use the tools available and keep your opportunity set broad.

- Spot potential high risk high reward setups early by scanning these 3568 penny stocks with strong financials that already show stronger balance sheets and fundamentals than many expect.

- Position ahead of the next wave of automation by focusing on these 29 healthcare AI stocks that apply machine learning to real world medical problems.

- Build your own watchlist of potential mispriced ideas with these 868 undervalued stocks based on cash flows that screen for stocks priced below what their cash flows might suggest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal